How to transform your business planning model to effectively execute your strategy

19 June 2020

Life is full of planning the future. Living entirely in the moment is difficult. A strong belief in own capabilities and in the idea of progress – that the future would be different and better than the past – is often a key motivational factor. In fact, research reveals that 80% of your company’s success is driven by internal factors. In other words, your company will succeed not because of external factors but because of what you plan and choose to do

Move towards dynamic planning

Yet detailed planning is an insult to this different and improved future. Traditional planning has long been recognised by time-consuming and non-value-adding processes, outdated assumptions and wrong focus, as the big picture is often lost in the details. Essentially, it provides a corporate theatre with a false sense of security and undesired behaviour in the organisation.

The last decade’s financial planning has gone beyond budgeting and introduced assumption-based rolling forecast processes in many organisations. However, moving towards dynamic planning is as much about changing processes as it is about changing leadership.

Dynamic planning is about providing the autonomy for the organisation and inspiring through values and purposes to make decisions. It is about discussing scenarios and debating alternatives, including a collective formulation and understanding of both risks and opportunities, moving away from corporate sandbagging. We have yet to see the collective and full transformation towards transparency, trust and autonomy in the organisation to fully leverage the concept of dynamic planning.

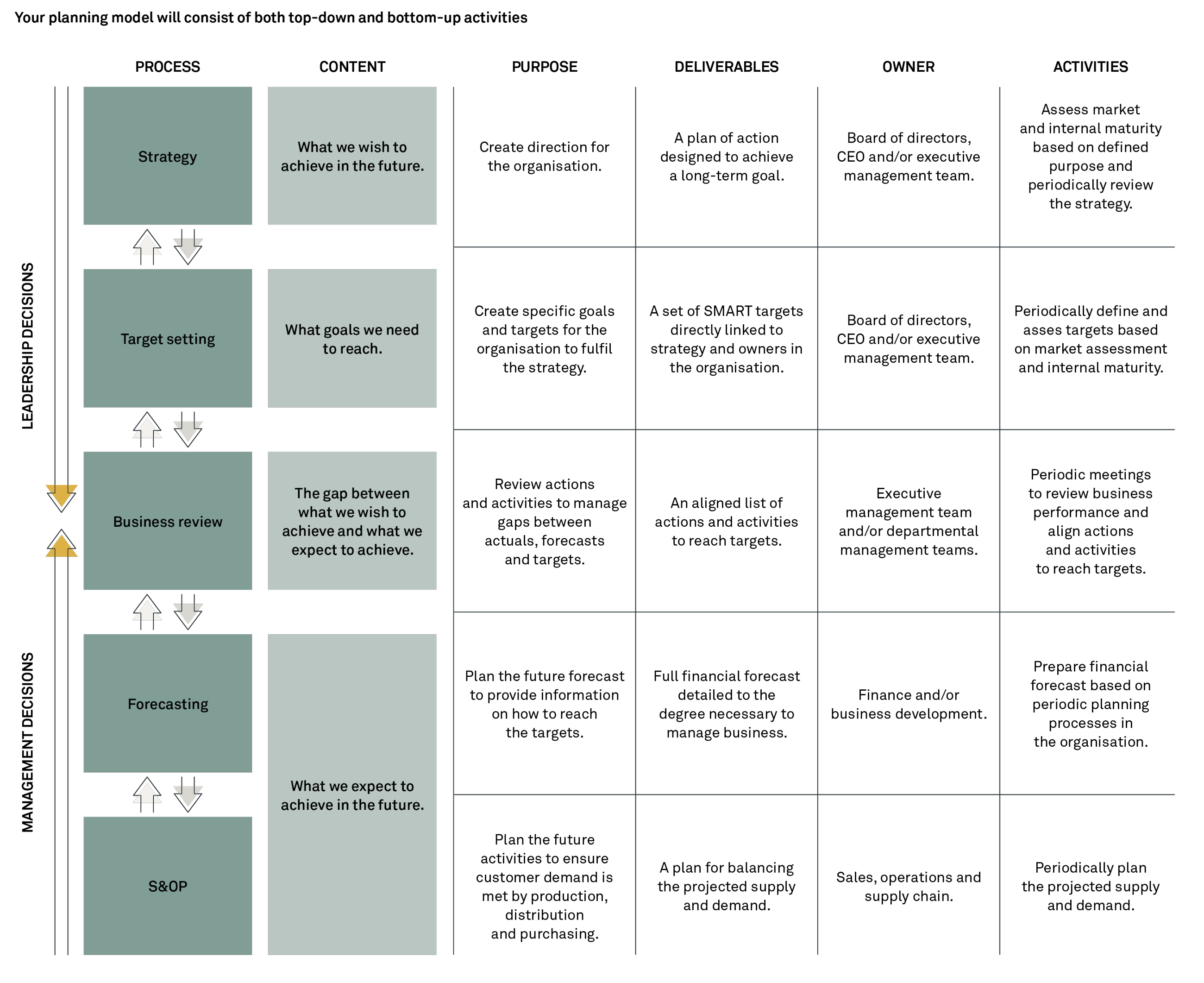

The role of finance is to clearly distinguish between several incompatible purposes in the planning process. They are highly interlinked; however, they require their own frequency, process and resources.

- Target setting: Set up a few relative targets covering the goals you need to reach to deliver on the strategy. Allow for an autonomous cascading of targets in the organisation, i.e. allow for departments and teams to develop their own set of KPIs that will deliver the targets.

- Forecasting: Set up an assumption-based rolling financial forecast with a frequency that is driven by business needs and not the calendar. Remove bias and focus on the organisations’ known abilities.

- Resource allocation: Set up a sales and operations planning process that will provide the relevant details for executing operations.

Follow one simple planning model

This distinction will allow for a simple and coherent planning model with a specific purpose to steer the organisation to deliver on the strategy.

By doing so, the financial forecasting will leverage the sales and operations planning process by delivering e.g. expected revenue, direct costs and approved investments.

Make decision

Planning is about making conscious decisions about the future now. The business review will be the key to establishing momentum and ensuring informed decision-making. With regular business reviews, the organisation will be able to bring actuals, forecasts and targets together and set the scene for the identification of actions and initiatives.

In addition, a clear communication of the strategy and few, simple targets along with a culture of autonomy, trust and transparency allow for the organisation on all levels to make decisions that correspond with the strategy.