How a Finance Transformation Office can balance control and change

16 December 2025

In today's dynamic business environment, companies face the perennial challenge of balancing stable operations with pursuing transformative change. As highlighted in our previous exploration of rightsizing during uncertain times, this balancing act is crucial for organisational resilience and growth. But how can businesses achieve this equilibrium effectively, especially within Finance functions under intense pressure to adapt rapidly? Think like an airport: you need a control tower. The answer lies in structured execution led by a dedicated Finance Transformation Office (FTO) – the central hub that provides line of sight, coordinates traffic, and keeps transformation on course while operations continue to run safely.

The dual challenge: Balancing operations with transformation

Finance functions today are at a crossroads, required not only to manage day-to-day operations efficiently but also to drive strategic transformation. The reactive, scorekeeping role is evolving into a proactive, strategic partner demanding end-to-end excellence and innovative solutions. Yet, the journey from operational efficiency to transformational leadership is fraught with challenges:

- Operational inefficiencies: Existing processes can inhibit responsiveness and agility, locking teams into outdated methods.

- Talent management: Developing strategic capabilities takes time, commitment, and foresight.

- Resistance to change: Cultural inertia can impede transformation efforts. Only 21% of employees are engaged at work, highlighting the struggle to garner support for change initiatives.

- Risk and uncertainty: Transformation introduces unknown risks, which must be meticulously managed to avoid unsettling organisational foundations. Initiatives with strong governance mechanisms are 63% more likely to achieve their transformation goals.

- Time and cost overruns: Despite intentions, only 22% of transformations are successful, indicating a 78% failure rate similar to the 70% noted by American economist John Kotter over 25 years ago.1

A need for new design approaches

Economic geographer Bent Flyvbjerg’s research on megaproject statistics provides a stark reminder of the challenges inherent to large-scale projects. Out of 16,000 megaprojects globally, only 0.5% meet time, budget, and benefit expectations. This so-called ‘Iron Law of Megaprojects’ (over budget, over time, under benefits) helps to illustrate the critical need to design programmes differently, emphasising strategic planning, robust governance, and cross-functional stakeholder engagement.2

Lessons from complex finance transformations

Large, business‑critical finance transformations surface the same transformation challenges seen in many enterprise programmes. Common pitfalls include rushing the start, setting goals that do not fit the organisation’s needs, and underinvesting in programme organisation and stakeholder management across Finance, IT, and the business. Three disciplines consistently make the difference:

- Comprehensive planning: Establishing clear definitions of success and realistic timelines to avoid off-track scenarios.

- Vigilant programme governance: Employing governance structures that support cross-functional decision-making and stakeholder alignment.

- Iterative methodologies: Utilising hybrid delivery approaches that combine agile with waterfall methods to effectively manage complexity and change.

The solution: Establishing a Finance Transformation Office as the control tower

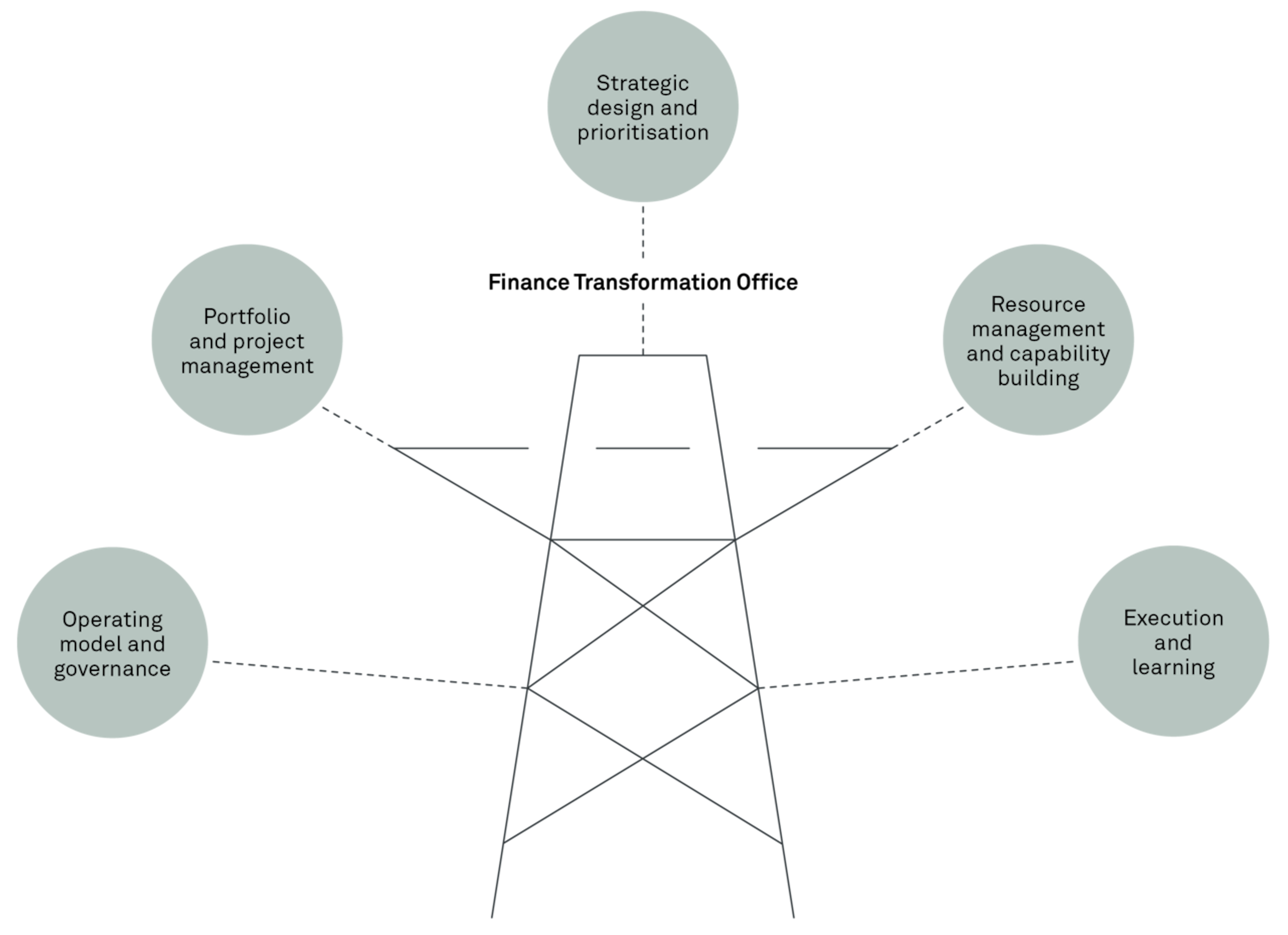

Confronted with these challenges, a well-structured Finance Transformation Office (FTO) can serve as the linchpin for effective transformation. Like a control tower, the FTO acts as the centralised hub that directs complex transformation programmes through robust project management and disciplined governance.

Here’s how the FTO keeps transformation on course:

- Strategic design and prioritisation: Clearly defining the strategic vision and financial targets, aligning objectives across the organisation.

- Portfolio and project management: Ensuring the right projects are selected and executed efficiently, maximising impact.

- Operating model and governance: Streamlining operations with a defined governance structure, mitigating risks.

- Resource management and capability building: Continuous development of capabilities and culture necessary for project execution.

- Execution and learning: Tracking value creation, fostering a culture of continuous improvement. Projects following a structured framework boast a success rate of 74%, outperforming those without such frameworks.

Implementing the transformation office

Setting up an FTO is akin to building and commissioning a control tower – you need to establish the purpose, design the operating model, define the flight rules, manage a safe transition, and train the crew. Done well, the FTO enhances the finance strategy's success and strengthens the finance operating model over time:

- Strategy and guiding principles: Define why the control tower exists and what success looks like. Ensure alignment with organisational goals.

- Operating model design: Design how the tower operates to illustrate how the FTO will function.

- Governance structures: Establish roles and responsibilities to meet strategic objectives effectively – who authorises takeoff? Who monitors in flight? And who approves course corrections?

- Transition plan: Map the migration from current ways of working to the tower model, while acquiring necessary capabilities.

- Initiation and upskilling: Begin with core transformation capabilities – upskill the ‘air crew’ (programme leads, PMO, finance SMEs) and execute pilot programmes to prove value and refine the approach.

A future-ready framework

As we navigate the complexities of Finance transformation, the lessons from ERP implementations and rightsizing during uncertain times, coupled with Flyvbjerg’s compelling statistics, remind us that structured execution, cultural engagement, and strategic vision are essential. With a Finance Transformation Office as the control tower, organisations can not only navigate turbulence but chart a steady course toward enduring growth.

Sources

1Argenti, P. A., Berman, J., Calsbeek, R., & Whitehouse, A. (2021, September 14). The secret behind successful corporate transformations. MAHA Global. https://maha.global/blogs/the-secret-behind-successful-corporate-transformations-by-paul-a-argenti-jenifer-berman-ryan-calsbeek-and-andrew-whitehouse/ Maha Global

2Flyvbjerg, Bent: ‘What You Should Know About Megaprojects and Why: An Overview’ (2014)