Three strategic themes for banks to succeed in the coming recession

9 November 2022

The macro-economic outlook is set to worsen as increased interest-rates push the economy into recession amid high inflation.

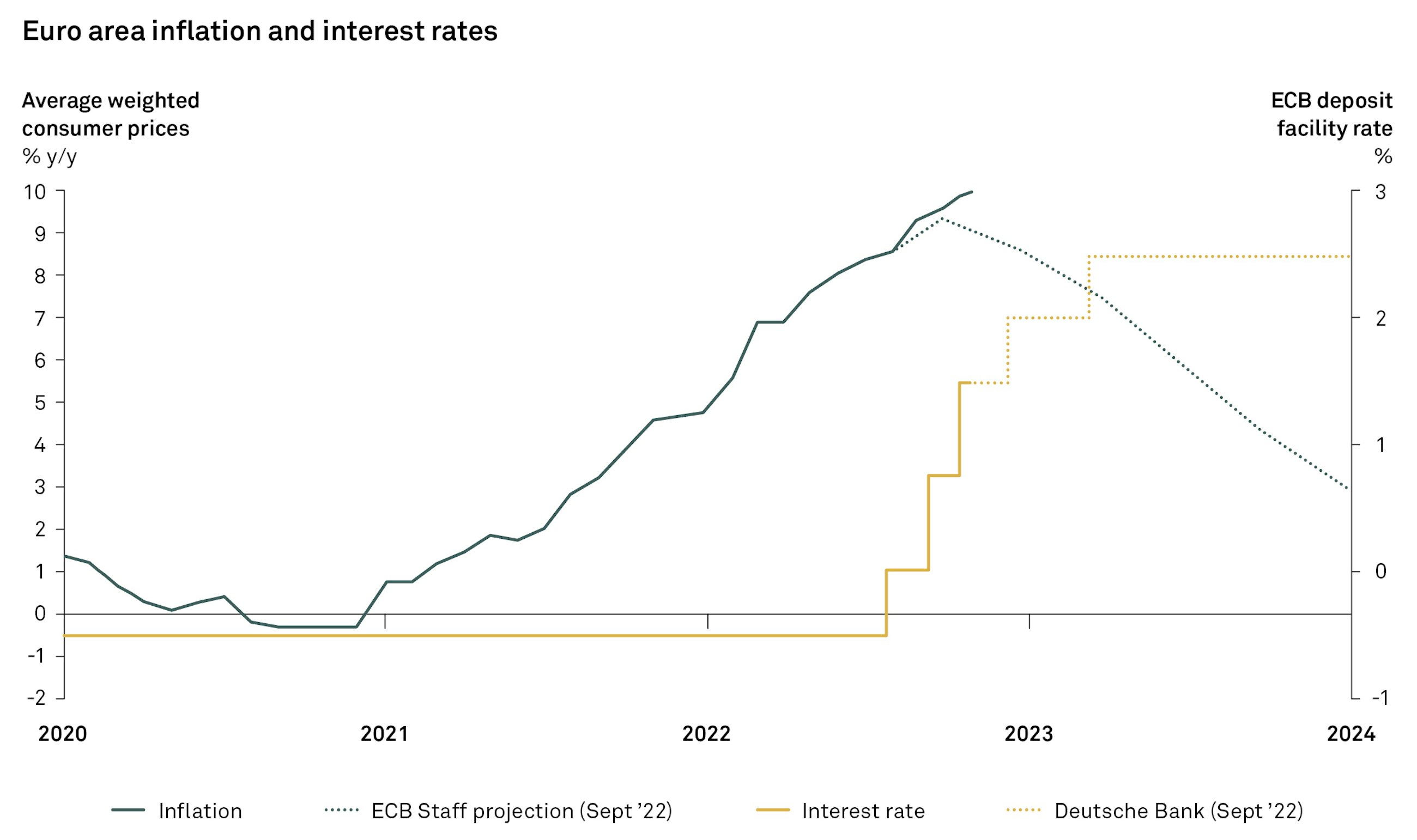

During recent years, the challenges of the pandemic have led to extraordinary actions in the form of low or negative interest rates and expansive fiscal policy. Combined with high consumer demand and recent supply-chain disruptions, Europe has experienced steep increases in inflation throughout 2022. The inflationary pressure has soared due to increasing energy prices, and it is now at historically high levels – not seen since the early 1980s.

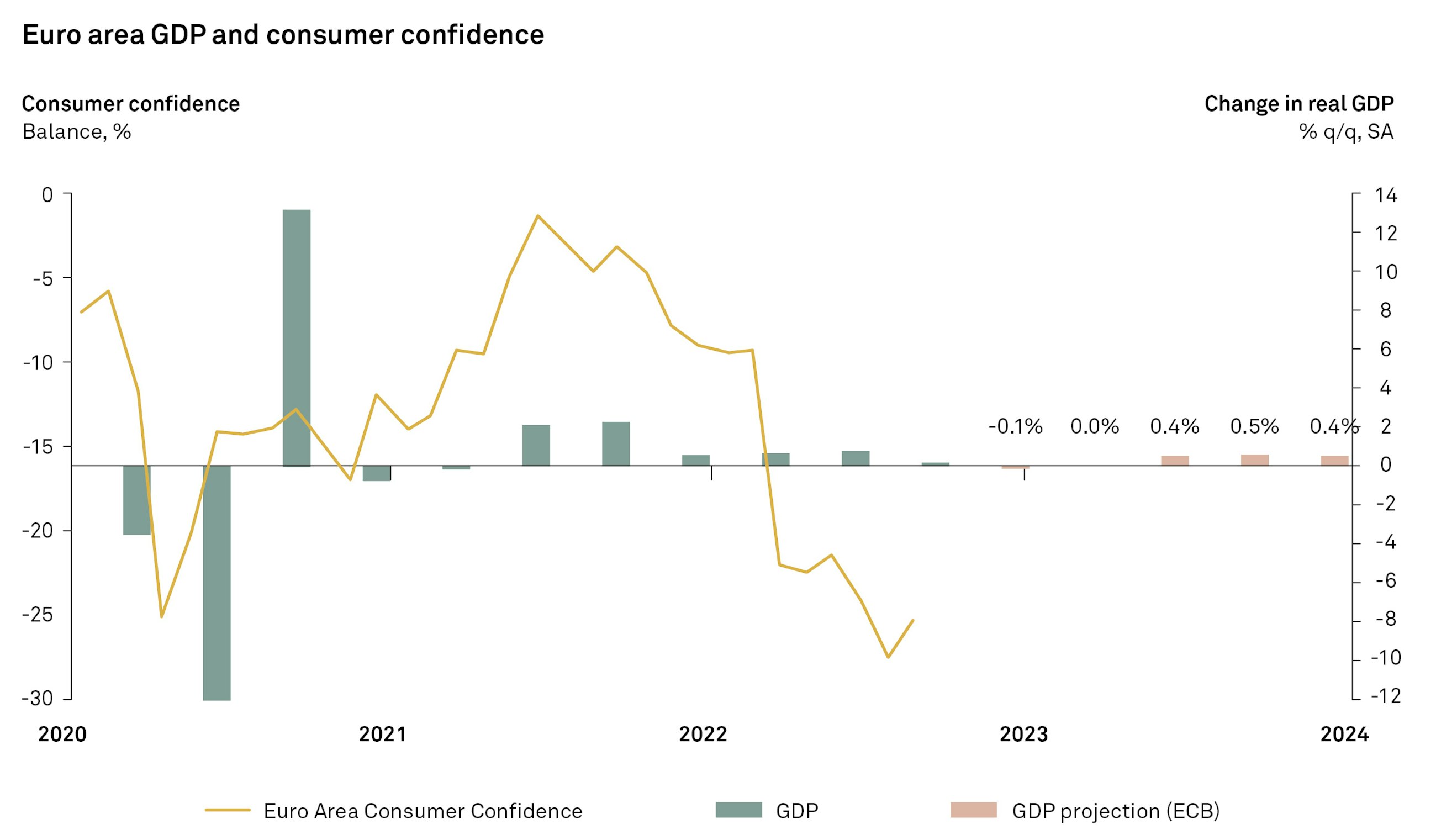

Faced with increased inflation, European central banks have taken action by rapidly increasing interest rates at an unprecedented pace, to battle the short-term inflation. The increase in interest rates has slowed economic activity, and as a result, a downturn is expected with negative GDP growth, increased unemployment rates and low consumer confidence.

The recession will put pressure on profitability in the banking sector

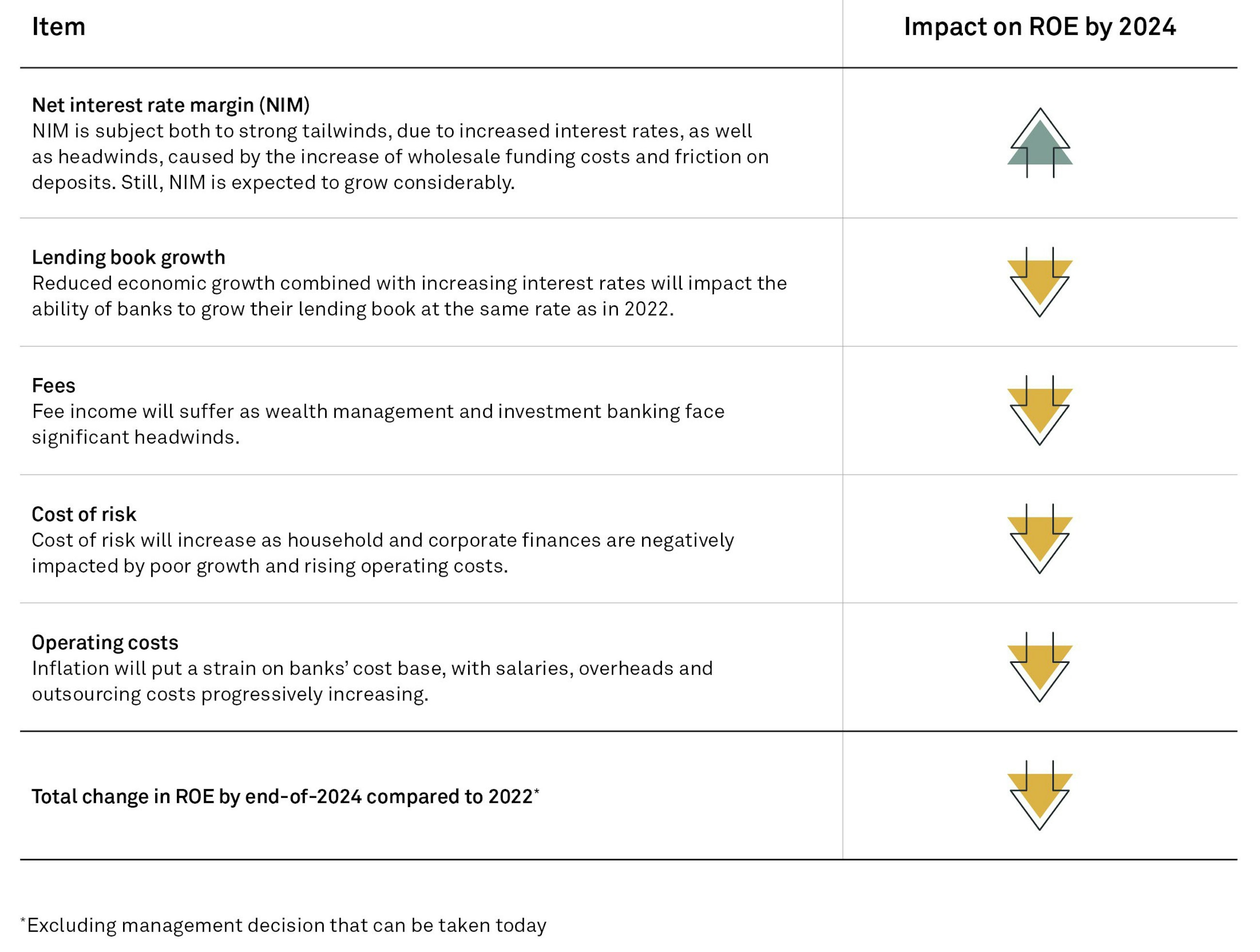

Naturally, the Nordic banking sector will be impacted directly by the upcoming recession. Our expectation is that the sector will enter a trajectory of decreasing revenue opportunities and increasing costs as the effects from sustained high inflation and increasing interest rates affect the economy.

Therefore, we expect that the Nordic banks’ profitability will fall towards 2024, compared to 2022 (*excluding management decisions that can be made today). The impact on profitability from sustained high inflation and interest rates should be at the top of the CXO agenda.

If we zoom out to the wider economy, the most pressing issues facing the banks’ customers is the cost-of-living crisis and the energy crisis, where the energy crisis has since morphed into a green energy transition crisis. Supporting the wider economy by enabling the green energy transition as well as helping with the cost-of-living crisis should therefore also be at the top of CXO’s agenda within the Nordic Banking sector.

By helping to tackle the biggest issues facing the Nordic economy today, the Nordic Banking sector can gain a stronger sense of purpose and ensure its ongoing relevance beyond the recession.

The success of the Nordic banks will be measured by their ability to launch strategic initiatives to weather the storm, thereby emerging as more successful from the downturn than when it began.

Three key strategic themes to weather the storm

The composition of this recession leads to three themes that need to be addressed for banks to emerge successful:

- Increasing efficiency and profitability in this recession: How can banks build resilience and navigate towards a trajectory of increasing profit during this recession?

- Delivering on customer promises in a cost-of-living crisis: How can banks deliver on customer promises as the cost-of-living crisis creates uncertainty and pressure on households and corporations?

- Supporting the green energy transition: How can banks support the green energy transition by efficiently facilitating the reallocation of capital needed to succeed?

1. Increasing efficiency and profitability in this recession

Reducing costs and improving competitiveness by streamlining processes and automating experiences

A new cost-income reality will emerge as the economy enters recession. To manage costs, improve competitiveness and build future resilience, banks should start identifying areas of the operating model in need of calibration to the new income-cost reality.

To do this, banks should increase managerial and executive focus on planning and simulation to ensure that strategic decisions are made in a timely manner and are informed by clear data.

On an operational level, banks should maintain a laser-sharp focus on dynamic risk management, while at the same time increasing response time for debt services to capitalise on growth opportunities in strategic segments. Additionally, the increase in cost of risk is an invitation for banks to review their debt collection and default processes and prepare initiatives to lower costs from default risk.

Banks should consider the following steps to increase efficiency and profitability in this recession:

- Adapting the customer service model towards digital and virtual customer engagement with supporting analytics will enable increased advisor efficiency and effectiveness. A digital service model with supporting analytics will free up time for more and higher-quality engagements, including time for cross-selling of fee-based products.

- Manage risk by utilising data proactively to engage with customers in risk of default and prompt tailored communication flows and actions for advisors to help customers. Additionally, banks should structure fast-track debt solutions which will allow advisors to decrease response time in supporting customers with liquidity issues or default risk, given certain risk profiles.

- Review current strategic initiatives and risk appetite to ensure that they are fit for a new business environment with a new risk and opportunity outlook. First movers will disproportionately be advantaged by developing strong views and sectorial plays in growth areas, along with strong customer solutions to the cost-of-living crisis as well as alignment towards the green energy transition.

Banks need to prepare for the forthcoming economic downturn and prioritise the streamlining of their processes as soon as possible to avoid cumbersome internal and external processes in a market that will disproportionately benefit those who are able to capitalise on a changing risk and opportunity outlook.

2. Delivering on customer promises

Being a trusted advisor during times of trouble by proactively guiding customers to steering their economy

The cost-of-living crisis has and will increasingly lead to customers reviewing their ongoing expenses more thoroughly. Revisiting existing products and pricing, while benchmarking against other banks, will lead to more customers changing banks. To avoid this trend and limit customer churn, banks have an opportunity to focus on customer loyalty and strive to deliver on customer promises, also in difficult times.

The most valuable business and retail customers from the long economic upturn can be hit by technical insolvency and will have many questions and worries about how the changing market conditions affect their situation. Banks that manage to proactively guide their customers on how to navigate through the stagflation will build security and trust and tighten relations with their customers – and as a bonus, they will also reduce the number of inbound calls and messages.

Given the anatomy of the recession, the following three areas will be most critical for customers to grasp:

- Improve their debt situation and build stability in a fluctuating market. Banks can proactively inform customers on how the market and interest changes affect their economy and what options they have to reduce uncertainty.

- Manage their money and understand the rules of thumb to improve the day-to-day economy. Banks can help their customers understand how to establish a budget to gain more control of their ingoing and outgoing money flow.

- Balance long- and short-term thinking when considering rebalancing investments and pension depots. As stock markets have plummeted and interest levels soared, banks can help their customers understand the impact on investments and how to balance risk appetite and their time horizon.

Succeeding in these three areas will help banks establish a more sustainable market position, while also improving their customers’ economy and reducing the number of defaults and write-offs.

3. Supporting the green energy transition

Establishing the green energy transition as a key strategic value lever

The energy crisis has led to urgency in the economy to speed up the green energy transition. Banks should start viewing the green energy transition as a strategic value lever, crucial for their business model’s future success.

As such, the green energy transition should shape banks’ behaviour, mindset, risk-appetite and lending decisions – and will be a lever for banks to create resilience, reduce costs, create value and increase purpose in the long term.

To get started, banks have an opportunity to support the green energy transition by:

- Setting targets for lending book composition that guide capital allocation towards the green energy transition.

- Taking a stand on investment opportunities by creating transparency on the green energy impact of investment products. Additionally, they should make it easier for clients to invest sustainably and support companies with positive environmental impact.

- Create incentivised credit products that will nudge clients to prioritise the green energy transition and ease customer decision-making on energy improvements.

The three focus areas above are the core way banks can play their part in enabling the green energy transition by empowering their clients to fund, understand, prioritise and participate in the green energy transformation.

Sources

(1) European Comission (2022). Latest business and consumer surveys. https://economy-finance.ec.europa.eu/economic-forecast-and-surveys/business-and-consumer-surveys/latest-business-and-consumer-surveys_en

(2) European Central Bank (2022). GDP - ECB staff projection. https://www.ecb.europa.eu/pub/projections/html/ecb.projections202209_ecbstaff~3eafaaee1a.en.html

(3) European Central Bank (2022). Key ECB interest rates. https://www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html

(4) European Central Bank (2022). Inflation and consumer prices. https://www.ecb.europa.eu/stats/macroeconomic_and_sectoral/hicp/html/index.en.html

(5) Deutsche Bank (2022) Deutsche Bank forecast. https://www.dbresearch.com/ser...

(6) European Central Bank (2022). ECB staff macroeconomic projections for the euro area. https://www.ecb.europa.eu/pub/projections/html/ecb.projections202209_ecbstaff~3eafaaee1a.en.html