Article

Why big companies are struggling, the role of start-ups and how disruption is playing into everything

Published

24 November 2022

Update 2024

As an article written a week before the release of ChatGPT, a lot of terminology has changed and our perspectives have matured significantly. This article stands. Today, use cases are plenty and more are rapidly being added. The original premise of the startup victory has been true, but large companies have largely also responded and we've learned that both sides can be winners and the market has expanded already as a result. The recommendations in the original article largely stands.

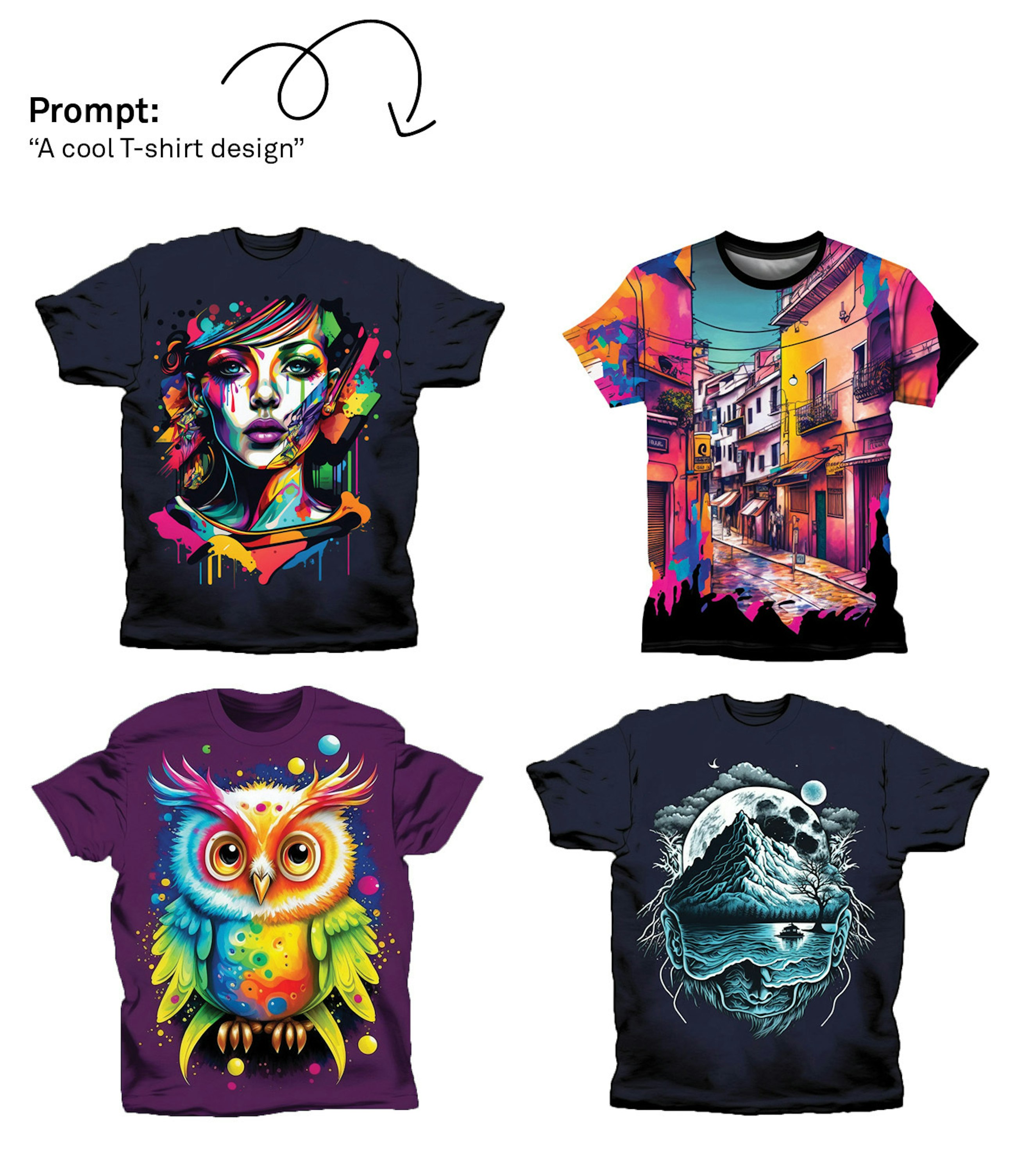

DALL-E, MidJourney and Stable Diffusion are examples of a new kind of technology, capable of creating creative and photorealistic images of anything within seconds. What is this incredible technology going to mean for businesses and the economy?

Collectively referred to as image generation models, this class of machine learning models can take any piece of text and produce a creative, high quality rendition of it. Over the last months, it has taken the internet by storm, but reasonable questions are being raised regarding the big-impact business cases.

In this article, we examine the capability of these image generation models, what they mean for businesses and how they might disrupt select industries.

A solution looking for a problem

Image generation models are incredibly powerful, and most people who see them in action are immediately struck by the potential they represent. Issues arise when formulating this into specific business cases.

While we might be able to automate the design of clothes, this is rarely the main driver of cost in fashion companies. We might be able to assist brainstorming for architecture firms, but “better brainstorming tools” was never particularly high on the agenda in architecture.

The image generation technology is a fantastical solution looking for a problem.

As such, we should not underestimate it!

A lot of people once asked with scepticism about the essential use case for the original iPhone which could justify the price tag. Was it an expensive music player? A large phone? Or an oddly shaped internet-device? It turned out the iPhone had many use cases, and a lot of them (like the App Store) would come later as the technology matured.

Image generation models are in a similar position right now. It is fair to ask what the use case is, and while we can mention some, the existing ones do not seem to justify the hype.

But make no mistake. The use cases are coming. This is just the hard part. So, who can solve it?

Disruption is in the air

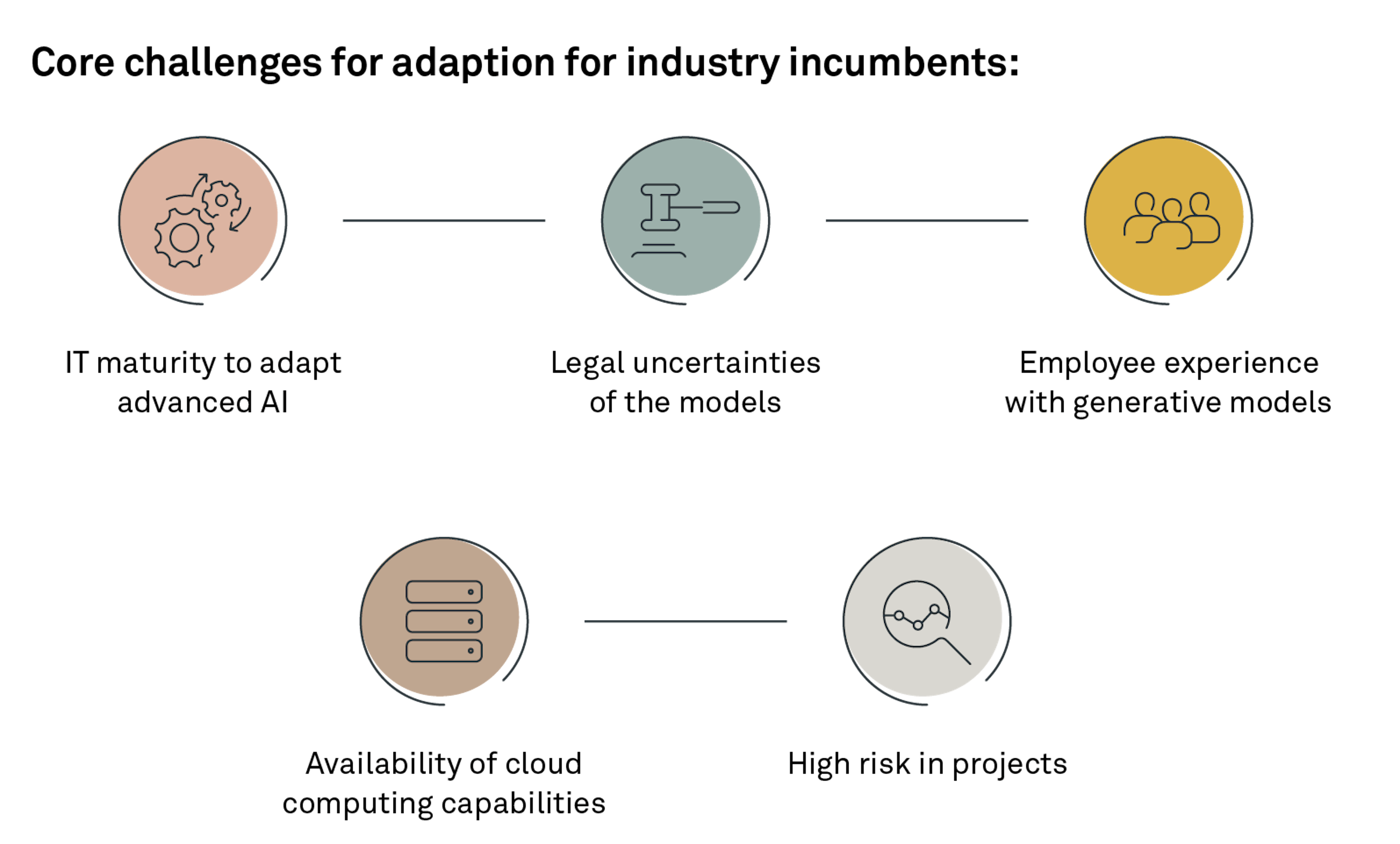

Image generation models are hard to use for large established companies. The models require a very high level of IT maturity, and inherent legal uncertainties can make them unpalatable for a large company. If a company is not comfortable in the cloud or driving heavy compute loads, using this technology will prove a great challenge.

The big winners: start-ups and vc’s

With a technology looking for a solution, start-ups are especially well positioned to leverage these new tools. Start-ups can find a strong product-market-fit, and launching a cloud native company can often be easier than performing a cloud transition. Start-ups can also more easily accept the legal risks, as they already face several risks. It is not insignificant, but some start-up is going to risk it if the idea is good.

We already see this. Sequoia Capital already tracks over 120 individual start-ups based on these technologies, even if they are just months old. Stability.AI, provider of the Stable Diffusion model, is valued at more than USD 1 billion, and several others in the field are rapidly breaking USD 100 million. Major players like MidJourney do not yet have an official valuation.

This provides an immense opportunity for venture capital funds (VCs). While obviously a high-risk investment, a lot of these start-ups are bound to disrupt major industries, from design and manufacturing to entertainment and communication. The start-ups need capital for the technology, and the VCs can spread their risk.

What can incumbents do?

Not all is lost for the large incumbents. While it might be chilling to know a potential avalanche of AI-powered start-ups is bound to disrupt your industry, mitigation can be done. A strategic effort to identify core use cases can help. A well-funded data science team might be able to get out ahead of the start-ups and ensure scale of certain solutions.

And even if that is unsuccessful, getting internal experience with the technology is going to be key in a potential acquisition later down the line. If you are in an affected industry, prepare your M&A team to look for strong opportunities to leverage high-tech start-ups with strong synergies with your core business. Predicting what use cases are going to come up will be near impossible, so the best we can do is react.

Want to know more?

At Implement, we have as much experience as you can possibly have. We have several strong data science consultants monitoring the technological developments as well as the business scene, both globally and specifically in the Nordics.

Reach out if you need deeper insights in the opportunities presented.

Related0 4

Article

Read more

Digitaliseringens rygrad

Datacentre i Danmark driver det moderne digitale samfund, bidrager til den grønne omstilling og skaber jobs og økonomisk...Article

Read more

The AI opportunity for eGovernment in Belgium

Adopting AI in public administration to enhance productivity and create value for citizens and businesses.Article

Read more

The AI opportunity for eGovernment in Poland

Adopting AI in public administration to enhance productivity and create value for citizens and businesses.Article

Read more