13 November 2024

A company’s ability to proactively manage its manufacturing footprint has traditionally been centred around achieving cost efficiency and flexibility within the supply chain to support business growth. However, in today’s rapidly evolving business environment – marked by increasing regulations, geopolitical conflicts and disruptive events – manufacturing footprint strategies have expanded beyond mere cost considerations and now play a crucial role in achieving broader objectives.

In this article, we explore four global trends that are currently reshaping how companies should approach their manufacturing footprint strategy.

What is a manufacturing footprint?

A manufacturing footprint is a blueprint describing where and how a company’s manufacturing activities are executed. It includes the strategic placement and roles of factories, the coordination between these factories within the network and their integration with adjacent functions such as research and development (R&D) and distribution. Additionally, it encompasses decisions on which activities to perform in-house versus outsourcing to suppliers and partners.

Trend #1 | A resilient supply chain

In the last few years, we have seen supply chains being disrupted by global events like pandemics, natural disasters and geopolitical conflicts. Notable examples include the COVID-19 pandemic, the Suez Canal blockage, drought in the Panama Canal and the Russian-Ukraine conflict. These disruptions are becoming more common. In 2023, nearly 13% of organisations faced more than 10 supply chain disruptions, up from 5% in 2019. Consequently, supply chain risk management has become a top priority, with 75% of organisations reporting high or medium commitment from executive management.

Many companies today are moving manufacturing away from conflict-prone or politically unstable regions, opting for near-shoring and local-for-local strategies. While these moves are sometimes necessary, they can be difficult and costly if reactive, causing imbalances in the network, unplanned investments or even factory closures. To stay ahead, companies must evaluate risks before establishing manufacturing in new regions and use strategies to reduce dependencies on high-risk areas. In our experience, revisiting the manufacturing footprint can reduce revenue at risk by 20-35%.

Navigating the trend: Key solution elements to consider

- Establish dual manufacturing and supply strategies

- Build regional or local-for-local network approach

- Harmonise plant processes to increase flexibility

Trend #2 | Intensified trade policies

In recent years, global trade policies have intensified, with trade restrictions tripling between 2019 and 2023. This shift has profoundly affected global trade which saw negative growth in 2023. Since the 1990s, this has only happened on a few occasions: in 2001 (the dot-com bubble burst), 2008 (the global financial crisis) and 2020 (the COVID-19 pandemic). Additionally, global trade is increasingly forming clusters among geopolitically aligned partners, a trend known as “friend-shoring”.

The ongoing trade war between the U.S. and China, which began in 2018, is a prime example of intensified trade policies. The share of U.S. imports from China fell from 22% in 2017 to 14% in 2023. New policies continue to target Chinese imports, with recent examples including increased tariffs on critical sectors such as semiconductors, batteries, minerals, steel and aluminium.

The European Union is also intensifying its policies on foreign trade. One recent example is the import duties of up to 35% on EVs imported from China. Another one is the Carbon Border Adjustment Mechanism (CBAM), imposing carbon taxes on import of carbon- intensive goods like steel and aluminium.

As trade with China faces increasing restrictions, other Asia-Pacific countries like India, Vietnam and Indonesia are emerging as alternative manufacturing hubs. However, the shift from China to these countries may not happen as quickly as some experts predict due to their relatively lower infrastructure and manufacturing ecosystem capabilities.

New trade policies can significantly impact the total cost of goods sold (COGS) for companies in global supply chains. Manufacturing footprint strategies must account for these impacts and strategically mitigate risks by understanding key trading partners on both the supplier and customer sides in relation to the company’s own footprint. Ultimately, this may involve choosing manufacturing locations that offer long-term stability and compliance benefits over short-term cost savings.

Navigating the trend: Key solution elements to consider

- Diversify manufacturing footprint

- Diversify supplier base

- Regionalise supply chain and manufacturing capabilities

Trend #3 | Fight for talent

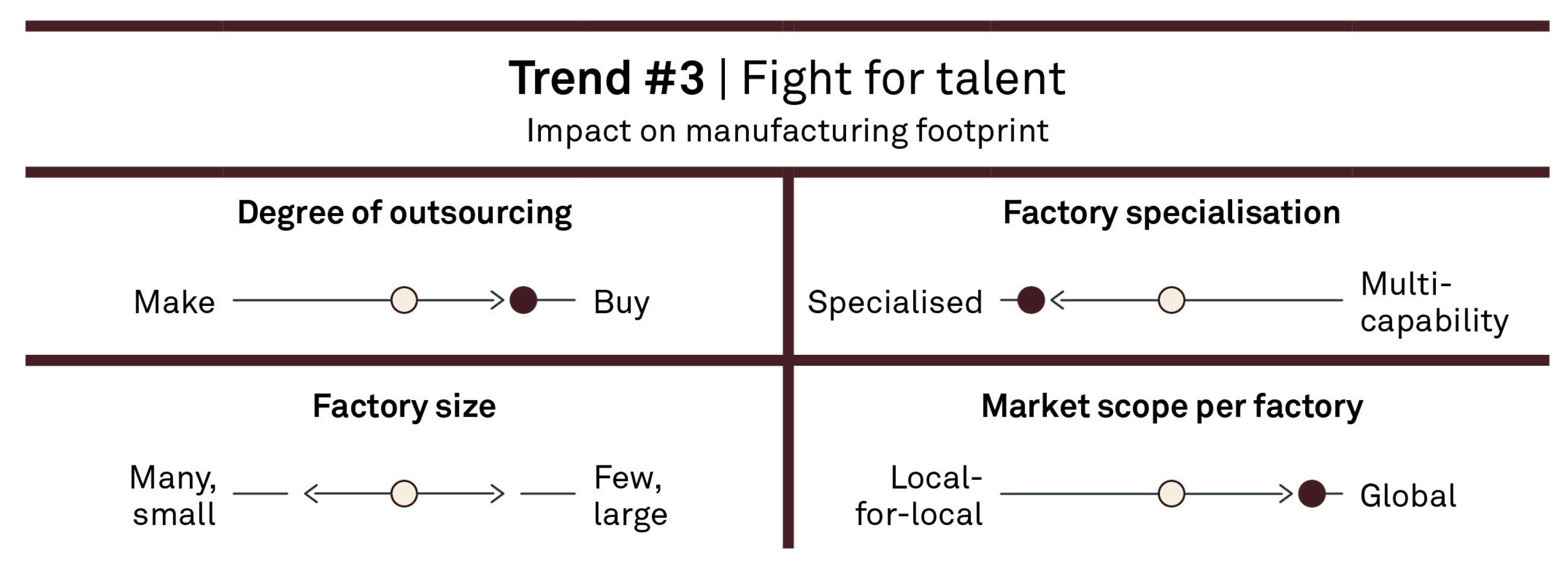

The competition for talent is significantly impacting the manufacturing sector. As supply chains become more digital and new technologies like AI are introduced, workforce requirements are becoming more specialised, making it increasingly difficult to attract the right talent . Furthermore, strained labour availability increases the need for automation and advanced engineering capabilities.

To address this challenge, many companies are prioritising talent acquisition in their manufacturing footprint strategy. Locating manufacturing in knowledge clusters near large universities or industry groups is increasingly important to access rich talent and labour pools.

A notable trend in this regard is the establishment of centres of excellence (CoEs), where companies strategically build and gather competences within a specific field at one location, preferably in proximity to specific knowledge clusters. This approach not only provides access to specialised skills and fosters collaboration but also offers geographic, economic and quality-of-life benefits. By leveraging these advantages, manufacturing companies can build a more robust and competitive workforce, better prepared to meet future challenges and drive sustained growth.

Navigating the trend: Key solution elements to consider

- Place manufacturing sites close to strong labour markets

- Reduce labour needs through increased automation

- Establish CoEs with proximity to knowledge clusters

Trend #4 | Direct-to-consumer

Traditional sales models involving intermediaries are becoming less appealing due to the restrictive margins and the need for more control over pricing, inventory and customer data. The COVID-19 pandemic accelerated this shift, as supply chain disruptions and changing consumer behaviours prompted many manufacturers to invest in direct-to-consumer (DTC) channels.

Transitioning from B2B to B2C through a DTC strategy allows manufacturers to bypass middlemen, retain higher margins and gain direct access to consumer data, which is crucial for R&D and marketing strategies. This transition requires re-evaluating manufacturing footprints to build efficient, technology-driven systems that support direct consumer interactions and agile supply chain management.

A DTC strategy requires a more agile supply chain that can quickly respond to consumer demands and market trends. Manufacturers may need to shift from large, centralised facilities to smaller, strategically located hubs to better serve consumer markets. Additionally, they must ensure that they have the right team, products suitable for direct sales and technology to streamline operations and minimise errors as they increase the number of customer contact points.

Navigating the trend: Key solution elements to consider

- Place manufacturing sites close to customer demand

- Establish flexibility in manufacturing and supply chain management setup

- Invest in technology and supply chain connectivity requirements

How to develop your manufacturing footprint strategy

The trends discussed in this article are global and impact most companies, though their effects vary by industry and business context. These trends often present conflicting implications for manufacturing footprint strategies, emphasising the need for a holistic approach to navigate trade-offs effectively.

Based on our experience, these five considerations are crucial for a successful manufacturing footprint strategy:

Define clear design principles: A structured approach based on well-defined design principles selected by top management is essential for managing diverse scenarios. These principles set the boundaries for the future manufacturing footprint, ensuring alignment with strategic goals and providing a framework for evaluating feasibility and impact.

Explore a wide range of scenarios: At the beginning of the strategy process, explore a broad spectrum of ideas informed by current insights and future trends from various industries. Encourage creative thinking and consider diverse possibilities such as different levels of centralisation vs decentralisation, automation and outsourcing options.

Broaden the definition of attractiveness: Evaluate the attractiveness of a future manufacturing footprint beyond mere cost optimisation. Consider factors like geopolitics, technological advancements, labour market dynamics and climate impact. A holistic evaluation ensures that the strategy is resilient, sustainable and adaptable to future challenges and opportunities.

Define true customer requirements: Understanding and prioritising customer requirements is crucial. Consider factors like service levels, shorter lead times and local incentives but also anticipate future customer needs. This foresight will help design a manufacturing footprint that meets evolving expectations and increases customer value.

Accept and manage uncertainty: The external environment is evolving rapidly, making traditional 5-year strategy cycles obsolete. Regularly analysing the manufacturing footprint helps manage risks and uncertainties. Establish periodic reviews to adapt to new developments and conduct additional sensitivity analyses as needed. This proactive approach keeps the company agile and responsive to unforeseen changes.