An introduction to Implement’s Tech Due Diligence approach

8 May 2023

What is tech due diligence, and why should you conduct it?

A tech due diligence is an audit, investigation or review performed on a technical/software company, i.e. a tech native company with core products and/or services that are digital.

The main purpose is to make an external assessment of the company before an investment or divestment to support decision-making and valuation.

Three key questions are answered in a tech due diligence

- How technically mature is the company?

- Does tech support commercial growth ambitions and scalability?

- What technical risks exist that impact the business?

Common pitfalls that Implement finds in a tech due diligence

- Insufficient cybersecurity

- Technical debt

- Inhibited scalability

- Lack of strategic alignment

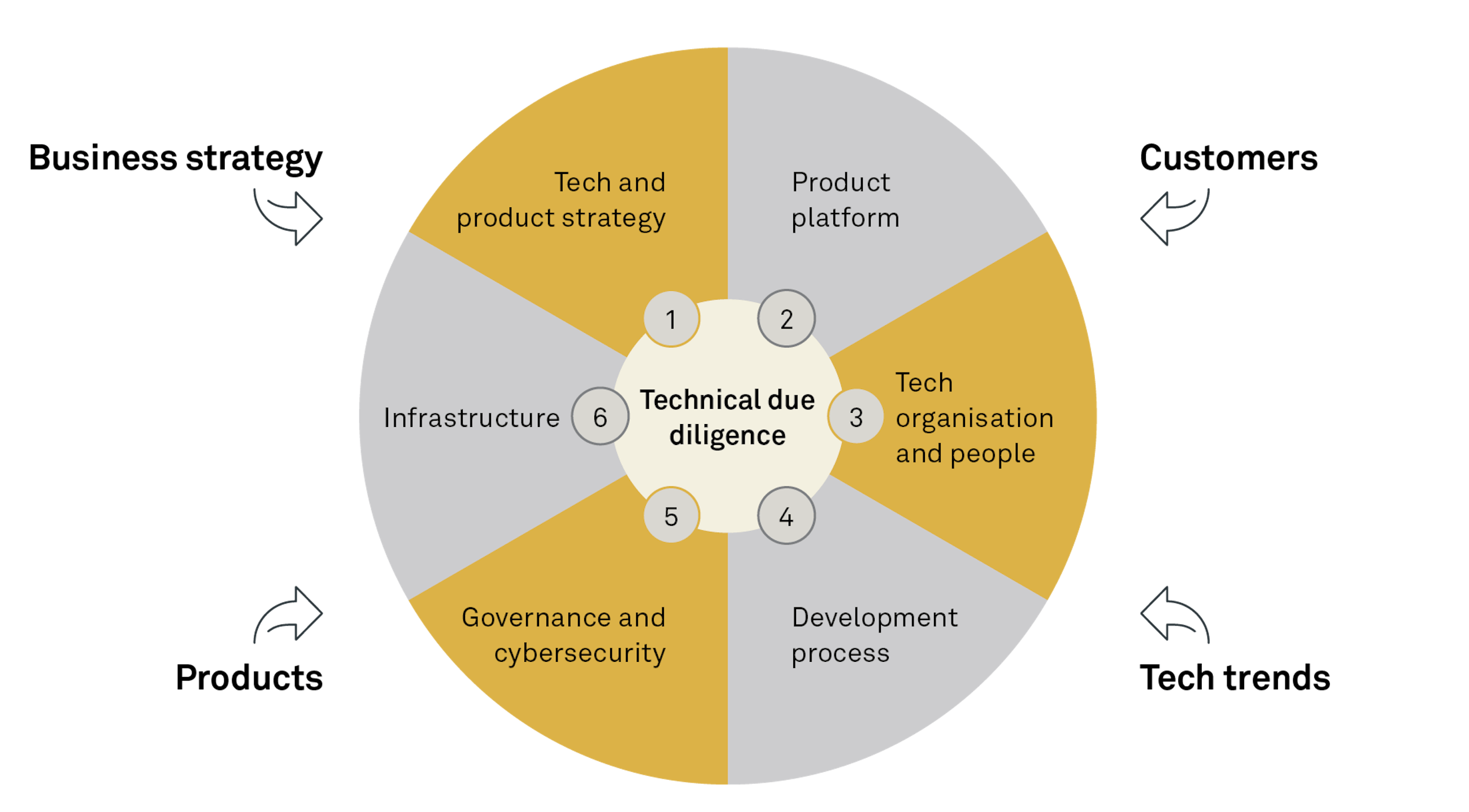

Implement’s approach to technical due diligences is built on six domains

A typical Implement technical DD process spans three weeks and includes an evaluation of the target’s tech and product strategy, product platform, tech organisation and people, development process, governance and cybersecurity and infrastructure.

The technical vendor due diligence is a crucial step in preparing for a divestment process

Implement has performed 100+ buy and sell-side tech DDs and are experienced in:

- Reducing risk in the transaction.

- Coaching the management team.

- Advising on actions plans to mitigate identified risks.

- Documentation support.

A tech VDD identifies dealbreakers, streamlines the transaction process and enhances credibility with potential buyers.

Conducting a hybrid tech and commercial due diligence provides substantial synergies

Implement is doing many standalone commercial and tech DDs with strong delivery, but certain aspects will be missed when performing standalone DDs of tech companies. A combined commercial and tech DD ensures that key commercial and technical questions are answered, and that synergies are leveraged in the combined DD delivery.