Article

Published

2 September 2025

As shifts in customer expectations and regulatory demands reshape industry standards, sustainability has become a strategic imperative. It is no longer a matter of corporate social responsibility but a vital lever for growth and innovation. Companies that integrate sustainability into their core business strategies are better positioned to drive business growth, enhance brand reputation, and secure long-term viability.

To guide leadership conversations and strategic thinking, Implement Consulting Group has developed an integrated framework for sustainable value creation that offers an overview of key levers for value creation and potential pathways for embedding sustainability deeper into corporate strategy.

Taking an integrated approach to value creation

Gone are the days when financial objectives and sustainability goals were considered divergent pursuits. Companies now face increasing pressure from customers, regulators, investors, and a broad range of stakeholders to adopt sustainable practices. An integrated approach to sustainability aligns these goals, offering a strategic advantage that enhances resilience and ensures future readiness in a rapidly changing business environment.

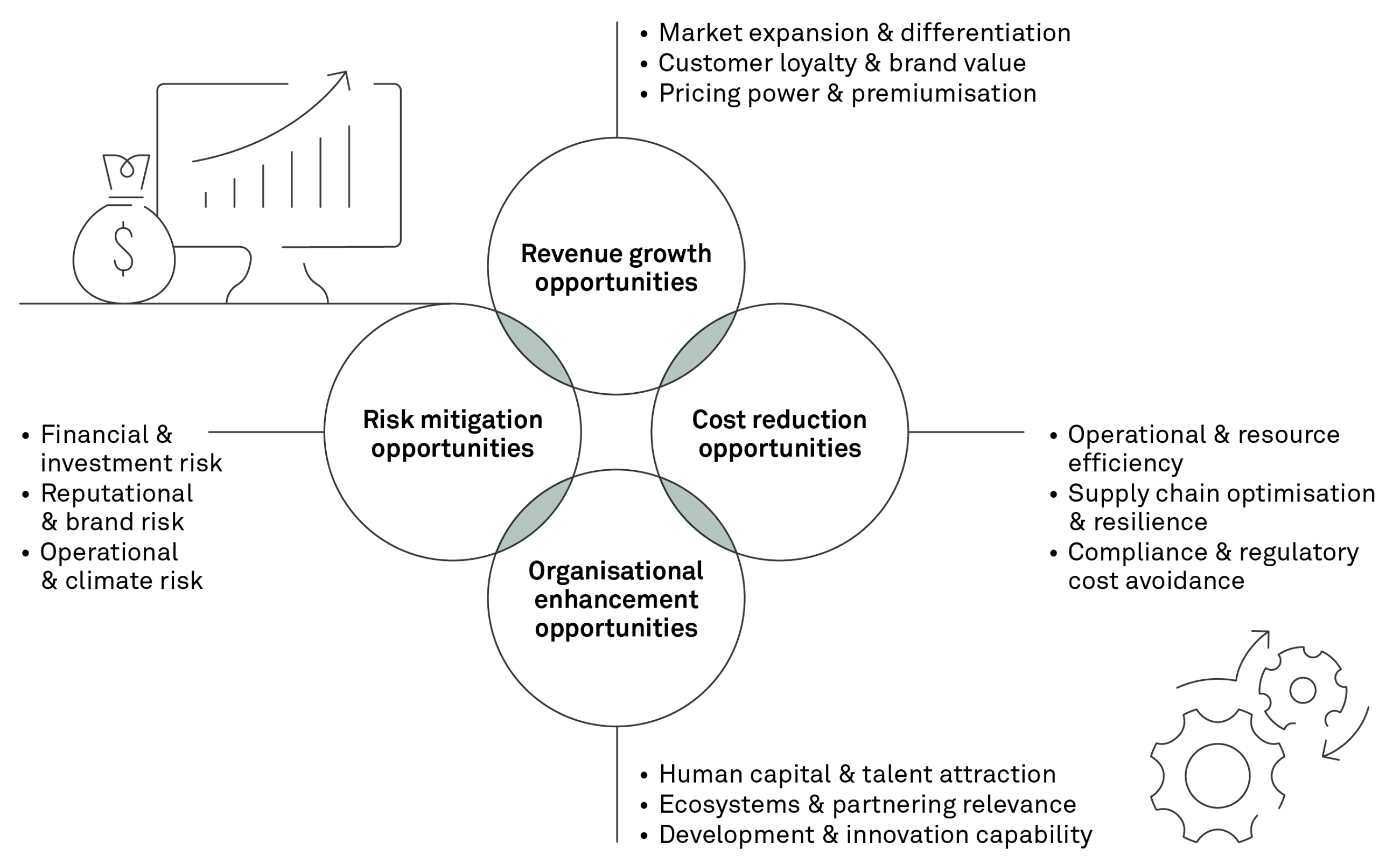

To guide businesses in leveraging sustainability for a shorter-term competitive advantage, we have created a four-dimensional framework focusing on revenue growth, cost reduction, risk mitigation, and organisational enhancement opportunities. This framework provides a structured approach to integrating sustainability within the business model. Consider using it to support ideation of strategic opportunities or the evaluation of potential actions.

Dimension 1: Revenue growth opportunities

Sustainability offers transformative approaches to revenue generation and market expansion:

- Market expansion and differentiation: Companies can upgrade or create new sustainable products, services, or business models – for instance, applying circular economy design principles that appeal to new customer segments. This innovation does not just satisfy market demand; it also sets brands apart from competitors and increases market share.

- Customer loyalty and brand value: Developing transparent sustainability reporting and loyalty programmes that reward eco-friendly behaviours, strengthens customer trust, and fosters long-term brand loyalty. This is about deepening existing customer relationships to increase lifetime value and reduce churn.

- Pricing power and premiumisation: A growing number of consumers are willing to pay more for brands that are seen as leaders in ethical or environmental practices. Sustainability can thus allow a company to command a price premium for its products – a direct lever for revenue growth.

Unleashing revenue growth opportunities is all about understanding changing market dynamics and customer segments at a granular level to identify, test, and scale promising innovation opportunities.

Nike's Flyknit innovation

A compelling example of leveraging sustainability for revenue growth is Nike’s Flyknit technology. By adopting advanced yarn-based manufacturing methods, Nike was able to reduce waste by up to 80% per shoe, while simultaneously cutting materials costs. Beyond the environmental benefits, Flyknit unlocked significant market opportunities by appealing to eco-conscious consumers and athletes seeking high-performance footwear. Since its launch, Flyknit has generated over $1 billion in revenue, exemplifying how sustainability-driven product innovation not only meets evolving customer expectations but also drives premium pricing and market expansion.

Source: https://www.thefashionlaw.com/flyknit-a-1-billion-shoe-and-a-worldwide-legal-war/

Dimension 2: Cost reduction opportunities

Sustainability can drive significant cost efficiencies across operations:

- Operational and resource efficiency: Adopting sustainable processes to minimise e.g. material, energy, and water use leads to substantial savings and decreases environmental impact, contributing to a leaner, more efficient operation.

- Supply chain optimisation and resilience: Enhancing supply chain resilience through sustainable partnerships reduces costs associated with waste and improves responsiveness, mitigating risks related to disruptions.

- Compliance and regulatory cost avoidance: Proactively adapting to regulatory changes not only ensures compliance and helps avoids fines but also positions the company to capitalise on financial incentives like tax breaks and subsidies, further boosting cost-saving efforts.

To tap into cost reduction opportunities, internal and external value chains need to be scrutinised to identify hot spots where cost reductions will go hand in hand with improved sustainability as well as careful due diligence of potential regulatory changes.

IKEA's energy efficiency strategy

IKEA’s long-term commitment to sustainability has yielded significant operational cost savings. By investing in renewable energy projects and systematically improving energy efficiency across its stores and warehouses, IKEA managed to save over €130 million in just five years. These initiatives included the large-scale deployment of solar panels and transitioning to LED lighting, which reduced both energy consumption and environmental footprint. IKEA’s strategy demonstrates how embedding sustainability into operations creates a leaner, more cost-efficient business model while simultaneously aligning with regulatory trends and customer preferences.

Source: https://www.ingka.com/newsroom/ikea-invests-eur-1-5-billion-to-accelerate-phase-out-of-fossil-fuels/

Dimension 3: Risk mitigation opportunities

Integrating sustainability into risk management frameworks is crucial for organisational resilience:

- Financial and investment risk: Embedding sustainability into investment strategies can enhance risk management and reduce financing costs by improving credit ratings and increasing investor confidence.

- Reputational and brand risk: Robust sustainability initiatives preserve brand integrity and reputation, fostering trust and loyalty among customers and stakeholders. A strong sustainability profile acts as a buffer against negative public opinion.

- Operational and climate risk: Adopting eco-friendly practices enhances operational resilience, reducing the likelihood of disruptions from extreme weather or resource scarcity. This point also addresses the physical and logistical risks posed by climate change.

To navigate and mitigate risks, alternative future scenarios should be modelled and assessed based on clearly defined assumptions and accounting for key uncertainties. In this way, you can more easily pinpoint the most urgent sustainability-related risks and make clear choices on strategic mitigation measures.

Ørsted's stakeholder engagement

Ørsted, the global leader in offshore wind, offers a textbook example of sustainability as a risk mitigation tool. Recognising the potential for costly delays and opposition in large-scale infrastructure projects, Ørsted proactively engaged with local communities, fishing groups, and environmental NGOs to build a robust social license to operate. This stakeholder-driven approach has streamlined permitting processes and significantly reduced project risks, enabling faster deployment of renewable energy assets. By addressing reputational and operational risks head-on, Ørsted has increased investor confidence, lowered its cost of capital, and secured long-term competitive advantages in a rapidly growing market.

Dimension 4: Organisational enhancement opportunities

Internally, sustainability strengthens a company’s foundation for long-term success across a range of aspects:

- Human capital and talent attraction: A company’s commitment to sustainability is a major driver for attracting and retaining top-tier talent, as these values are increasingly significant to current and prospective employees. Such initiatives also foster a purpose-driven culture that boosts employee engagement and productivity.

- Ecosystems and partnering relevance: Companies can successfully build and leverage strategic ecosystems with a wide range of stakeholders – academia, NGOs, suppliers, and even competitors. This type of collaboration is key to building competitive advantage and co-innovating sustainable solutions, sharing knowledge, and creating more resilient value networks. Essentially, value is created when your company stands out as an attractive and forward-looking ecosystem partner.

- Development and innovation capability: Integrating sustainability into development processes and portfolio management clearly drives innovation. By actively managing products and assets with long-term sustainability in mind, companies can develop future-ready business models and avoid the risk of stranded assets or obsolete technologies. Sustainability demands that companies rethink and stay at the forefront of developments. It simply keeps you on your toes.

To create value from organisational enhancement opportunities, a starting point might be to assess current practices and capabilities. Is sustainability merely considered an isolated organisational function driving specific initiatives and ensuring basic compliance? Or is sustainability an integral part of key business processes and leadership decision-making? If you can answer yes to the latter, most likely, you are already reaping some of the potential benefits of organisational enhancement opportunities.

Patagonia's purpose-driven culture

Patagonia stands as a benchmark for how sustainability can enhance organisational capabilities and culture. The company’s “Don’t Buy This Jacket” campaign and its Worn Wear repair and resale initiative not only reduced environmental impact but also deepened its relationship with customers who share its values. This authentic commitment has been a magnet for top-tier talent, fostering a culture of innovation and purpose that translates directly into business performance. Patagonia’s revenue surged by 30% back in 2011 following these initiatives, proving that a sustainability-led culture drives both internal engagement and external brand strength.

Source: https://scienceofretail.com/patagonia-dont-buy-this-jacket/

Linking sustainable practices with financial performance

The connection between sustainability and financial performance is undeniable. By methodically applying this framework, companies can maximise value creation, spur innovation, and secure enduring competitive advantages. Integrating sustainable practices in the right way quite simply results in tangible financial benefits – higher revenue, reduced costs, minimised risks, and enhanced organisational capabilities – and establishes sustainability as a cornerstone of modern business strategy.

Adopting a robust and strategic framework for sustainable value creation thus empowers companies to thrive in an evolving environment where economic and environmental priorities intersect. By following this approach, organisations can achieve lasting success, demonstrating that sustainable practices, far from being a cost, are a source of enduring value.

Any questions?

Related0 4

Case

Read more

Leading global investment bank

How can sustainable choices lead to higher returns for investors?Case

Read more

A global energy company

How does a leading energy player leverage sustainability to win more business?Case

Read more

Leading private equity firm

How can private equity use sustainability as a value creation lever across its portfolio?Case

Read more