How to keep your finance function relevant for your business

25 August 2020

It is time to bring the finance function into the spotlight. Traditional value chains and business models are subject to huge disruption. Combined with market volatility as well as shorter business and strategic cycles, this calls for taking finance beyond just reporting. The finance function must become an investigative and decision-making partner for the entire business.

Traditional budgeting is changing, with time-to-market and more agile decision-making processes impacting the underlying thoughts and models behind our usual budgeting approach. Integrated Business Planning is now vital to ensuring efficient use of capacity and proper capital allocation, supported by complete and accurate data. Hence, high quality data is a necessity for the finance function, which also needs to acquire a new set of capabilities.

Why is transforming finance relevant?

You may wonder why a finance transformation is needed or relevant today.

Generally, businesses choose to transform their finance function due to one or more of the factors below:

- Strategic changes

- New business areas and a new business model

- Preparing for growth

- Mergers and acquisitions

- Cost/efficiency in busines

- A need for improved finance efficiency/excellence

- A need for improved business support

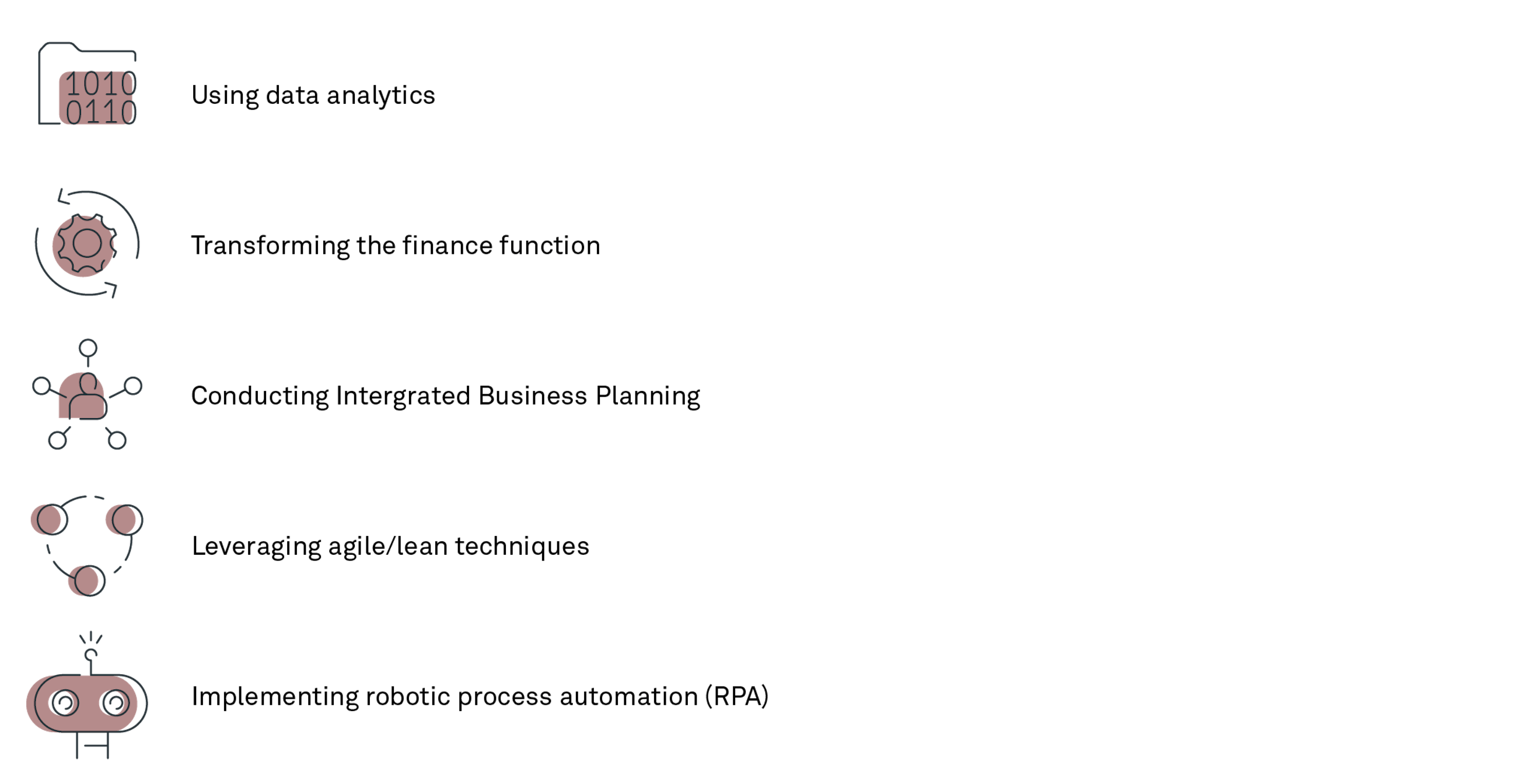

According to an APQC Finance 2020 analysis, the top five initiatives undertaken within the finance function during transformations are:

*Finance transformation in this survey includes examining the service delivery model and how finance processes are structured as well as streamlining and standardising processes and effectively leveraging digitisation and automation.

In today’s business environment, the finance function needs to transform if they want to stay relevant for their internal and external stakeholders. Finance needs to acquire the ability to constantly change and adapt.

The finance function must be:

- Agile: Able to adapt to new market conditions, business models and changes in regulatory matters.

- Trustworthy partners: Able to provide stakeholders with accurate and timely analyses and challenge and recommend actions to improve business performance.

- Dedicated to their customers: Able to focus on stakeholders’ needs and organise themselves in a service-minded manner to deliver on quality.

Transforming finance to be fit for the future and relevant for the business

The length and extent of a finance transformation process depends on a number of factors, including your level of ambition, your current capabilities, tech maturity and the robustness of your processes, including roles and responsibilities.

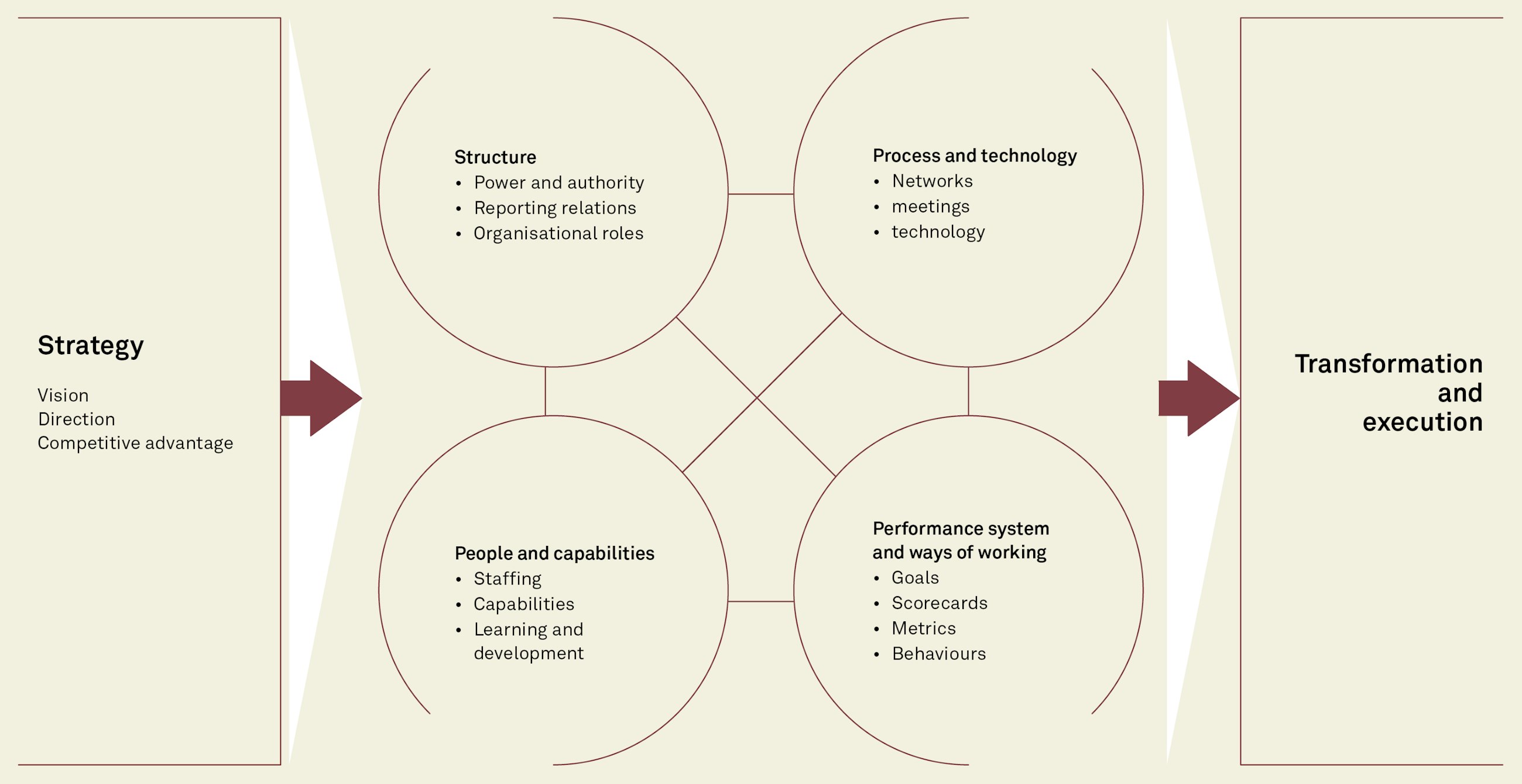

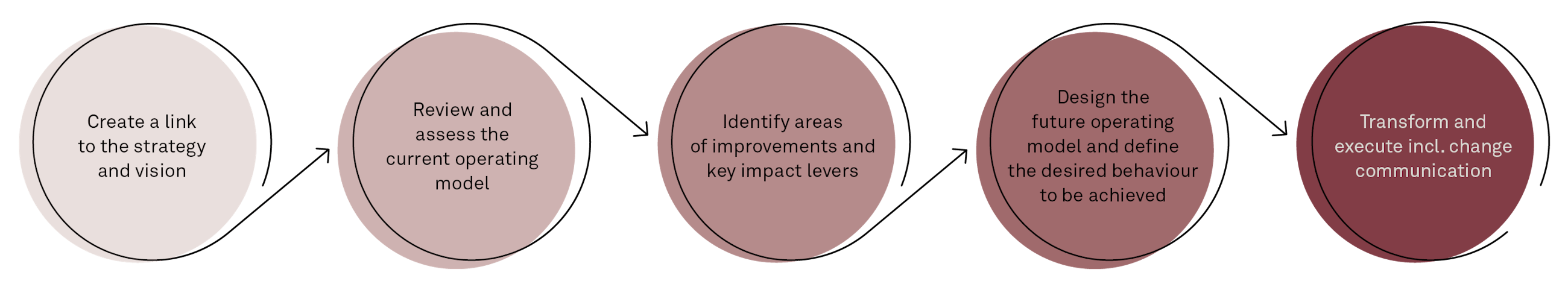

A transformation process is by no means an easy feat, and the model below provides an overview of the areas and factors you should consider before initiating a finance transformation:

Defining the right strategy and vision

The finance strategy and vision determine the direction and focus areas of your finance function. To stay relevant to the business, it is important that your finance function does not become a mere “institution” but stays proactive and able to predict the needs of stakeholders.

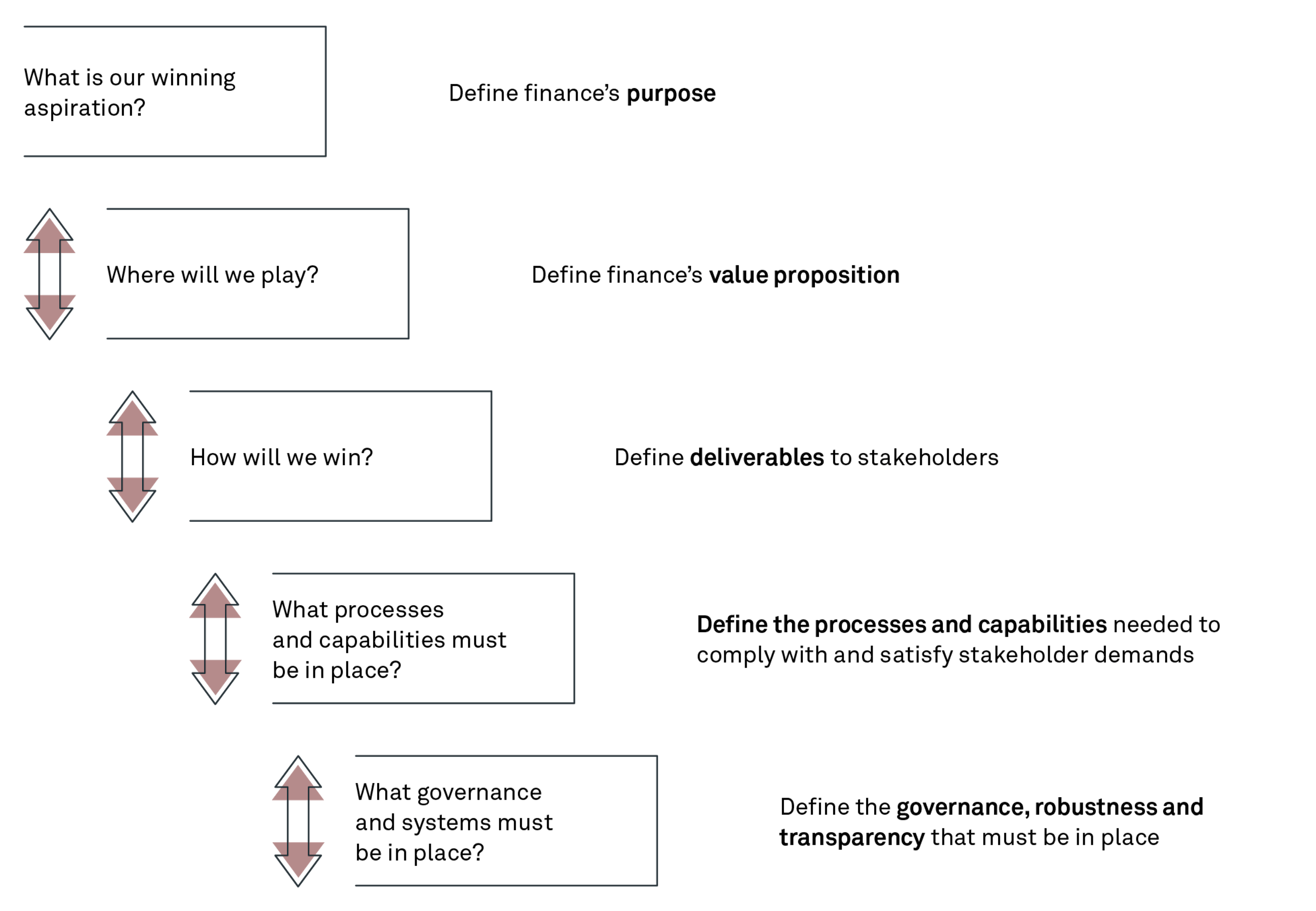

Thus, you should review your finance strategy and vision regularly to make sure that they still support the overall strategy of your company and keep your finance function proactive. If you want a proven and robust method when formulating your finance strategy and vision, we recommend that you use the “Playing to Win” framework by Roger Martin.

You can formulate your strategy and vision through five steps:

Having formulated your strategy and vision, your finance function must also acquire skills and capabilities that match – and to some extent exceed – the expectations of their stakeholders in order to be relevant. Being proactive and predicting stakeholder needs provides the finance function with a license to operate and be relevant for the business.

A roadmap to bridging strategy and transformation

When you design your roadmap for your finance transformation, you should consider a number of elements so you can bridge the gap between strategy and transformation.

These essential finance transformation elements are illustrated below:

First of all, it is important that your finance strategy and vision support the overall strategy of your company to fulfil organisational needs in terms of, e.g. growth, markets, capital allocation and value drivers.

Subsequently, you should review and assess the current operating model within your finance function, focusing on processes, people, technologies and the organisational setup.

Hereafter, you can identify areas of improvement (and what to keep) by conducting a gap assessment within each area of the operating model and focusing on key impact levers.

Once you have identified and prioritised areas of improvement, you can design changes to your current operating model. This must be done before you start prototyping a new operating model.

Finally, you should implement the designed changes into the operating model which entails change communication and change management activities including training.

Strengthen the operating model of your finance function

When you review and assess the current operating model of your finance function, you identify what to keep, what to discard and how your current model can be improved.

Thereafter, you can start strengthening the foundation in your finance operation, which typically requires one or more of these levers

- Implementing a revised finance operating model

- Implementing intelligent automation

- Mapping and upgrading relevant competences and capabilities in the respective roles

- Creating strong process ownership for both finance operations and business finance

- Using advanced data analytics and robotics in the finance operating model

- Creating success stories to enable trust-building

- Critically assessing and developing for future planning and decision paradigms

Choose your transformation partner

A finance transformation is linked to areas such as:

- Finance efficiency and excellence

- Business support

- Digital finance

You can choose to conduct your finance transformation with a transformation partner. At Implement, we believe in a hands-on and collaborative approach where we co-create the transformation journey in collaboration with you as the customer.

Together, we define the transformation journey and create an end-to-end process view that goes beyond just finance. We work across practices to ensure that cross-functional expertise is employed in the transformation process, and we focus on creating value and business impact that lasts by defining the changes needed in existing behaviour for the transformation to be a success.

Please do not hesitate to reach out to one of our finance transformation experts if you want to have a chat about how to transform your finance function to stay relevant for your business.