Create growth and delighted customers

11 June 2013

The text is an extract – go to the top of this page to download the entire article.

Short term competitive advantage is created by exploiting existing business models. But in the long term all markets mature, competition intensifies and turbulence increases. Consequently, new sources of growth must be explored and fresh answers to enduring success must be found.

The classic answer used to be: Innovate or die! But research shows that pouring more money into pure new product innovation does not lead to better performance.

To succeed in innovation and to seize new growth opportunities, the scope of innovation must be expanded to encompass the full spectrum of business model components. While rewards are potentially big, stepping outside the comfort zone of the core business and known operating models is risky business that must be managed carefully.

The articles in this hands-on case collection investigate how a range of companies have mastered the process as well as have explored and exploited strategic options to identify new paths to creating customer value and capturing profits

- The Danish electric mobility operator CLEVER has turned traditional strategic thinking upside-down to overcome challenges in an immature industry and to pave the way for the mass market breakthrough of the electric vehicle.

- The core business of Danish cable operator YouSee is being challenged by disruptive technologies and by launching the online streaming service YouBio, the company has shown that the road to success can include disrupting yourself.

- The ground-breaking Daily Maersk service launched by Maersk Line has changed the game in the highly conservative shipping industry by challenging conventional wisdom and opening up a high-end market demanding high reliability, fast delivery and high consistency.

Hopefully, the principles used by the case companies can be translated into your organisational context to help you endeavour beyond the blinders of the dominant logic and to seize new opportunities.

CLEVER: Smart choices in uncertain times

The Danish electric mobility operator CLEVER A/S has turned traditional strategic thinking upside-down to overcome challenges in an immature industry and to pave the way for the mass market breakthrough of the electric vehicle. While some companies are still learning to plan in order to execute a firmly set strategy, CLEVER has chosen another path and knows that to make it in a highly turbulent industry, the most sustainable option is to plan to learn while implementing strategy.

Overestimating short-term change while underestimating long-term change

Ever since the Greek philosopher Heraclitus declared that the only constant is change, the dictum has been repeated so many times that it is almost a cliché. But change is a peculiar thing and comes in many shapes. Zooming in on technological advances, a general rule of thumb tells us that change is never linear but comes in s-curves.

However, our expectations are almost always linear. As human beings, it is simply challenging to perceive change as a non-linear thing. Consequently, we tend to overestimate short-term change but underestimate long-term change. The current change within the automotive industry is a perfect example of this perception bias.

For years, electric vehicles have been predicted to revolutionise the industry overnight but a closer look at the facts show that popular belief is far from reality. On one hand, the electric vehicle is still a niche product and incumbent automobile manufacturers are reluctant to fully commit themselves to entering the electric vehicle market space and switch to a new technology platform.

New technologies require investing in new competences while looking into lower after-sales revenues due to lower need for maintenance services. Further, battery technologies are far from competitive compared to ordinary internal combustion engine technology both in terms of driving distance and costs, leading to unattractive consumer prices and lower profitability levels for automakers.

On the other hand, the electric vehicle does hold the promise of enabling environmental-friendly transportation with low greenhouse gas emission levels, reducing dependence on oil and improving the end user driving experience remarkably. In the long term, the loading power on and off electric vehicles will also play an important role in an integrated smart grid. Governments all over the world have already gone far to support the adoption of the new driving technology with tax reductions, support from green investments funds and with tough standards on tailpipe emissions and fuel efficiency.

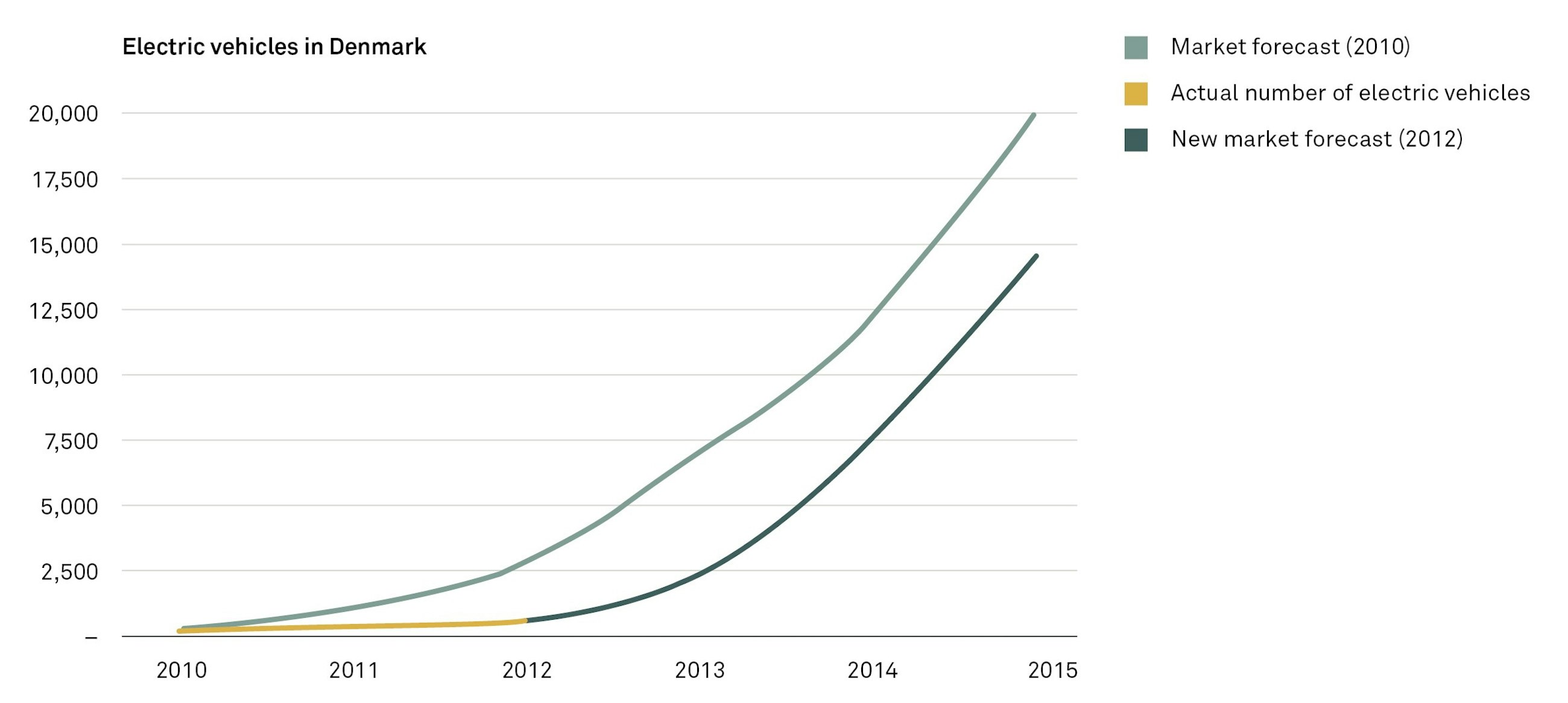

Yet, the promises have not had the potential to create the perfect storm for an electric vehicle mass market breakthrough. And a closer look at old market forecasts of electric vehicles clearly reveals overoptimistic penetration curves that do not match reality. Short-term change was severely overestimated. However, if technology performance improves and manages to outpace old and competing emerging technologies, electric vehicles could have a bright long-term future.

Today, the electric vehicle industry is caught in the no-man’s land between yesterday’s overoptimistic hype and tomorrow’s game-changing performance levels. Consequently, it is very uncertain when the market will take off and there is basically no single valid market forecast to use as the foundation for a solid game plan. Further, industry players are still struggling to position themselves in the value chain and define attractive business models.

Altogether, it is clear that constant change is not only a question about linear versus s-curve change. The electric vehicle industry is fundamentally difficult to predict and is characterised by a high level of turbulence with many interacting drivers as well as a lack of a dominating industry paradigm.

Old and new players in the electric mobility industry

The electric vehicle not only challenges the strategies of incumbent automobile manufacturers, but also opens up a market space for entirely new players such as battery manufacturers, electric utility companies, manufacturers of charging infrastructure equipment and a range of different mobility service providers.

A key to bridging the gap to a greener transportation future is the establishment of an adequate changing infrastructure that helps drivers recharge their vehicles on long-distance trips as well as an infrastructure of home chargers for recharging vehicles at night. Existing electricity infrastructure can be used for charging but for safety reasons and to increase the speed of charging, special equipment must be installed. In other words, there is an entirely new but all-important value chain role to be filled within production, installation, operation and service of the charging infrastructure. So-called electric mobility operators (EMOs) are emerging to play the role, but their approaches to create and capture value vary significantly across the globe.

CLEVER A/S was one of the first electric mobility operators on the Danish market and has served electric vehicle owners since 2009. CLEVER is now the market leader and provides access to a public charging infrastructure either through subscription-based or pay-on-demand services as well as installs home chargers that support safe and greener charging. A key to success in early years has been the roll-out of a nationwide infrastructure needed to overcome drivers’ so-called ‘range anxiety’ which is one of the key barriers for electric vehicle adoption. Further, CLEVER has successfully worked on influencing the political agenda and on forming relationships with key stakeholders in the industry to pave the way for electric vehicles. To bust myths, create positive awareness and increase adoption speed, CLEVER has also been running one of the largest electric vehicle test drive programs in Europe (www.testenelbil.dk).

CLEVER is owned and financially backed by five electric utilities SEAS-NVE, SE, NRGi, EnergiMidt and Energi Fyn, and when it comes to strategic choices the close links to utilities obviously can be seen as a way of colonising a new value chain position for the utilities. The investors are aligned around a long-term vision supporting green transportation and electrification of society, the desire to capture and protect market shares in a potentially attractive emerging market and to be on the forefront of the intelligent electric grid in which the batteries of electric vehicles play an important role.

However, early optimism about the promise of astonishing growth rates provided by seemingly competent industry analysts has been replaced by a more modest worldview and the once highly attractive future with high returns is still few years away. The perception bias has – among other external factors – hit not only CLEVER but more severely key competitors such as Better Place whose investment intensive strategy is based on high-risk assumptions on winning technologies.

Could CLEVER and other players have foreseen the development? Maybe! But looking back, only a few voices questioned fast penetration of the electric car at the beginning of the century. The entire electric car industry is currently struggling to gain foothold and find a profitable operating model.

Smart choices in uncertain times

Based on the uncertain future outlook of the industry, the key strategic challenge for the management team of CLEVER has been to design a business model that balances long-term establishment of a strong competitive position in an emerging market with strategic choices that minimise short-term exposure to risk and limits investments.

While some competitors have chosen a big-bet strategy with potentially high upside but unsustainable risk levels, CLEVER has crafted a strategy that will help them to compete for the long term. Digging into the business model, several strategic choices are revealed that are highly relevant to all strategic innovators and business model designers.

Gain a foothold in the niche before conquering the mass market

The optimistic market forecasts have led many industry analysts to the conviction that strategies should aim for mass market adoption and focus on high volume. However, the current electric cars do not match B2C mass market consumer needs. Driving distances are too short and retail prices are too high. While getting ready for the mass market, CLEVER has chosen to focus on a few selected B2B and B2C niches in which there is a match between cars and customer needs. Further, CLEVER has understood that value propositions must be tailored to the segment-specific needs.

Current customers need total solutions supported by advanced services as opposed to market offerings optimised for low touch and high volume. In other words, CLEVER has developed a targeted approach for developing highly valuable niche offerings and will eventually use this market foothold as a stepping stone for expanding into the mainstream segments when car performance levels match mass market demands.

Invest in the ecosystem to create long-term relations and limit risk exposure

All electric mobility operators are caught in a classic chicken-and-egg dilemma. There will be no cars as long as there is no charging infrastructure – and charging infrastructure investments are unattractive as long as there are no cars. CLEVER has chosen to lead the way through building a basic nationwide infrastructure and to carry some of the initial investments needed to kick-start the industry. But on the other hand, CLEVER knows that a single company alone cannot create the market momentum needed.

Therefore, a key choice has been to develop solutions for partnering with long-term investors who share the same green transport vision. In other words, CLEVER’s basic charging infrastructure will be extended and scaled up through integrating the charging stations of other infrastructure owners. In that way, the network will be highly scalable – and risks as well as investments will be shared among stakeholders in the ecosystem.

This strategy is far from the winner-takes-it-all strategies but offers a promising way forward while risks are still high. Further, CLEVER’s network-centric approach includes investing in development of long-term relations with key stakeholders such as car dealerships, public authorities, suppliers of charging equipment and technology innovators within the industry. The aim of investing in the ecosystem is clearly to be able to leverage a privileged position in the future when the industry matures and becomes more attractive.

The text is an extract – go to the top of this page to download the entire article.