Article

Why hydrogen – and why now?

Published

3 July 2025

After three decades of boom-and-bust expectations, 2024–25 is the first time that three mutually reinforcing factors are converging:

- Decarbonisation: With frameworks like the IMO draft Net-Zero Framework , Fit-for-55, RED III, FuelEU, and ReFuelEU, decarbonisation has transitioned from voluntary efforts to a mandatory regulatory requirement.

- Energy security: The urgency of resilience and energy security has reinforced EU industrial policy towards e.g., hydrogen, especially after the geopolitical shifts following the Russian invasion of Ukraine.

- Capital mobilisation: There is a renewed mobilisation of capital towards energy infrastructure, rejuvenated since the 2023 interest rate adjustments, backed by initiatives like the EU Innovation Fund, European Hydrogen Bank, and the Inflation Reduction Act rivalry.

The Nordic region is uniquely positioned to utilise this with an abundant low-cost renewable power potential, proximity to Germany – the largest future import market – and a project pipeline that is unusually mature for Europe. If the Nordics get the next five years right, the region can potentially lock in a structural export position similar to offshore wind fifteen years ago.

Yet, the region may just as easily lose momentum. Most announced capacity is still in the “paper pipeline”, Danish pipeline COD dates are still far away, and the market conditions required to monetise the electrons-to-molecules story are still in a nascent stage of shaping.

There is a call for solutions that aid in the transition from grey hydrogen to low/zero carbon intensity hydrogen. The industries and existing infrastructure don’t change overnight, but if we are to meet our climate goals the hard-to-abate industries need a clear path toward reducing their carbon footprint.

Lotte Rosenberg, Chief Executive Officer, Carbon Recycling International

Where the market stands today

Demand

The European industrial hydrogen demand is ~10 Mt today of which 91% is unabated grey hydrogen based on fossil fuels. In accordance with the EU’s REDIII, 42% of this hydrogen must be replaced by a RFNBO (Renewable Fuel from Non-Biological Origin) by 2030. Additionally, RED III requires an uptake of a minimum share of 1% of RFNBOs in total transport fuel consumption by 2030. In Europe, Germany is currently the largest consumer of conventional hydrogen, consuming approx. 1.4 Mt, followed by the Netherlands, Poland, and Spain (which also holds strong potential for competitive green hydrogen production due to favourable PV conditions).1

Supply

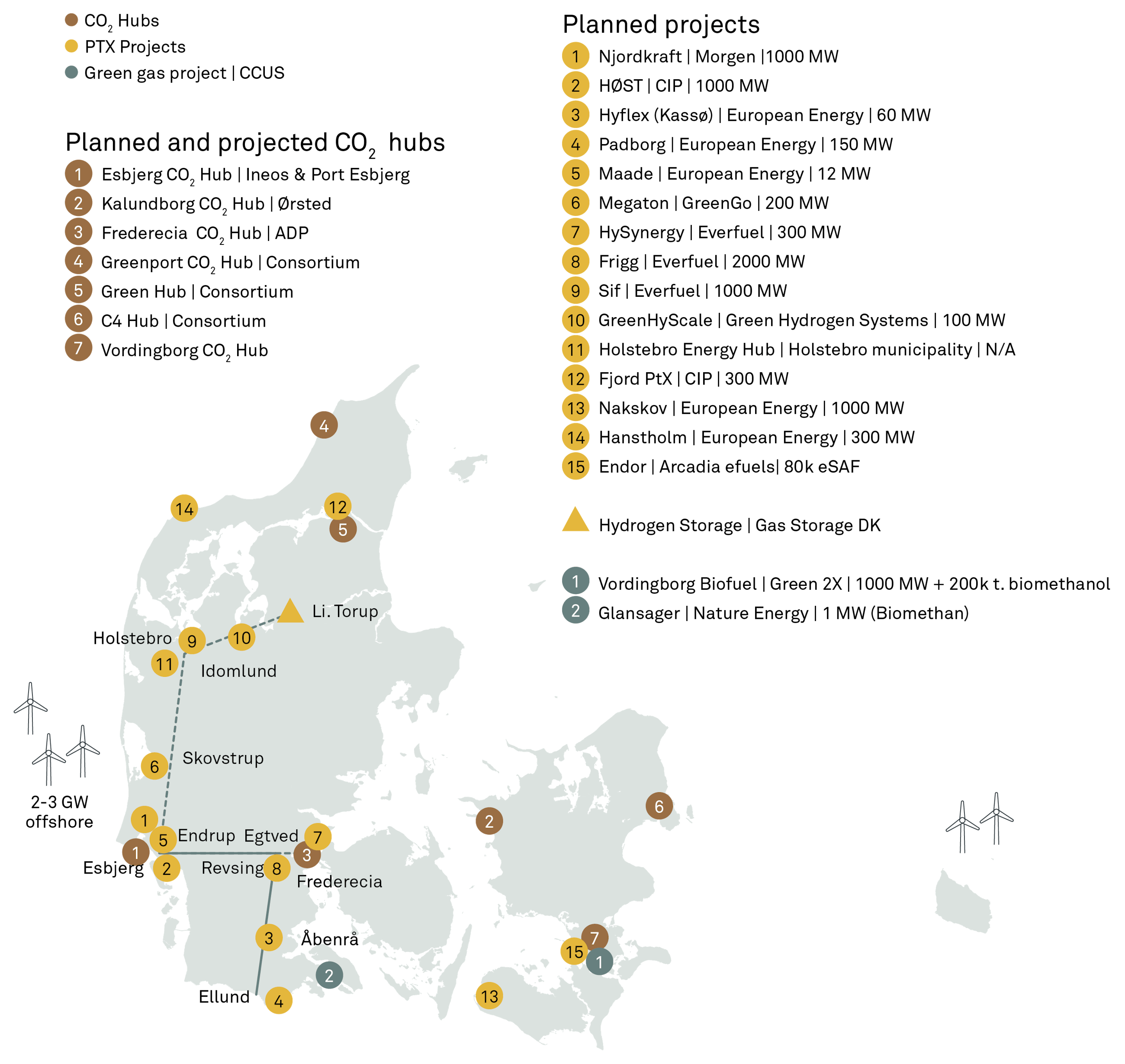

The global electrolysis capacity is still below 1 GW, but more than 400 GW has been announced. Actual FIDs lag, particularly in Europe, where cost inflation, permitting queues and auction design have slowed scaling due to a prolonged process of accessing subsidies.2 In Europe, a yearly production of 2 Mt renewable hydrogen was supported by the first EU auctions in 2024–25. Denmark and Finland stand out as having the most mature green hydrogen and PtX projects, including one of Europe’s first operational green hydrogen plants (12 MW) in Måde, e-methanol plant in Kassø, e-methane at Glansager, and an industrial scale green hydrogen plant (20 MW) in Harjavalta, Finland.

Denmark’s differentiated position

Proximity to offtake market reduces costs of transport

Denmark has a unique advantage in developing a hydrogen ecosystem due to its proximity to one of Europe’s largest offtake markets, Germany.3 This proximity combined with the perspective of a new state subsidised hydrogen backbone connecting to Germany, allows Denmark to efficiently supply hydrogen to German industries, especially hard to abate industries in Schleswig-Holstein, where there is a growing demand projected to be more than 100 kt per year by 2030 fuelled by hydrogen in various applications, including industry (e.g. green steel), refineries, and transportation.4

Denmark's national hydrogen backbone, backed by significant political and financial support, is meant to unlock this opportunity. The pipeline, which in its first phase will span from Esbjerg to Ellund is planned to connect to Germany in 2031, connecting to key Danish hydrogen projects in 2032 and 2033.5 Over 60 green hydrogen projects are located within truck distance of the pipeline, including two 500MW projects (Njordkraft/Morgen and Høst/CIP). Only one 500MW project is required to underwrite the required capacity of the pipeline.

Nordic cost advantage

Access to substantial shares of renewable electricity at relatively low costs makes the Nordics a competitive location for hydrogen production compared to other European regions. According to a recent LCOH forecast by Implement based on PPA data6, Swedish price zones and Danish price zone DK1 have the potential for hydrogen production at a cost of €4–7/kg by 20307, whereas Central Europe's forecasted LCOE stands at several Euros higher. Norway also demonstrates a promising potential for low-cost hydrogen production, with LCOH estimates of €4–6/kg across all price zones, largely due to affordable hydropower availability.

Additionally, the ability to convert excess offshore wind into hydrogen, thereby mitigating curtailment, can lead to larger-scale PPAs at reduced LCOE. This, in turn, may further decrease the LCOH of hydrogen produced in the Nordics. This is a competitive price point, given that refineries are willing to pay upwards of €7–8/kg by the end of the decade, as assuming current ETS trajectories (€100+/t CO₂) and RED III quotas.

Key barriers

Demand uncertainty: Beyond the refinery and fertiliser baseload, end-markets depend on quotas that are not yet final (green steel, maritime, aviation). Under-shooting demand would strand the Danish hydrogen backbone and other hydrogen infrastructure investments whose tariffs must be recovered from throughput.

CAPEX and interest rates: Electrolyser costs have come down (> 60% since 2015) but flattening learning curves and higher WACC squeeze project IRRs; European projects compete with IRA-backed US plants for equipment and capital.

Infrastructure “chicken-and-egg”: The first stage of the Danish hydrogen backbone is unidirectional (north-to-south). Without the benefit from a bidirectional flow to secure baseload or clear rules for line-pack or storage injection, domestic industrial consumers might hold back on investments related to domestic productions of green fuels.

Tariff and certification opacity: No final rules exist for (i) entry/exit tariffs, (ii) GO/COO accounting for blended hydrogen streams, (iii) cross-border congestion management. Each introduces volume or price basis risk that lenders will price.

Permitting drag: Electrolysis and PtX fall under multiple regulatory regimes (SEVESO, IPPC, Natura 2000). Current Danish permitting averages 2–4 years; COD slippage erodes offtake contract synchronisation with RED III timelines.

What must be solved to accelerate and create a functioning market

Synchronised roll-out calendar:Regulators, TSOs, developers and German end-users need a joint plan linking wind FID, electrolyser COD and pipeline commissioning so that each asset has a clear counterpart.

Transparent, competitive tariff regime: Early publication of entry/exit tariffs and interruptible capacity products gives producers the data to lock in long-term offtake prices.

Risk-sharing financial instruments: CfDs for hydrogen, carbon contracts for difference (CCfDs) for steel, and offtake guarantees (European Hydrogen Bank) will shorten pay-back periods and attract pension-fund capital and other long-term investors.

Digital and governance platform: A neutral Nordic “hydrogen data hub” – mirroring the current power data hub – can pool nominations, guarantees of origin and real-time capacity booking, lowering transaction costs.

Renewable build-out: Achieving the Danish target of 13 TWh hydrogen by 2030 requires >30 TWh additional renewable generation. Offshore tender volumes must therefore stay ahead of electrolyser rollouts.

Outlook

If the Nordic region converts its natural advantage into bankable projects, it can satisfy a quarter of Germany’s import gap and position Danish and Swedish ports as hydrogen and e-fuel gateways. The next 24 months will decide whether we move from announcements to concrete actions – or repeat the 1990s/2000s “false dawns”. The commercial upside is significant—but only if infrastructure, regulation, and offtake mature in sync.

Sources

1European Hydrogen Observatory (2023)

2Hydrogen Europe (2024)

3European Hydrogen Observatory (2024)

5Clean Energy Wire (2024)

6Undisclosed client data (2024)

7Incl. electricity grid tariffs and taxes.

Reach out

Please reach out if you want to discuss the perspective of the future hydrogen economy and talk about how we can help you leverage your hydrogen and PTX potential.

Related0 4

Article

Read more

Cut the carbon, not the business

Why your Scope 3 roadmap needs to align emissions, financials, and operations.Article

Read more

The Nordics as Europe’s carbon removal hub

Transforming the Nordics into Europe's carbon removal hub while driving economic growth across Norway, Iceland, Sweden, ...Article

Read more