2 June 2020

Table of contents

- An introduction to turnarounds

- Example of an entire industry in turnaround during the great financial crisis

- Common pitfalls and how internal issues are typically the main causes of turnaround situations

- The changes to adapt to in the COVID-19 pandemic

- The Turnaround Toolbox – to help manage turnaround situations

Why turnaround management?

The primary purpose of this article is to provide general managers with a practical perspective and recommendations for how to tackle turnaround situations, sharing insights, tools, techniques, frameworks and examples on “how to”/ “how not to” tackle and manage turnarounds successfully. However, it is not the ambition to provide an exhaustive all-encompassing guide on how to manage all turnaround situations, as there are as many ways to tackle a turnaround as there are turnarounds.

An introduction to turnarounds

All companies strive towards profitable growth. However, achieving it does not seem to be that easy. According to one survey, CEOs project two times the growth they achieve, and while profitable growth is even harder, CEOs project four times(!) the profitability they achieve. Furthermore, not only do most companies not meet their profitable growth ambitions, there are many companies where things go very wrong. These companies consequently need a dramatic improvement in their financial performance, i.e. “a business turnaround”. In fact, one analysis1 suggests that in most industries 10-15% of large companies are in distress at any given time – requiring successful turnaround management to succeed.

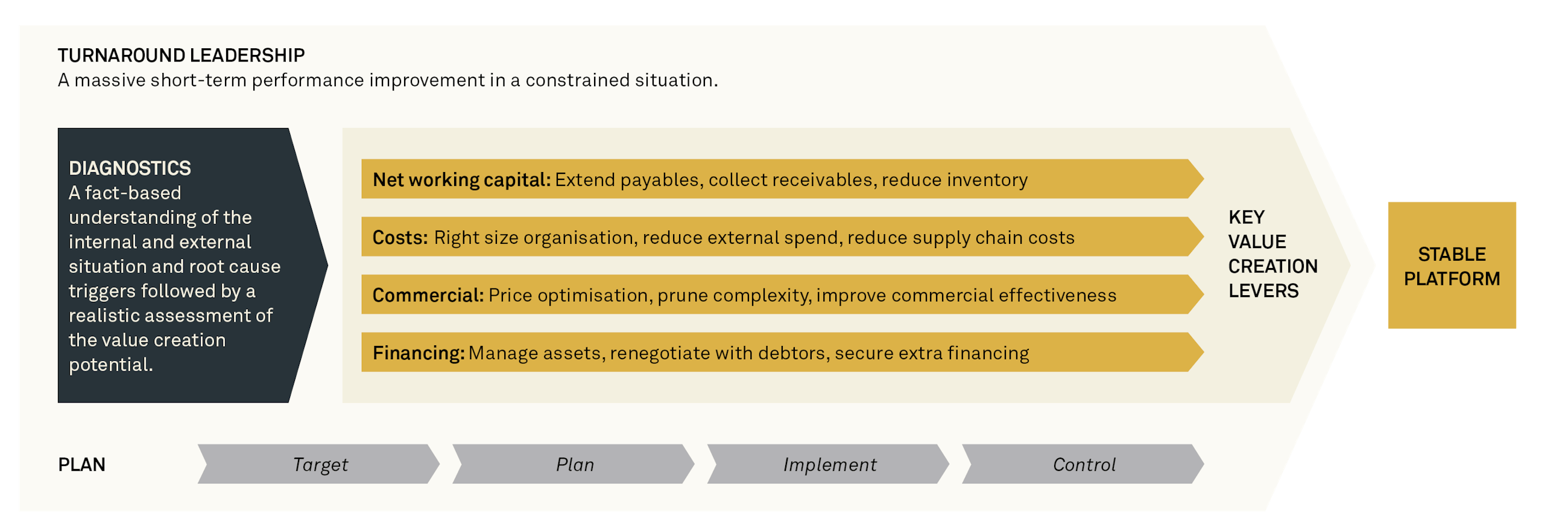

Essentially, a turnaround is a massive short-term performance improvement in a constrained environment; and most successful turnarounds are completed in two years or less.

Companies in a turnaround situation are companies with declining, critical and/or non-sustainable financial results. Such companies have many challenges, limitations and constraints such as lack of resources, declining sales, lack of time and lack of investors patience and require faster financial results improvement as the patience of owners (and other stakeholders) reduces the longer the financial results are non-acceptable.

Most turnarounds are completed in two years or less. From a larger macroeconomic perspective, it is interesting that recessions – which often trigger externally driven conditions for turnaround situations to emerge – also typically have a duration of two years or less. As an example, the average duration of the 11 recessions in the USA between 1945 and 2001 is 10 months2.

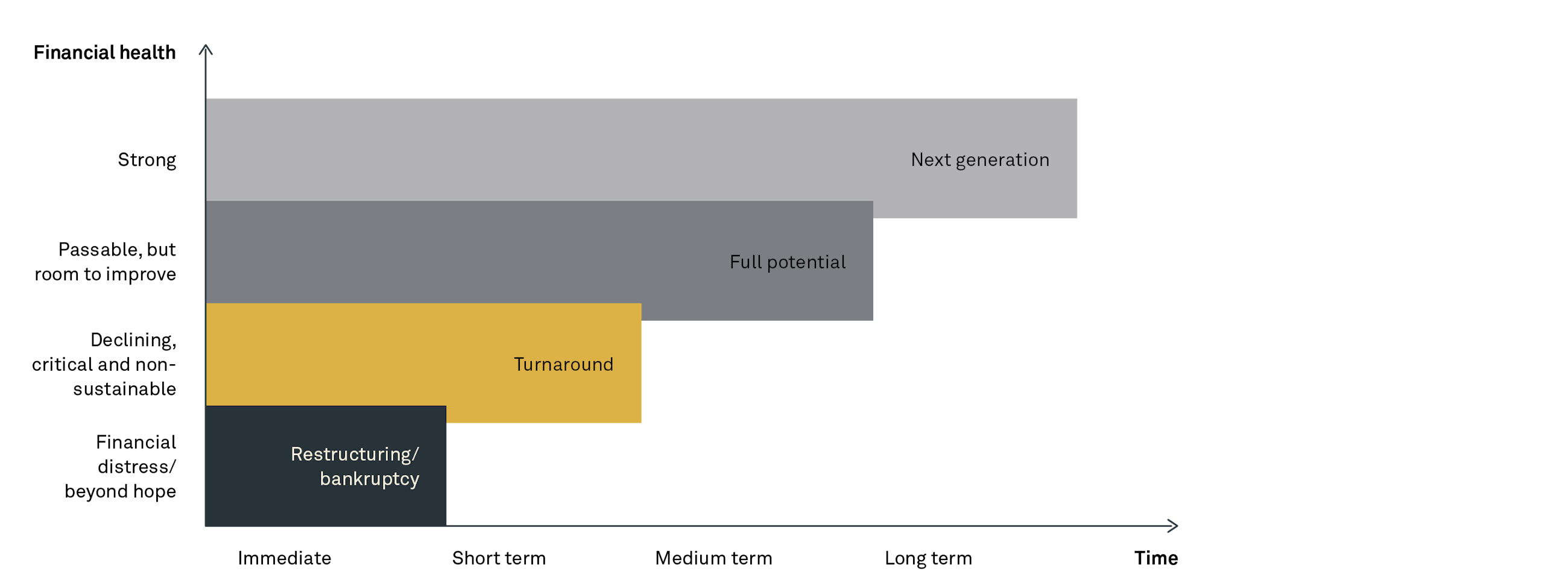

Let us now introduce The Conceptual Situational Business Development Framework – which showcases how turnarounds differ from other types of business development efforts with regard to time horizon and financial health of the business. The point here is not to introduce an exact framework, but rather a conceptual framework to aid us in establishing a common understanding of what we mean by turnaround and how this contrasts to other types of business development efforts.

Which business development action is the most suitable depends on the financial health of the business and the time horizon of the expected impact the action will provide. A turnaround effort is initiated when the financial health is at a critical and non-sustainable level and is typically short term by nature.

If the turnaround fails, the business can slip into more severe development needs requiring immediate radical restructuring or even filing for bankruptcy because of severe financial distress and no more time, patience or possibilities to fix the situation. Conversely, successful turnarounds typically create stable platforms from which businesses can further develop.

Businesses with acceptable financial performance to continue operations but with significant room for result improvements (e.g. low margin businesses) typically put in place improvement efforts to take the business or parts of it to its full potential. With the short-term turnaround time pressure gone, full potential programmes (e.g. implementing sales force excellence or best-in-class cost levels) have more time and resources to achieve the needed improvements.

Next Generation development is more long term by nature and is the main type of business development when the financial health of a company is strong. Naturally, this conceptual framework is not exact, and there can be many exceptions.

Company turnarounds require a massive short-term performance improvement in a constrained environment.

Heavy-duty construction equipment – example of an entire industry in turnaround during the great financial crisis

The global construction business is a USD 7.2 trillion industry or roughly 11% of world GDP3. In other words, the construction industry is a very large industry. The construction industry can be segmented in many ways and involves actors such as building contractors, building material suppliers and construction equipment suppliers. The heavy construction equipment industry is roughly estimated to be USD 0.6 trillion in size4 and includes all sorts of construction equipment like drilling machines, excavators, loaders, haulers, road equipment, cranes etc.

In the long term, the construction industry is a growth industry. From 1975 to 2009, the overall construction equipment industry grew 4% per year, whereas world GDP grew 3%5. The higher growth rate of the construction equipment industry can be explained by four factors: a growing world population, increasing wealth in emerging markets, increasing urbanisation and increased investment in infrastructure.

In the years 2008 and 2009, the world business community experienced the great financial crisis resulting in negative world GDP % for the time since World War II.

Most industries in the world were negatively affected by this development. The construction equipment industry was affected more negatively than the general economy. In fact, from 2008 to 2009, many western construction equipment businesses experienced a double-digit percentage decline in sales. The construction equipment market is cyclical with highs and lows that correlate to the highs and lows of world GDP, and it was dramatically impacted by the financial crisis.

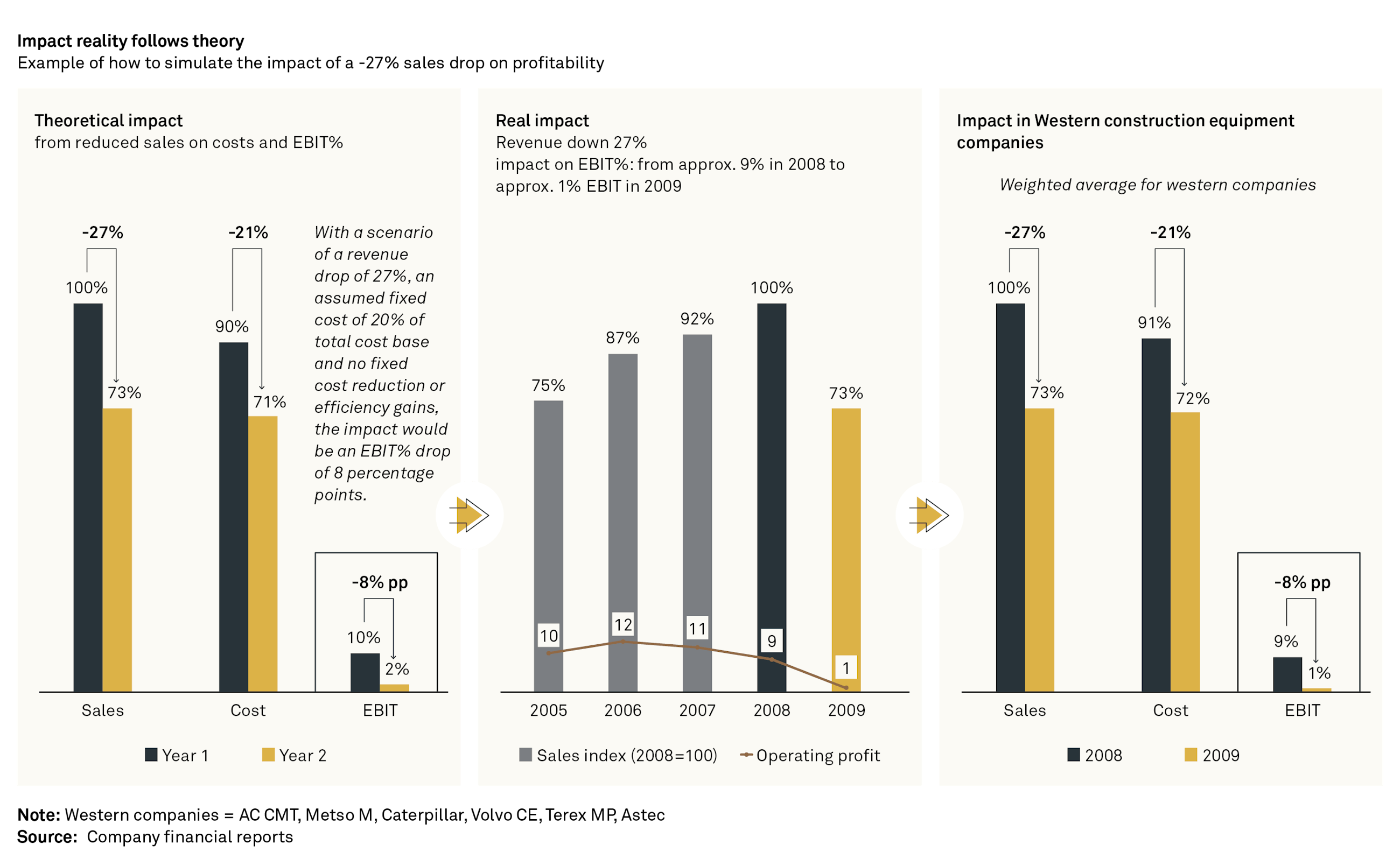

The theoretical impact that reduced sales would have on the construction industry closely followed the actual impact on the western construction industry6. Interestingly, in a recent webinar on “Keep margins in tough times” by Implement Consulting Group, 48% of the attendees believed in a revenue decrease of 10-30% for their companies and 30% of the attendees in a decrease of more than 30% during 2020. This could mean a significant drop in EBITA.

One explanation of how hard the construction equipment industry was hit is the bullwhip effect, which describes how a small change in one part of the supply chain can have a much larger effect upstream. In this case, a -1% GDP growth between 2008 and 2009 led to 6% decrease in general construction activity, 16% decrease in construction equipment customer growth (e.g. contractors and material producers), 27% decrease of construction equipment supplier growth and, down the line, 60% decrease of purchasing spend from construction equipment suppliers7. Like a bullwhip, a comparatively small movement led to a substantial hit at the other end.

One reason for this magnification of the problem is to be found in the inventory buffers between the steps in the value chain, where companies were reluctant to place new orders before using their on-hand inventory levels and available solutions. Other reasons are to be found in the general reluctance to invest and prioritisation of cash conservation, i.e. to not spend unless absolutely necessary given the uncertain outlook.

With customer confidence at an all-time low and orders being cancelled, it resulted in negative order intake for the construction equipment companies in the months after the Lehman Brothers failure. Because of the financial crisis, most, if not all, western construction equipment companies faced the need to manage a business turnaround. In fact, one could say that the whole western construction equipment industry was in a turnaround situation. The typical global construction equipment supplier has ~60% of costs in purchasing, ~15% of costs in sales and marketing and ~25% in other costs, and for these companies their cost management started by prioritising:

- Right-sizing of the organisation within sales, administration, manufacturing and operations

- Price optimisation and negotiations with suppliers

- Reduction of inventories

As an example, Caterpillar met the crisis with large layoffs in 2009, where 15-30% were typical levels8. Volvo also reduced headcount as well as focused on cutting operational costs and avoiding inventory build-up by lowering production capacity9. These value creation levers are explained in the Turnaround Toolkit further down. The post-crisis market development was very turbulent, difficult to predict and showed a shift in power with the Chinese suppliers becoming relatively more important. These changes can be seen when comparing which companies were the 50 largest construction equipment manufacturers in the world before and after the crisis. Sany and Zoomlion, for example, climbed from place 20 and 22, respectively, to place 6 and 7, respectively10.

Internal issues are typically the main causes of turnaround situations

Underperforming companies usually have many internal and/or external challenges that have caused the underperformance. It can be very difficult to fix these and turn around the company to positive lasting performance. Turning around a company involves making radical changes to improve business results and boosting earnings from critical, non-sustainable, levels. Change in itself is difficult, and in a turnaround situation this difficulty is compounded by both having to make many radical changes in parallel, and by the fact that the company is in a context with many constraints.

Only approximately 40% of companies achieved a successful turnaround!11

Common pitfalls include:

- Lack of focus on areas with the most cash potential.

- Lack of consequential management – too late/too soft/too difficult.

- Too complicated programme – too many initiatives, unclear priorities.

- Taking short-term gain actions that undermine longterm business health.

- Lack of clarity on ownership and accountability for delivering results.

- Insufficient resources dedicated or allocated too slowly.

- IT requirements neglected until too late.

- Lack of transparency in tracking progress and results – hiding problems.

Turnaround solutions are not long-term solutions but rather efforts to quickly boost earnings, e.g. by implementing decisions needed to bring financial stability to the business while longterm strategies are being designed. However, if possible, it is important that turnaround actions do not diminish the long-term profit potential. Actions to gain short-term profits at the expense of the long-term business results and development potential should be avoided or done with caution. There should be a risk analysis to understand the consequences and full cost benefit of the actions. Turnaround efforts help “buy time” to weather out tough market and/or cash flow situations and stabilise performance to more acceptable levels. When this has been achieved, more improvement actions and longerterm strategies can be developed and implemented.

Turnaround situations are most often caused by internal issues. A study by Stuart Slatter & David Lovett12 cites that 7 out of 10 most common cases are caused by internal factors, including:

- Management issues

- Poor financial control

- High cost structure

- Poor marketing

- Big projects

- Acquisitions

- Financial policy

While internal issues are most often the cause of a turnaround, they are also the issues that are easiest to work with and change, if the issues are recognised and dealt with correctly. This is a big “if”, which is why management and leadership is so important in turnarounds. However, management can be incapable or unwilling to acknowledge the full extent of the problem(s) until they run out of money and only accept reality when the balance sheet can no longer act as a buffer to absorb poor performance.

John W. Gardner

All managers and management teams make mistakes. However, one key difference between poor management and good management is the number of mistakes made and, more importantly, the ability to fix them.

Further evidence to support the importance of good management can be found in growth data. Interestingly, many studies show that a company’s ability to grow is not correlated to the industry it is working in. In fact, some studies show that internal factors have five times more effect on growth than external factors, again pointing to the same fact that internal operational excellence is more important to a company’s success than external factors.

Turnaround situations can also be dependent on external conditions such as:

- Changes in market demand

- Competition

- Adverse commodity prices

- Government policy

- Strikes

- Pandemics

The Global Financial Crisis of 2008/2009 triggered a large wave of turnaround situations around the globe at a scale not seen since World War II, which had great adverse effect on many companies and entire industries – a similar effect that can now be seen from the COVID-19 lockdowns.

External conditions can create an environment for “survival of the fittest”, where companies with internal issues are hit harder, e.g. a company with low margins and limited cash can be affected a lot more by a decrease in sales.

The changes to adapt to in the COVID-19 pandemic

While external conditions are more easily accepted and understood, they are more difficult to influence and change than internal. Companies impacted by external conditions must adapt to the new circumstances. However, most external conditions impact several companies, so while performance is impacted, relative performance may be alright. How these changes are dealt with is key to survival in the short term and improvement of competitive advantage in the long term.

The COVID-19 pandemic has impacted the world economy, and some industries are hit harder than others. As mentioned earlier in this text, it is not the industry per se, but the business health of a company entering the crisis that will determine the odds of survival. At the same time, we also see new trends and a new normal that all companies, regardless of industry or market position, need to take into account; digital behaviours, the increased strength of Asia and health consciousness, and a company facing a turnaround situation should also, if viable and valuable, focus to act fast to incorporate and benefit from new emerging opportunities.

Digital behaviours are here to stay

The COVID-19 pandemic has accelerated the usage of digital solutions. During the quarantine season, we have seen an increase in usage of popular streaming services such as Netflix, a surge for the gaming industry and a shift towards e-books. However, these industries were already digital before the crisis. What is more interesting is that even industries that are traditional and trust-based with a more traditional customer base have seen an increased digital behaviour among their customers.

The healthcare sector is one that has seen a maturing of digital behaviour despite traditional roots. The Swedish digital-only health provider Kry (Livi in Europe) saw a 70% increase of doctor appointments in March compared to February 202013, and in Great Britain, the NHS has encouraged thousands of clinics across the country to start shifting to remote consultations and has fast-tracked approval of digital health services to ramp up their offerings14.

When people work from home, the professional meetings move online. Digital tools such as Skype, Microsoft Teams and Zoom are now being implemented as standard in many businesses, and Zoom saw a shift from their previous daily record of 10 million users in a day in December to 300 million users logging in on 22 April15.

There is no doubt that the acceleration of digital literacy is a major and important result of the COVID-19 crisis. Some even call it a forced behavioural experiment, and it all points towards that the behaviours are staying with us even when the coast is clear. The question is how your business will adapt to this new normal.

An even stronger Asia

In the financial crisis of 2009, there was a power shift where Asian manufacturing companies increased their market share. There are indications that Asian companies will, in general, once again strengthen their position of the global market as the Asian markets seem to have recovered faster from the COVID-19 outbreak and can restart their businesses sooner. In addition, there are many examples where Asian companies are taking the opportunity to invest and expand into the distressed European and North American markets.

The world has become health conscious

The pandemic has taught us a lesson on how to stay healthy and safe. Social distancing has become the norm, and the face mask, which has been a common sight in many Asian countries for a long time, is no longer considered an odd attribute in western settings. As we have internalised the importance of staying clean and shielding ourselves, consumers will also expect increased precautions from the businesses that serve them.

Introducing the Turnaround Toolbox – to help manage turnaround situations

While there is no magic formula for how to succeed in turnarounds, as each case is unique, there is a toolkit containing three critical parts to increase the chance of succeeding with the turnaround. Here is a very brief introduction to this toolkit, and we will then elaborate more on each of these toolkits in forthcoming articles.

Diagnostics – The current situation needs to be understood and diagnosed.

Key value creation levers to be used for a value creation plan that should follow the Target, Plan, Implement, Control approach.

Turnaround leadership needs to be in place throughout the organisation. Below is a summarised explanation of this framework:

Diagnostics

The diagnosis of the turnaround situation should take both external factors (market, competitors, customers and suppliers) and internal factors (results, plans and operational efficiency) into consideration. The diagnosis should give an overview of the current situation and explain what has led to it. This is important to be able to make a constructive plan for the future.

Conducting diagnostics can improve the turnaround success rate. On average, 40% of turnarounds are successful. However, only 34% of turnarounds that did not conduct diagnostics where successful, whereas 60% of the turnarounds that had done diagnostics were successful16. This data heavily supports the need to conduct diagnostics in a turnaround situation.

Value creation

When it comes to value creation, it is important to prioritise correctly what is possible do to when in order to improve financial results fast with extra focus on key short-term value creation levers.

There are four overall value creation levers. To quickly generate/improve positive cash flow requires to first prioritise Net Working Capital (NWC) improvements to free up much needed cash, then Cost reductions to boost earnings, then Commercial efforts to increase sales where possible and, if required, to rebalance the Financing obligations with the forward-looking cash- generating capacity of the business. Note that this turns normal management order of priorities a bit on their head as for normally healthy company development the first focus is developing commercial priorities, then cost management, then NWC management.

NWC can be dealt with through reduced inventory, extending accounts payable by for example negotiating delay in payments and collecting accounts receivable by for example enforcing overdue collections.

There are several ways to lower costs, and the main ones are rightsizing the organisation, cost savings with regard to sourcing and supply chain cost savings. Time is of the essence when it comes to cost management; delays can result in the need to cut costs even more.

With regard to commercial efforts, it is very difficult to “sell your way” out of a turnaround. However, there are salesrelated efforts which are a great source of short-term value creation. Pricing, pruning complexity and improving commercial effectiveness can all be useful.

Finally, turnaround companies need to rebalance financial obligations with the new cash-generating capacity. This can be done through asset management, renegotiating with debtors and securing additional financing.

The value creation plan should be summarised into a realistic forwardlooking cash flow projection highlighting the main sources and drainage of cash and the time horizon available with realistic best-, likely- and worstcase scenario options. This cash flow scenario is key to the overall turnaround plan. The turnaround plan starts with clear targets followed by pressure-tested action plans aligned to the value creation priorities as well as a disciplined implementation with follow-up control that plans are executed or need to be adjusted/ supported. This is a structured and disciplined approach to successful turnaround performance improvement impact.

Turnaround leadership

Succeeding with turnarounds is extremely difficult, requiring breakthrough ambition, tough decisions, fast action and doing things differently, i.e. strong and effective change leadership and communication, which needs to be applied throughout the organisation to ensure effective communication and realisation of the desired results.

References

1 McKinsey & Company Article in Perspectives on retail and consumer goods Winter 2013/14:

“In need of a retail turnaround? How to know and what to do” by Peter Breuer, Thierry Elmalem and Chris Wigley.

The McKinsey global survey on recovery and transformation was in the field from January 22 to February 1, 2013, and received responses from 1,527 executives representing the full range of regions, industries, company sizes, tenures, and functional specialties.

2 Wikipedia: https://en.wikipedia.org/wiki/List_of_recessions_in_the_ United_States

The average duration of the 11 recessions between 1945 and 2001 is 10 months.

3 “Global Construction 2020”, Oxford Economics

4 Off-Highway Research

5 World Bank Group, Off-Highway Research GDP: IMF, GDP Consensus Forecast

6 Company financial reports from AC CMT, Metso M, Caterpillar, Volvo CE, Terex MP and Astec.

7 Construction activity –Global Insight; Financial reports. Numbers based on estimates based on different sources, 2009.

8 Caterpillar Q1 report 2009

9 Volvo Annual report 2008

10 Khl, International Construction magazine, Yellow table 2008 and 2012

12 Studies of the reasons for turnaround … Corporate Turnaround – Stuart Slatter & David Lovett, 1999.

14 https://www.theguardian.com/ world/2020/mar/06/gps-told-toswitch- to-remote-consultations-tocombat- covid-19

15 https://www.cnbc.com/2020/04/23/ zoom-shares-pop-after-users-growfrom- to-300-million.html

16 McKinsey global survey on recovery and transformation from 2013 with responses from 1,527 executives representing the full range of regions, industries, company sizes, tenures and functional specialties.