Project portfolio management should not be complex

16 November 2015

Project portfolio management is not necessarily complex. As a matter of fact, you must do all you possibly can in order not to make it a complex discipline. That is, on the other hand, not an easy task.

If we cut to the bone, project portfolio management is only about two things:

- Overview

- Decisions

It is not difficult to obtain an overview of your project portfolio. At least not the simple overview, which is often sufficient. You may, of course, choose to spend time and energy establishing a number of various data for your projects and constructing numerous complex overviews. This could provide a shield against making decisions, and sometimes it is even a defence mechanism to avoid having to make the tough decisions.

The vast majority of projects are, in isolation, good business ideas, but it is just not possible to pursue them all – at the same time. Thus, responsible decisionmaking requires turning down good projects.

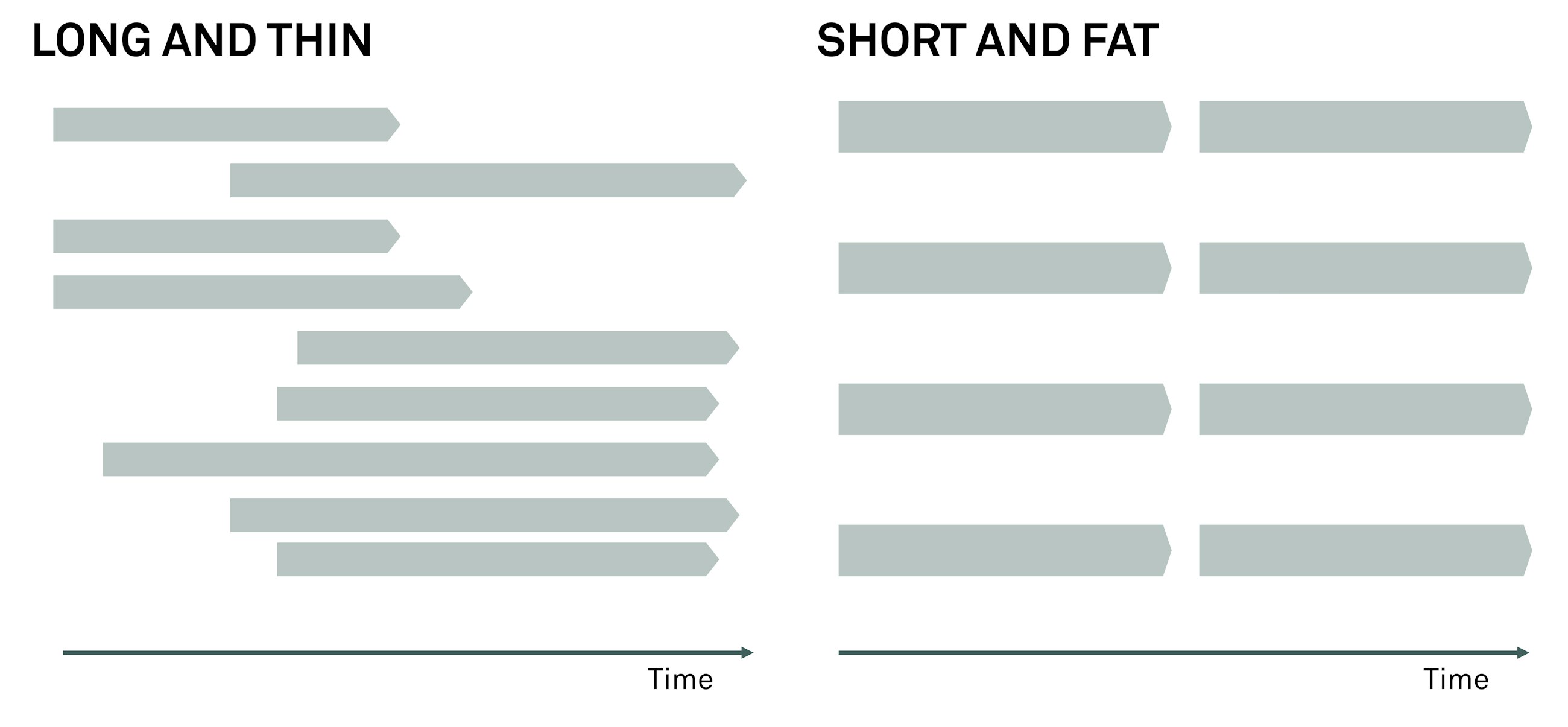

Many organisations have realised that the right solution – which calls for tough decisions – is aiming for a project portfolio of short and fat projects. Short and fat projects imply that the company runs few short projects armed with sufficient resources. This solution is on the drawing board in many organisations, but is not being executed. Where the solution is successfully realised, it must be considered ”best practice”.

The alternative is running many long and thin projects concurrently, which entails that the organisation’s resources are spread insufficiently between many parallel projects which are having a hard time crossing the finishing line. Portfolios consisting of long and thin projects are what we find in most organisations – this is ”common practice”.

The underlying logic is shown in the below illustration where takt has also been incorporated in the short and fat portfolio.

Many organisations have nodded approvingly and bought into the logic of this illustration – including those responsible for the project portfolios. However, the principle of short and fat is only very rarely implemented.

It seems as if we, logically, acknowledge the logic of the principle, but do not perceive it to be sufficiently relevant in relation to our own situation, and, consequently, the stomach ache fails to appear which would otherwise have encouraged us to change the situation.

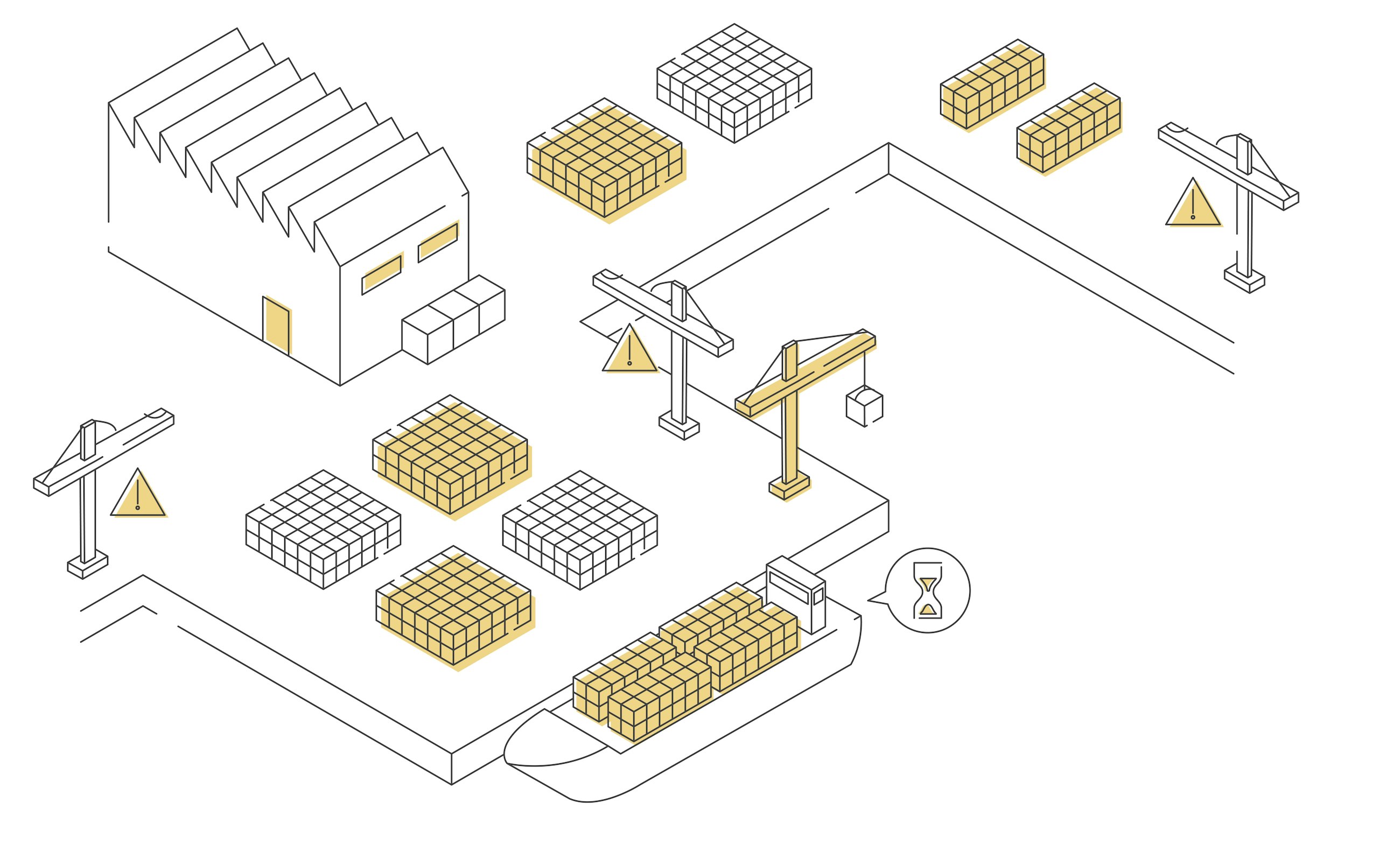

A container terminal in South America

Let us take a look at a fictitious example from quite another world – a container terminal in South America.

You are the manager of a container terminal at the South American west coast:

- The container terminal has four container cranes, but three of them are out of operation and will be so for several months.

- Thus, only one crane is in operation. The capacity of this crane is one ship per day. In other words, the crane can unload and load one container ship of 2,000 TEU a day (TEU: measuring unit for the carrying capacity of a container ship)

- In the shipping industry, it is a widely accepted industry norm that a 2,000 TEU container ship at sea between ports creates value of DKK 1 million per day. Every day spent in port, thus, ”costs” the ship owner DKK 1 million.

One Monday morning, six container ships arrive at your terminal at exactly the same time:

- All six ships are of the same size: 2,000 TEU

- The six captains are all eager to get started unloading and loading their ships and expect the terminal crew to begin working on their ship right away

- How would you plan the unloading and loading of the six ships?

- What is the total cost for the ship owners of having their ships wait in port?

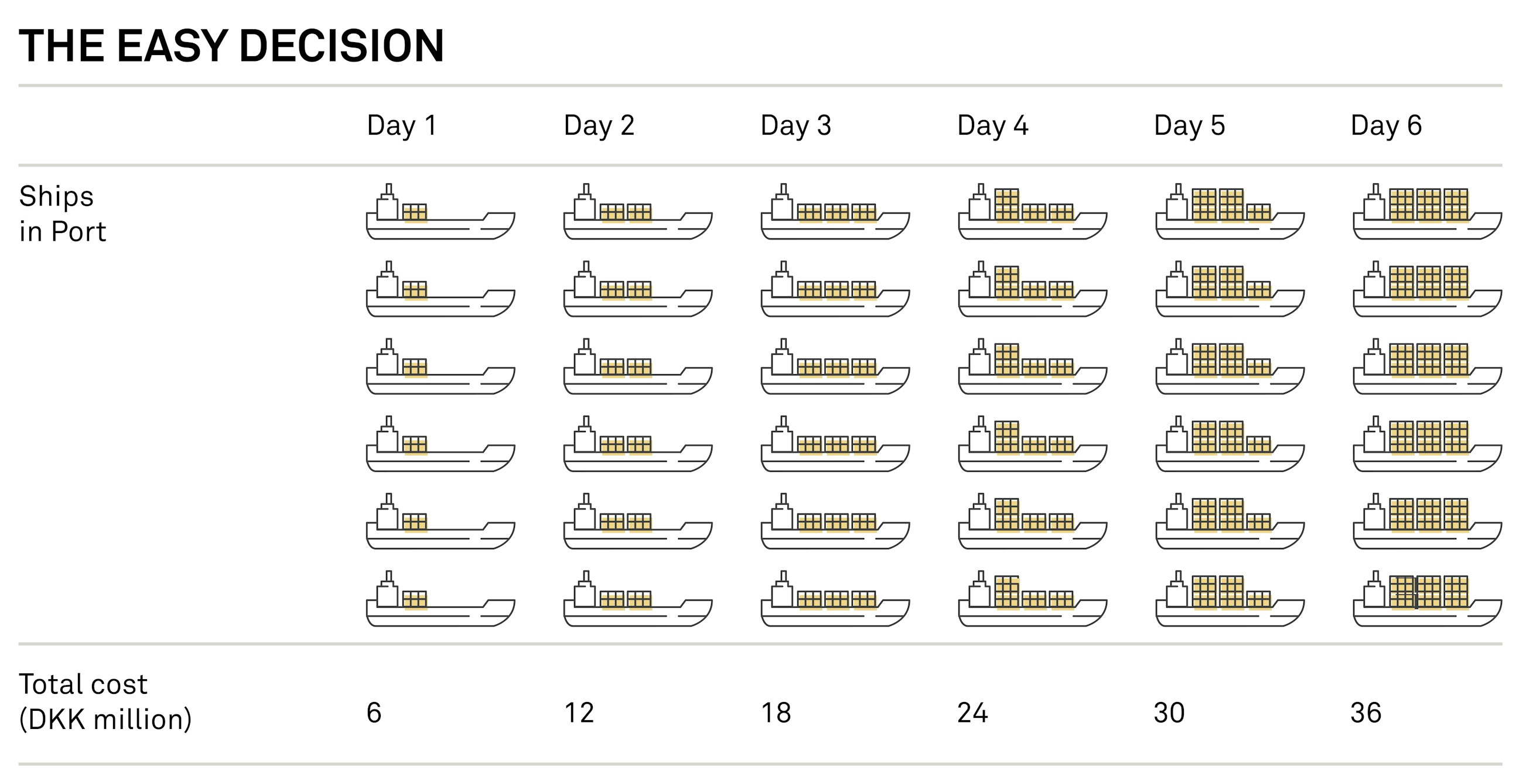

Scenario 1 – The easy decision

You feel the pressure from all six captains and realise that you will have to start working on all six ships immediately in order for them to see that action is taken. The operation time of the crane is split equally between the six ships. The effect of this decision is illustrated below.

In this way, all six ships leave the terminal at the same time – after six days in port, equalling a total cost of DKK 36 million for the six shipping companies. None of the six captains are particularly enthusiastic about this solution, but, on the other hand, none of them get really annoyed either, even though their bonuses depend on the annual earnings of the ship to the ship owners. After all, they can see that the terminal crew works on their ships, and that they work equally on all six ships.

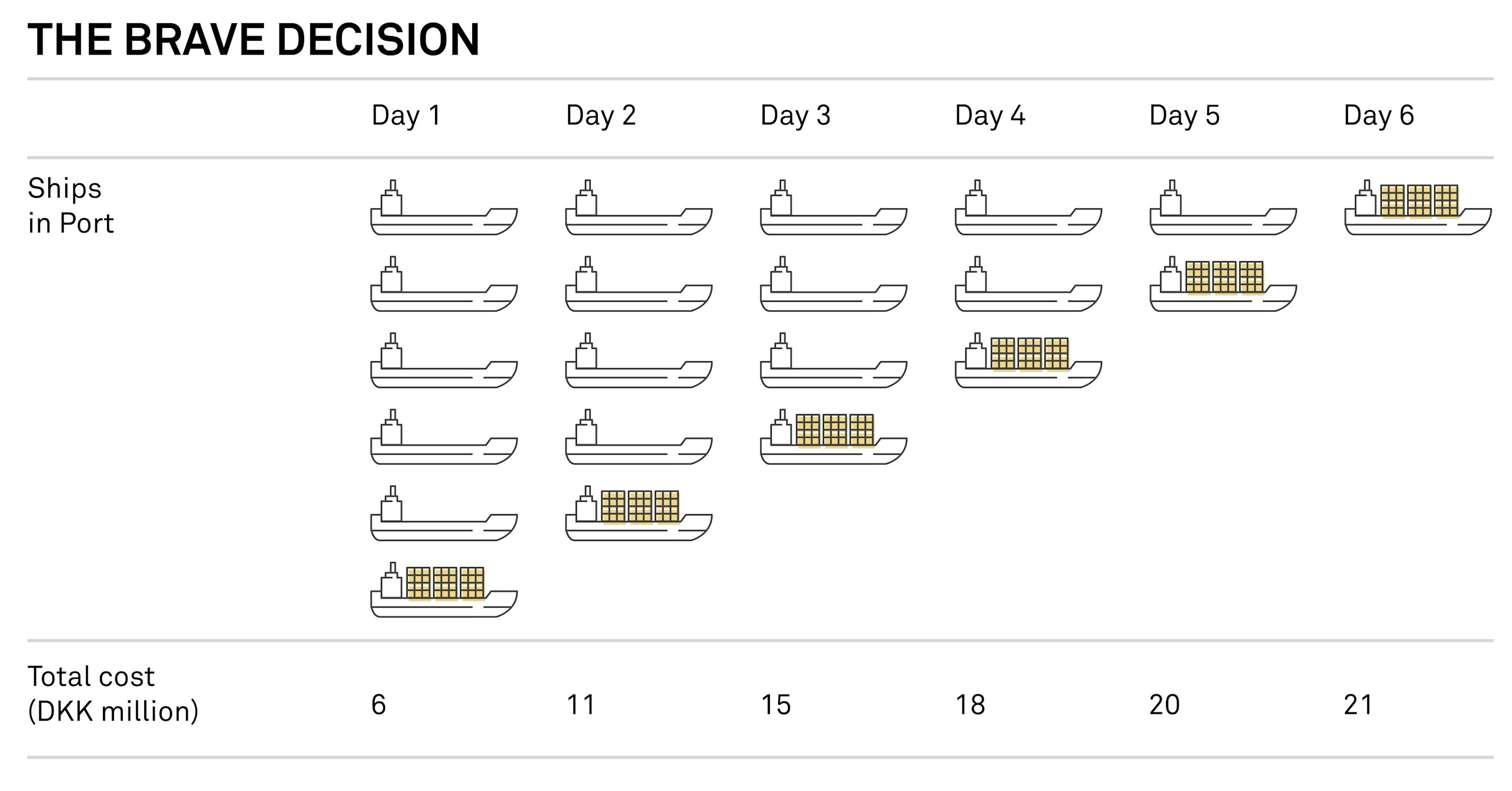

Scenario 2 – The brave decision

You feel brave and make the tough decision only to focus on one ship at a time and to complete unloading and loading each ship before starting to work on the next. The effect of this decision is illustrated below:

In its nature, the brave decision differs from the easy decision – and the consequences are significantly different. First of all, the brave decision makes one captain very happy. The satisfaction rate of the five other captains, however, is increasingly low, and the last captain to leave the terminal is quite furious, to put it mildly. Altogether, the captains’ overall satisfaction is probably lower in the brave decision than in the easy decision.

The other striking difference is that the total cost for all ship owners of having their ship in port is DKK 15 million lower in the brave decision than in the easy decision – which means savings of more than 40%!

Point no. 1 about project portfolio management

It is absolutely necessary that someone assumes responsibility at portfolio level.

Let us consider the captains as project owners and managers in the same organisation, but with each their individual targets they must achieve to become successful – and obtain bonuses. Each project owner has his primary interest in succeeding with his own project and, at most, a secondary interest in his colleagues succeeding with their projects elsewhere in the organisation. Which is, by the way, quite natural.

Carrying out successful projects is a difficult task, and project owner, project managers and key project participants must be passionate about the project and fight for it with blood, sweat and tears. That is their mission – and they need to have a somewhat single-minded focus on the project to succeed.

Only by giving a person or a group of persons responsibility and targets at portfolio level will it be possible to realise the profit of DKK 15 million. The task is still difficult. The game of resources and prioritisation between projects is perhaps one of the most heated and important games in many organisations, and those responsible for the portfolio are placed in the middle of this game. Having appointed someone responsible for the portfolio is, in other words, ”a really good idea”.

Point no. 2 about project portfolio management

The effect of projects must be taken into account as a crucial factor in the prioritisation of the project portfolio.

The DKK 1 million which is ”lost” for every day the ship is in port is a classic opportunity cost consideration: What is the profit loss for every day spent in port? If we apply this to our project portfolio, we are talking about the effect of the projects. And what we miss out on here is, in other words, that the effect of the projects will be realised later than otherwise.

Is that of any value to the organisation? Yes, it is. And often, it is actually of more value than e.g. eliminating some project costs (e.g. by carrying out certain processes in the project in a smarter way). However, it is rare that the effect (the benefit side of a cost/benefit calculation) is used actively in the project portfolio prioritisation. Here, focus is typically on out-of-pocket costs and other scarce resources.

A classic example of similar rules of thumb is the pharma industry where, in the past, the rule was that each day a new blockbuster medicine was introduced earlier into the market, the company would earn additional USD 1 million.

Prioritising based on the effect of projects and when it is realised is ”a really good idea”.

Back to the South American container terminal

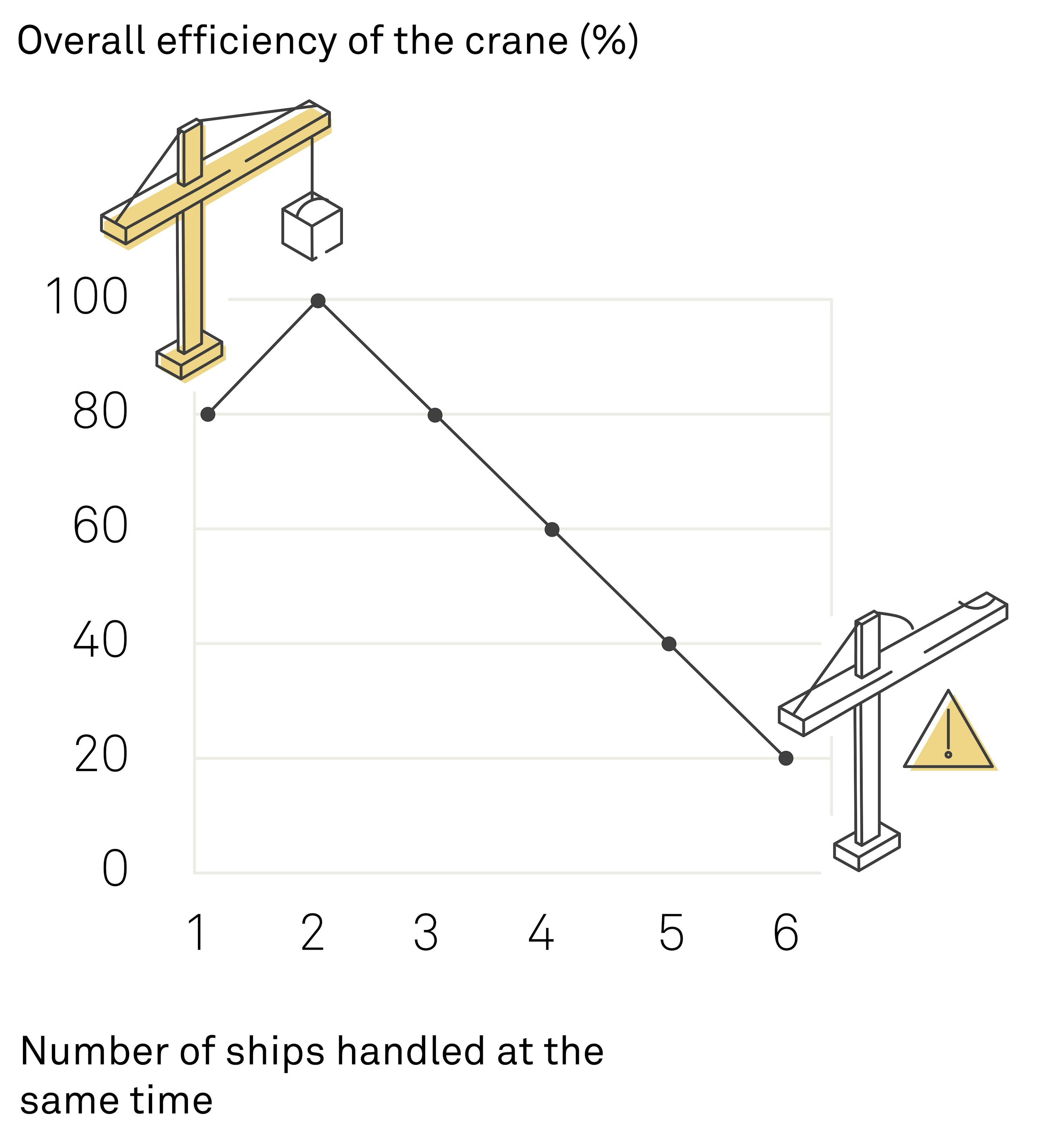

The world is not quite as simple as illustrated in our container ship example, and it would be sensible to take one more factor into consideration, namely the factor that the efficiency of the crane, based on experience, depends on how many ships it is to handle at the same time.

We presume that the efficiency of the crane can be described as follows:

As mentioned, the efficiency of the container crane varies according to the number of ships it handles at the same time:

- If the crane is to handle too many ships at the same time, its efficiency is dramatically reduced due to the shifting between ships, which is highly time-consuming. In this way, there is also no particular focus for the crane during a day.

- If the crane is to handle only one ship at a time as opposed to two, the waiting time will increase as the crane from time to time will have to wait for the ship’s crew to handle deck hatches and the like. Mentally, the crane operator also prefers to shift between two ships.

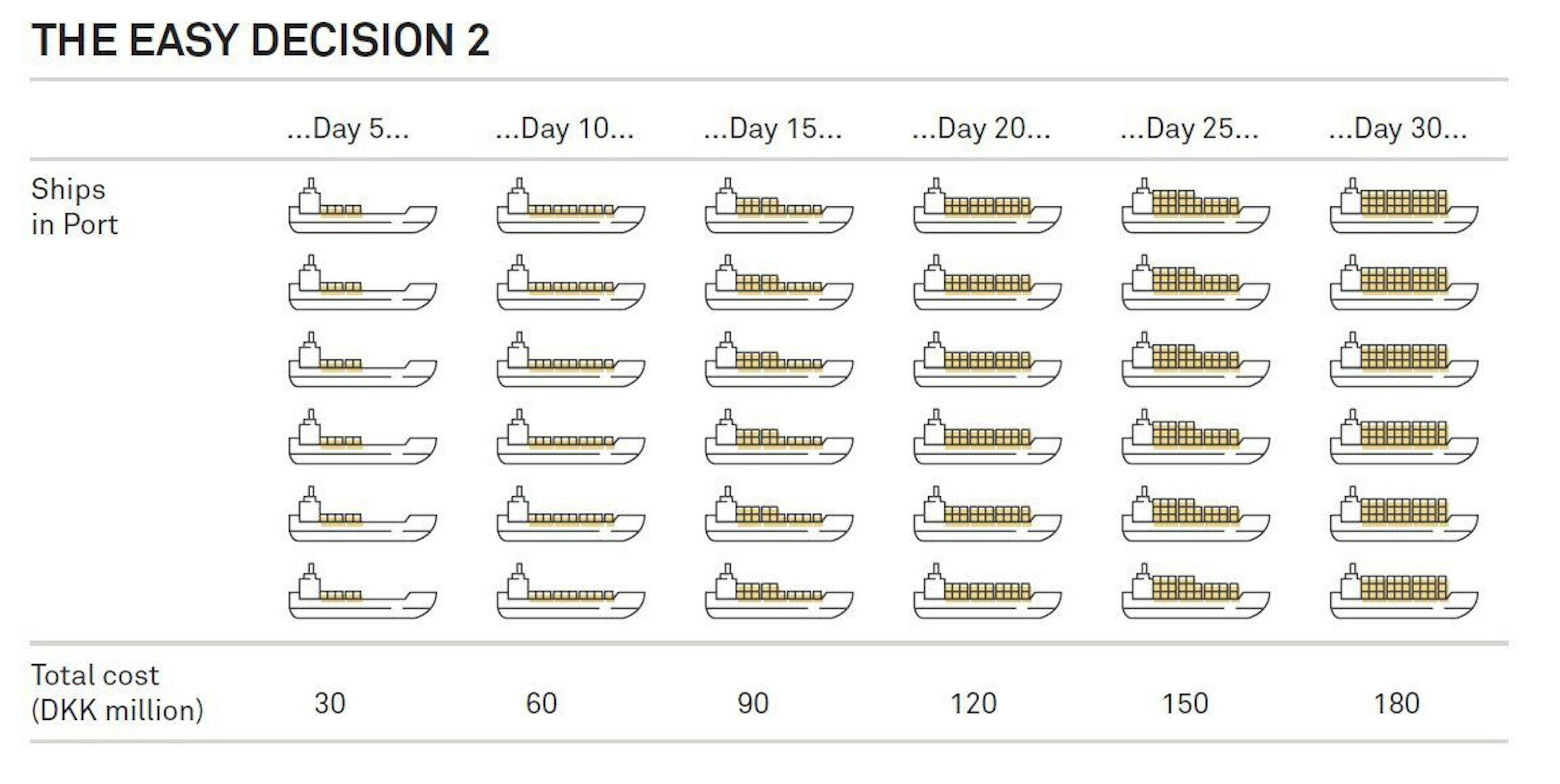

Scenario 3 - The easy decision 2

In principle, this solution is identical to ”the easy decision 1”, however, now we also consider the efficiency of the crane. The effect of this decision is illustrated below.

In this way, all six ships leave the terminal at the same time – after 30 days in port, equalling a total cost of DKK 180 million for the six shipping companies(!). This solution makes none of the captains happy. On the other hand, they feel that they have been treated equally and believe that the long waiting time is a result of laziness and lacking efficiency on part of the container terminal. This decision will also result in ”friendly” conversations and tumultuous meetings with managers from all six shipping companies.

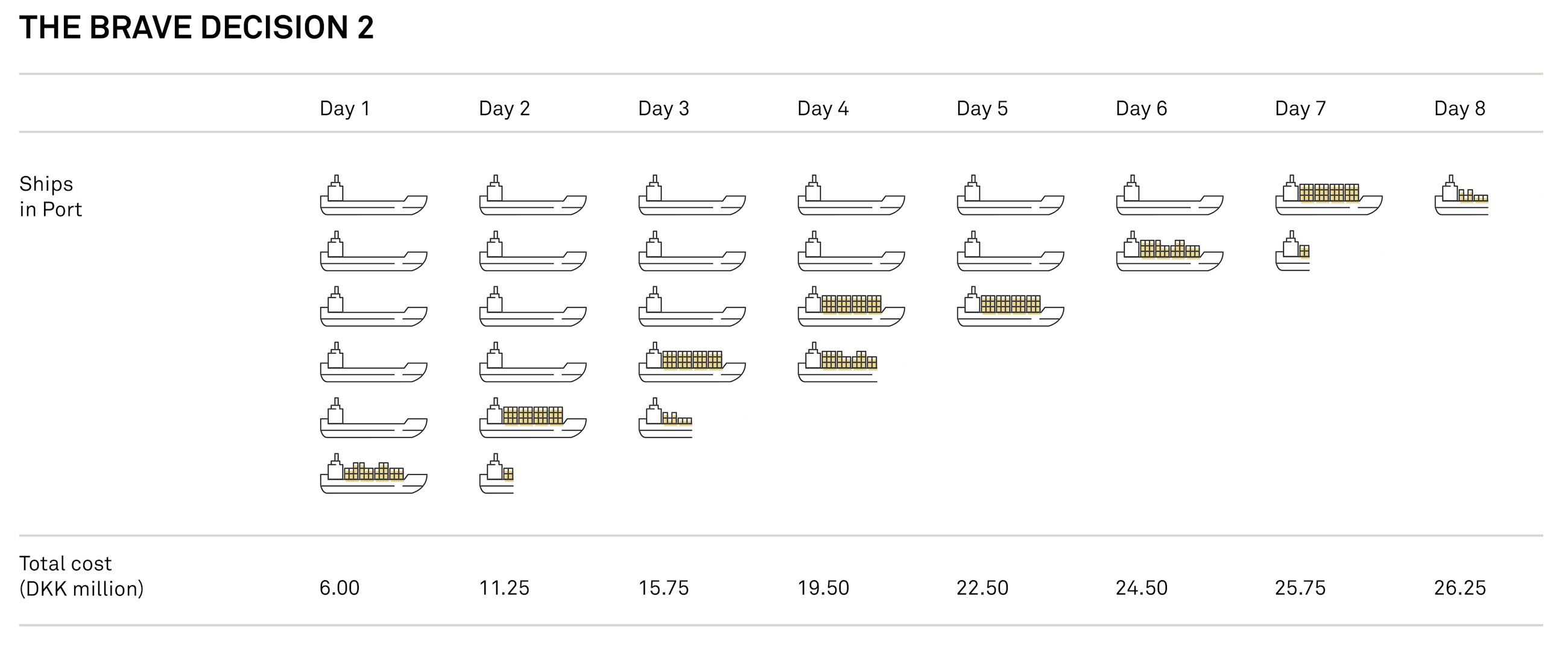

Scenario 4 – The brave decision 2

In principle, this solution is identical to ”the brave decision 1”, however, now we also consider the efficiency of the crane. The effect of this decision is illustrated below.

As previously, the consequences are significantly different – now the fluctuations are just even larger. The last ship leaves the port after 7.5 days, which, of course, leads to a rather annoyed captain on board this ship and perhaps a ”friendly” phone call from his shipping company. The captains also, each in their way, have a strong feeling of having been treated unequally, which is not particularly easy to handle. However, compared to the solution ”the easy decision 1”, it is, after all, a somewhat easier situation to tackle.

The captains in ”the brave decision 2” most often would not know the consequences of ”the easy decision 2”, which may actually imply that some of the captains in ”the brave decision 2” are almost harder to please than in ”the easy decision 2” (even though the last captain leaves the terminal after 7.5 days instead of 30 days). Therefore, it may be beneficial to try to explain to them some of this logic and then let those who left the terminal last head the queue the next time.

Financially, the difference in consequence is huge: DKK 180 vs. 26.25 million, a difference of DKK 153.75 million. Savings earned by having the courage to go for the brave decision are 85%.

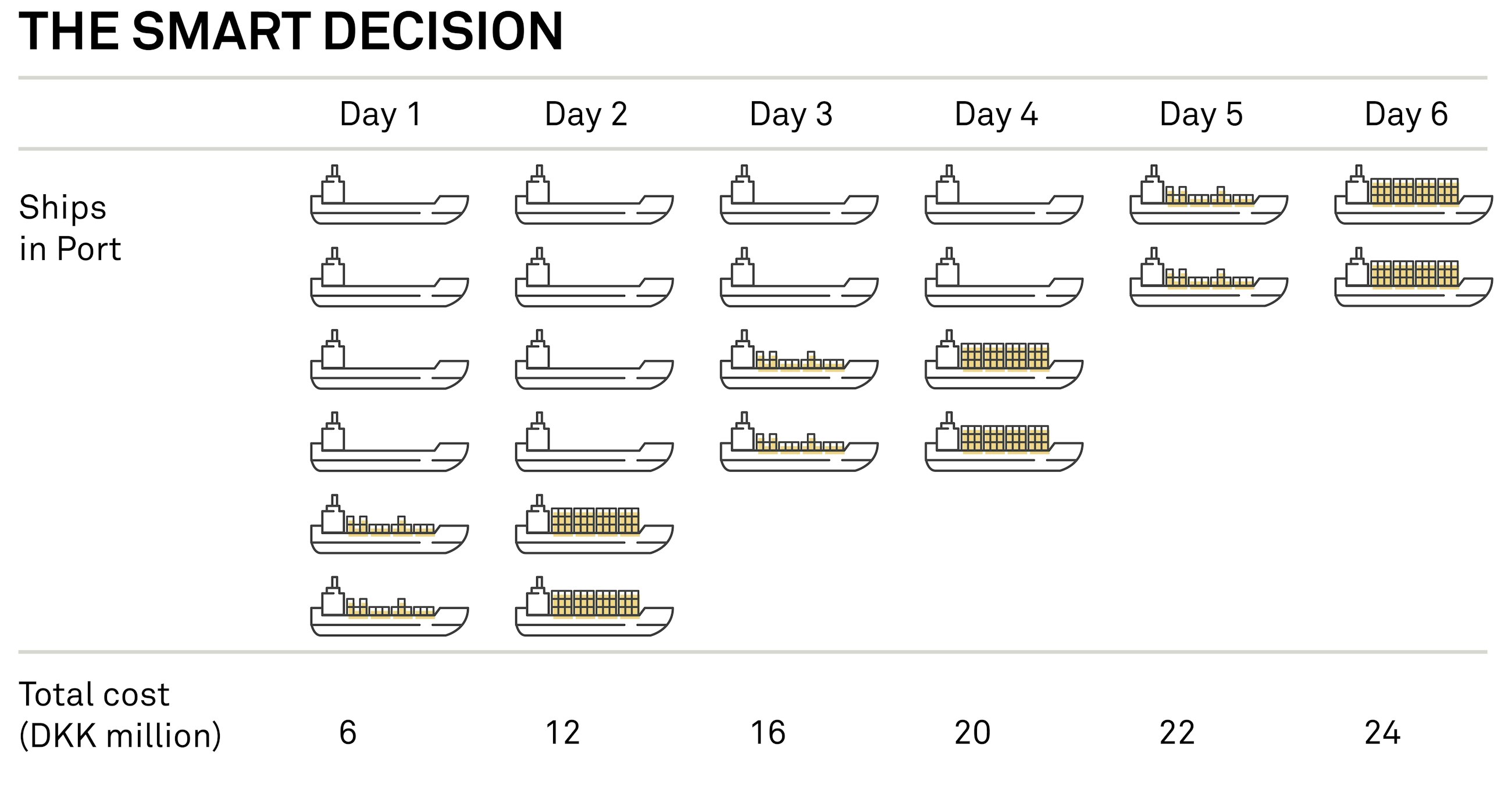

Scenario 5 – The smart decision

In fact, ”the brave decision 2” is not the optimal solution as it does not fully take into account the nature of the crane’s efficiency according to which the most optimal approach, as we saw, is to handle two ships at the same time. The effect of the smart decision is illustrated below:

Two ships leave the terminal together after two days, two more ships leave after four days, and the last two ships leave the terminal together on the sixth day. This entails further total savings of DKK 2.25 million and also leads to a more manageable situation concerning the satisfaction rate of the captains. The fact

alone that the last ship does not leave the port as the only one has a highly positive influence on the mood of the last captain.

Container cranes vs. project participants

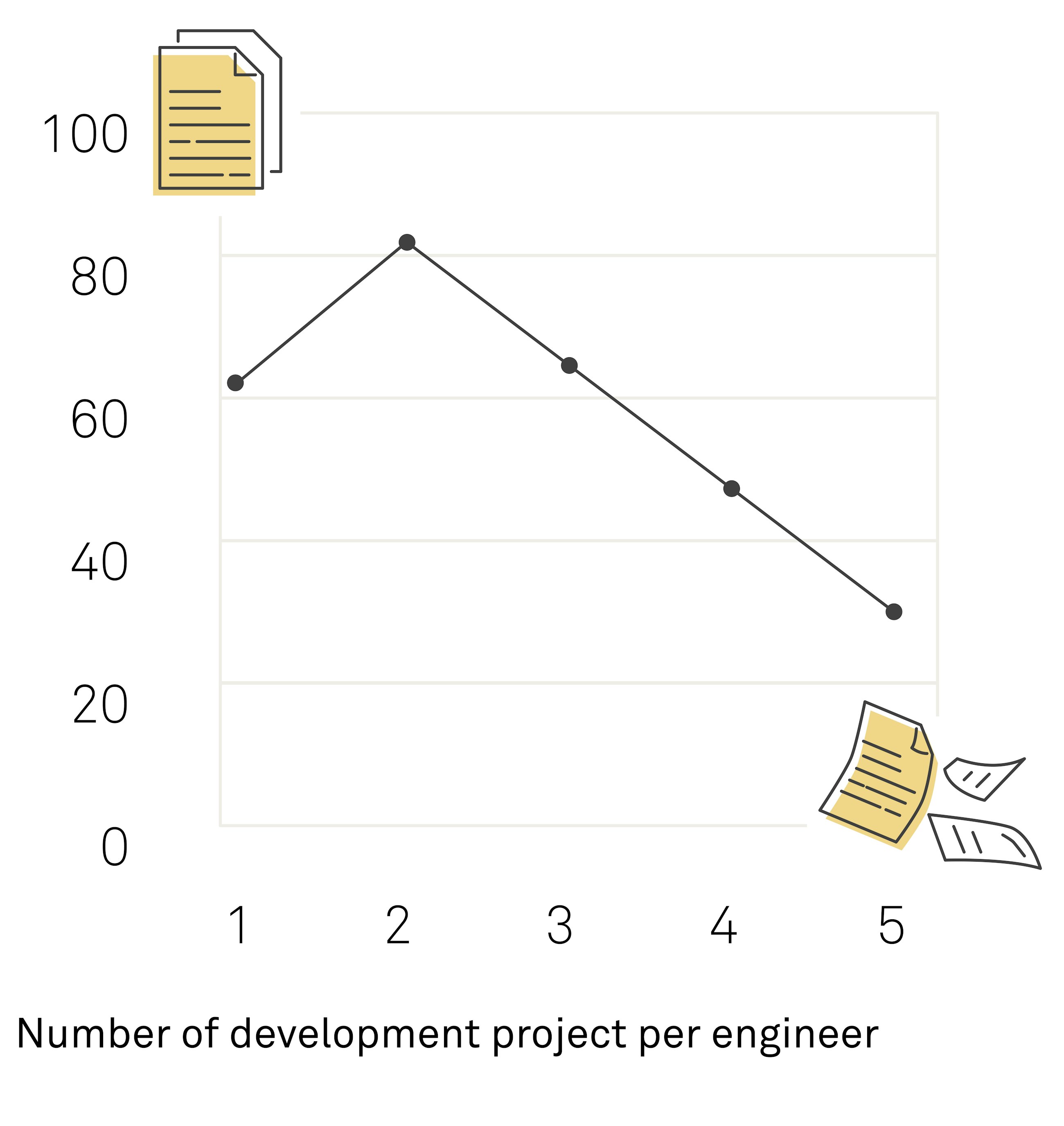

What makes the picture almost grotesque is the crane’s reduced efficiency when handling several ships at the same time. Unfortunately, there is clear evidence that the mechanism also applies to project participants as can be seen from the below figure on project engineers in product development projects.

As a matter of fact, the above correlation is somewhat worse for project participants than the crane at the South American container terminal since, with project participants, the overall efficiency can never reach 100% (project participants must, as opposed to cranes, spend time on department meetings, performance reviews, training, organisational development, illness etc.), and the overall efficiency when participating in five concurrent projects is merely 30%.

This also means that our example from the container terminal is not at all off the mark in relation to projects and project portfolios – actually, it is a bit conservative. The question on the tip of the tongue then is: Do we allow them to happen – the ”easy” solutions? In many ways, the container shipping industry is an industry which has been optimised and made more efficient to maximise earnings, and it is hardly probable that the easy solutions are commonplace here.

When looking at project portfolios – across most project types – we most frequently see a portfolio of long and thin projects, i.e. the easy solution where too much work is initiated at the same time.

Point no. 3 about project portfolio management

Spreading one’s scarce resources between too many projects is damaging to the bottom line – and to the scarce resources.

The scarce resource at the container terminal is the container crane. The crane is on ”the critical path”, while there is no scarcity of many of the other resources at the container terminal. The same applies to the project world.

And even more to your project portfolio. Usually, you can easily identify 5-10 people who constitute the scarce resources across the portfolio – those who are most sought-after by the organisation’s project managers, and those who are typically allocated to too many projects at the same time. And, according to the mechanisms and as illustrated by the container terminal example, these are the people (or the prioritisation of them) who also determine the progress in your portfolio and, thus, your bottom line.

The handling of the scarce resources – and how brave you are in your decisions in relation to these – is, thus, an important factor in the size of your long-term bottom line.

Another thing is the motivation of those who constitute your scarce resources. An overall efficiency of e.g. 30% is demotivating for most people (not even to mention the probability of stress, which can reduce efficiency to 0%). Protecting and utilising one’s scarce resources thoughtfully is ”a really good idea”.

Point no. 4 about project portfolio management

Project portfolio management is about making trade-offs – less is more

You can find numerous quotations by the recognised strategy guru Michael E. Porter stating that you do not have a strategy unless you have made tough trade-offs in choosing what not to do. Stanford University, among others, perceives project portfolio management as the first step in carrying out a strategy.

Project portfolio management may also be considered strategy management, i.e. the prioritisations – trade-offs – you make in relation to your project portfolio are strategic work, and the choices you make are strategic choices. Thus, Porter’s point about making trade-offs also applies to project portfolio management, which is also emphasised by the container ship example.

Wanting to do too much may become a problem. A saying goes: ”The best is the enemy of the good”. Making trade-offs and having a simple portfolio – even though you feel you can do much more and definitely have the ability to do so – are an art which separates the good from the best.

Embrace the mantra of ”Kill Complexity” – it applies to your portfolio in terms of consisting of few short and fat projects, and it applies to the strategic prioritisation of the individual projects. It should, by the way, also weigh positively on the prioritisation if a project reduces the complexity in your organisation as opposed to increasing it.

Having a simple, strategic and focused project portfolio and giving preferential treatment to projects that reduce complexity are ”a really good idea”.

Point no. 5 about project portfolio management

The notion of equality is poisonous to an efficient project portfolio.

According to our container terminal example, it does not make any sense that all projects which are good ideas – or equally good ideas – should be treated the same and e.g. be allocated the same amount of resources or be initiated at the same time.

Similarly, it does not make any sense to attach the same weight to all organisational areas or project types in a portfolio based on a principle of equality and justice. The organisation will, seen as a whole, lose on this. Trade-offs have to be made – even though it hurts.

Strategic courage is more important than mathematical optimisation. If we take a look at scenarios 3, 4 and 5 in the container ship example, a dramatic improvement takes place between scenarios 3 and 4 – a leap which most of all calls for courage, while the improvement between scenarios 4 and 5, which calls for insight into the mathematical details in the crane’s performance, only generates a marginal improvement. Taking the leap requires the courage to do what is right, while the insight of a bright mind into the mathematical details could optimise the margins.

Having the courage to give preferential treatment is ”a really good idea”.

Point no. 6 about project portfolio management

Remember the numbers 2 (number of concurrent projects per project participant) and 5 (maximum number of must-win battles).

Surveys of the efficiency of project participants show – both logically and mathematically – that it would be quite fantastic for your project portfolio and its progress if all project workers were only allocated to a maximum of two projects at the same time. The mathematics and logic are supported intuitively by those who time and again are allocated to too many concurrent projects and whose time is inefficiently spread between these – just ask them.

Another number to remember is IMD Business School’s rule of thumb for how many significant strategic initiatives (the so-called must-win battles) a management team should launch at the same time. This number is 5. And those 5 should be held on to until they are fully implemented. Behind the argument of a maximum of five must-win battles is the thought that it is not always as easy as in the container terminal example to identify the scarce resource.

When it comes to organisational development and strategic initiatives, the scarce factor includes intangibles such as the management team’s total amount of attention and the organisation’s overall ability to change. These are difficult to sum-up in figures, and, thus, it is important to have the courage to go for the short and fat approach, even though it cannot always be proven mathematically. Challenging yourself on not allocating project workers to more than two concurrent projects and not initiating more than five strategic and important initiatives at the same time is ”a really good idea”.

Recap

Key points to remember about project portfolio management:

- It is absolutely necessary that some-one assumes responsibility at portfolio level

- The effect of projects must be taken into account as a crucial factor in the prioritisation of the project portfolio

- Spreading one’s scarce resources between too many projects is damaging to the bottom line – and to the scarce resources

- Project portfolio management is about making trade-offs – less is more

- The notion of equality is poisonous to an efficient project portfolio

- Remember the numbers 2 (number of concurrent projects per project participant) and 5 (maximum number of must-win battles)

Main conclusion

“Your project portfolio must consist of short and fat projects - not long and thin”