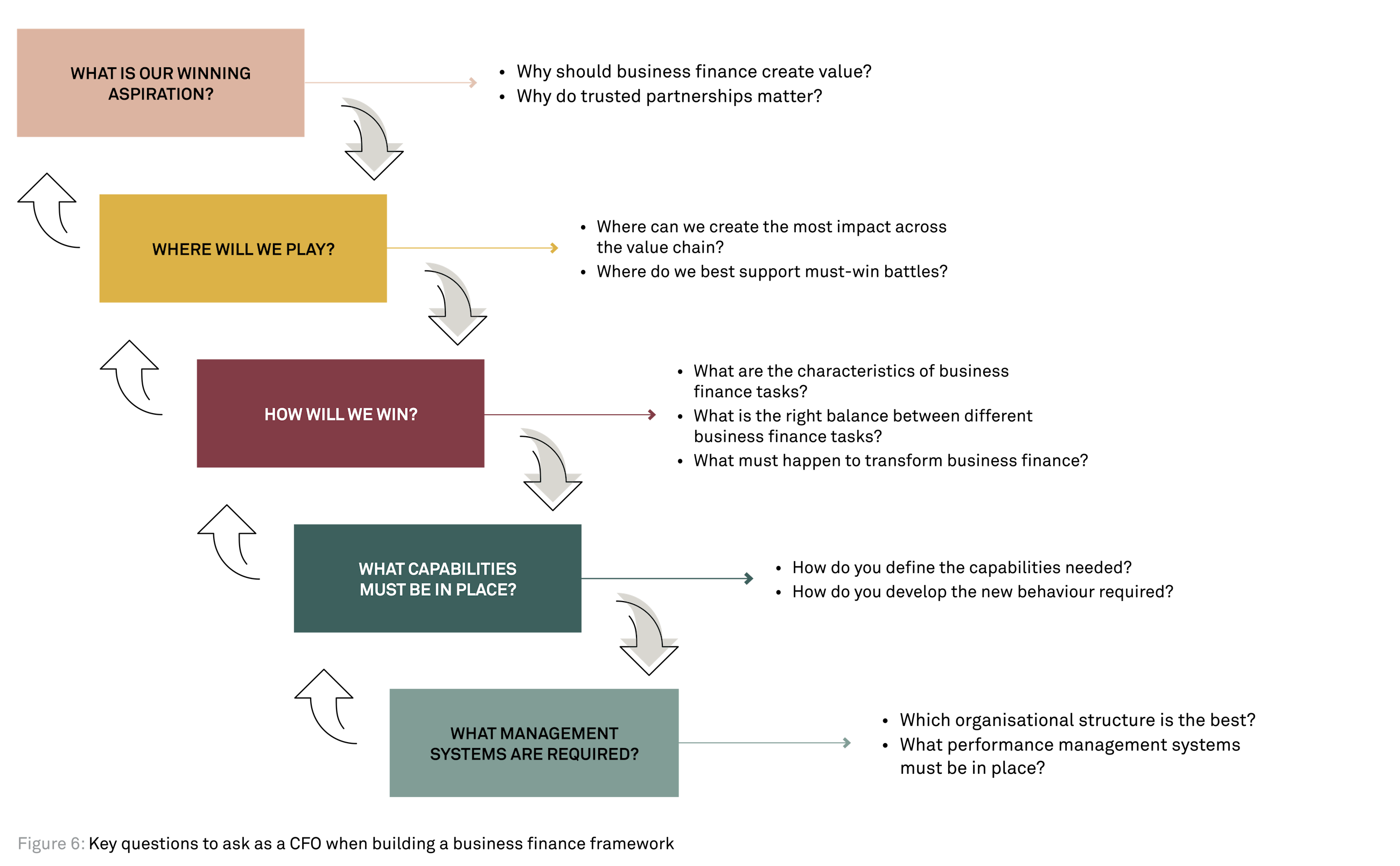

Key questions to ask as a CFO

10 January 2018

As finance transactions are becoming digital and compliance requirements are likely to increase, we are left with a key question: what is the future role of finance? Is it a guardian, steward, controller or business partner? Is there an opportunity for finance to create real value with the business? This is where business finance comes in the picture.

Business finance is the role that finance assumes in order to enable and challenge the business’ approach to delivering shareholder value at a tolerable level of risk. It is the involvement of finance professionals in business decision-making. In addition to business finance, most companies also have operational finance, primarily taking care of transactions and corporate finance, primarily responsible for protecting the company and consolidating financial performance.

We have met many CFOs who all believe that the future role of finance relies on building strong business finance capabilities, although they have varying approaches and maturities. We believe that the key to success is to create a solid business finance strategy that is presented in a framework.

Case

We were recently asked to co-create a global business finance framework with a customer to guide their efforts in building stronger business finance capabilities. Specifically, the customer had over 500 finance business partners located across the world and wanted to improve their impact on the business.

Based on the considerations outlined in this article, we developed a global business finance framework and rolled out personal learning journeys for the 500 finance business partners.

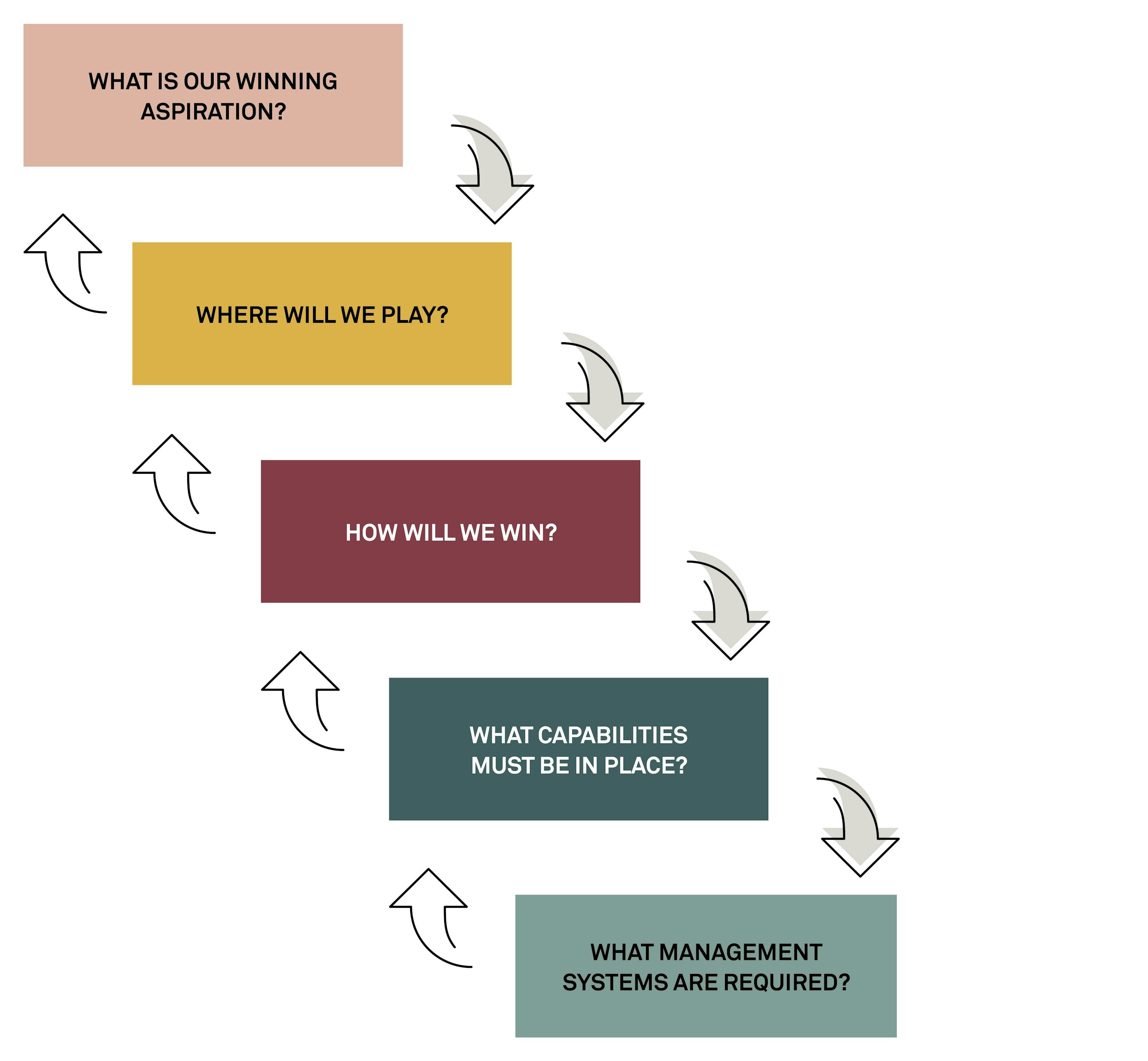

Our approach to creating a business finance strategy and framework builds on a simple process for making strategic choices that was first outlined in the book, Playing to Win: How Strategy Really Works1. Also referred to as the Strategy Choice Cascade, the process aims to clarify and simplify strategy by underlining that strategy is a set of interrelated and powerful choices that positions the organisation to win. There are five key choices in the Strategy Choice Cascade:

This viewpoint will delve into how CFOs and organisations can build a strong business finance framework and strategy by using the Strategy Choice Cascade process (figure 1).

1. What is our winning aspiration?

The winning aspiration is the overarching vision for business finance. Defining this starts off with the “Why” – in other words, the underlying reason/value proposition associated with the services provided by business finance. Understanding the “Why”2 allows us to deliver a clear message that engages stakeholders in business finance services and their relevance.

When exploring the “Why” of business finance, it is vital to understand that contrary to disciplines within operational finance and corporate finance, business finance cannot be justified by purely legal and/or compliance-related matters. A company is required to have finance employees who keep track of the accounts and prepare accurate financial reports, but there are no such official requirements associated with business finance activities. In fact, business finance can only be truly justified as a discipline if it somehow facilitates value creation for the company that exceeds the cost of its upkeep.

Trusted partnerships

The winning aspiration of business finance – value creation – can only be achieved by building trusted partnerships with the business. Trust is essential, as real value creation depends on business finance moving close to the business and stakeholders entrusting business finance to positively influence decision-making. Establishing trusted partnerships means that companies can execute decisions faster and implement solutions of a higher quality. Trusted partnerships between business finance and the business also ensure cross-functional collaboration that enables complex end-to-end decision-making, for example, executing integrated business planning spanning the entire value chain while also relying on pockets of critical information from a range of different functions. Recent data backs the importance of establishing trusted partnerships, as more than 90% of leaders seek to increase the level of business partnering3 and 70% of finance executives say that supporting decision-making is their number one goal4.

In other words, business finance needs to become a partner and excel in building trust and influencing decisions. Business finance needs an aspiration to drive performance management, recommend relevant actions and tell the story behind the numbers. A deep understanding of the business is therefore essential, so business finance can build and implement models for decision makers and represent the interests of the entire business. And finally, business finance needs to be a true partner – an active member of teams, meetings and committees in order to enable, challenge and influence decision makers.

2. Where will we play?

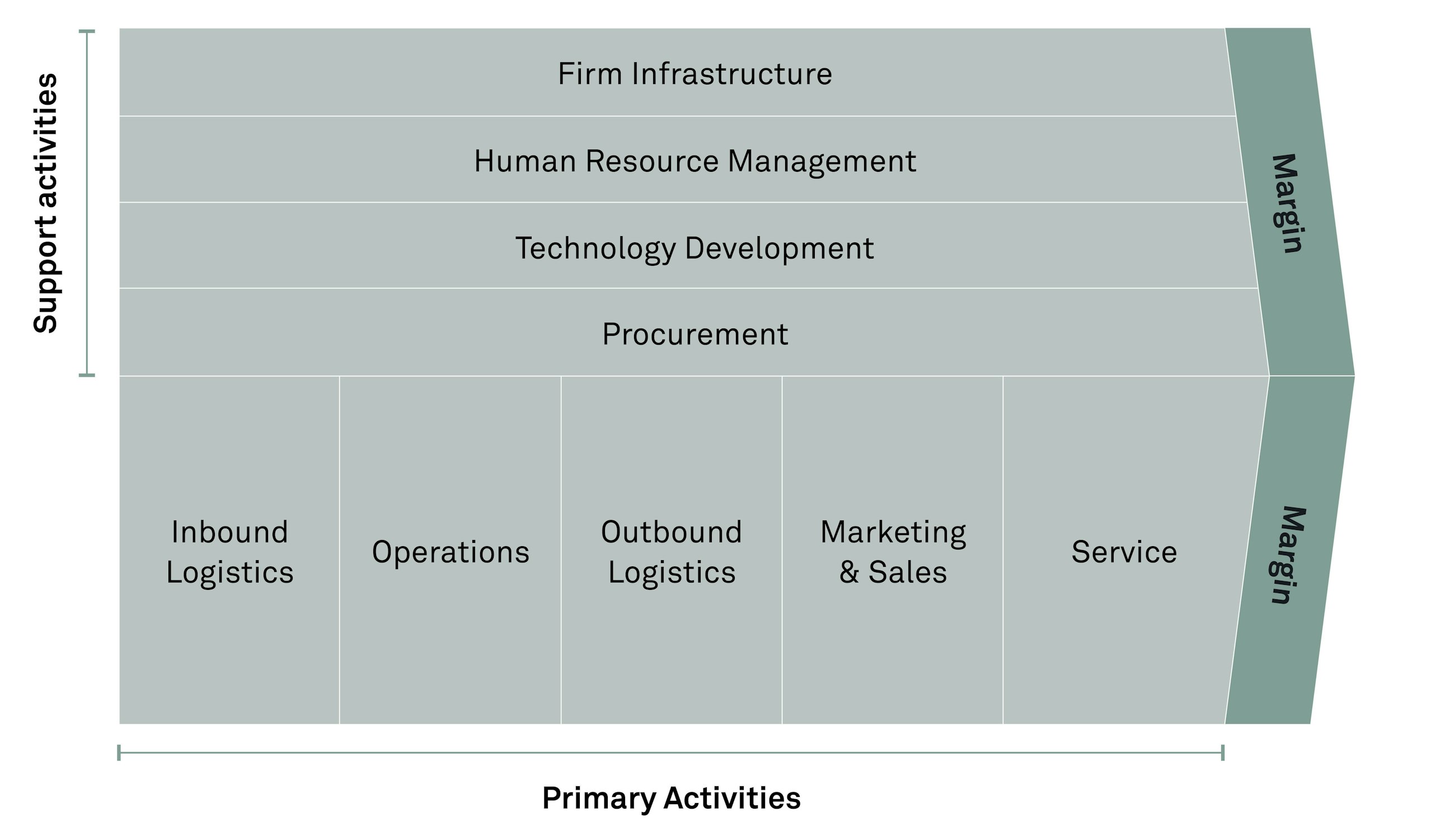

Defining the potential playing field for finance business partnering across the value chain is critical to achieving the winning aspiration and influencing decisions in moments that matter to the business. Business finance has the potential to create value in any part of the value chain, although not all parts of the value chain provide the same opportunities. Consequently, the key consideration is how we can target our efforts to maximise value creation.

Creating the most impact across the value chain

Working through the company’s specific value chain is essential in order to strategise and prioritise the focus of business finance. By working through the value chain, we can cultivate an understanding of the end-to-end value creation of the business and how business finance fits into this picture. The specific opportunities to drive value creation naturally depend on the type of business and industry, but a good example of this is Porter’s Generic Value Chain5, which can be used to illustrate how value creation occurs through five primary activities and four support activities (see figure 2).

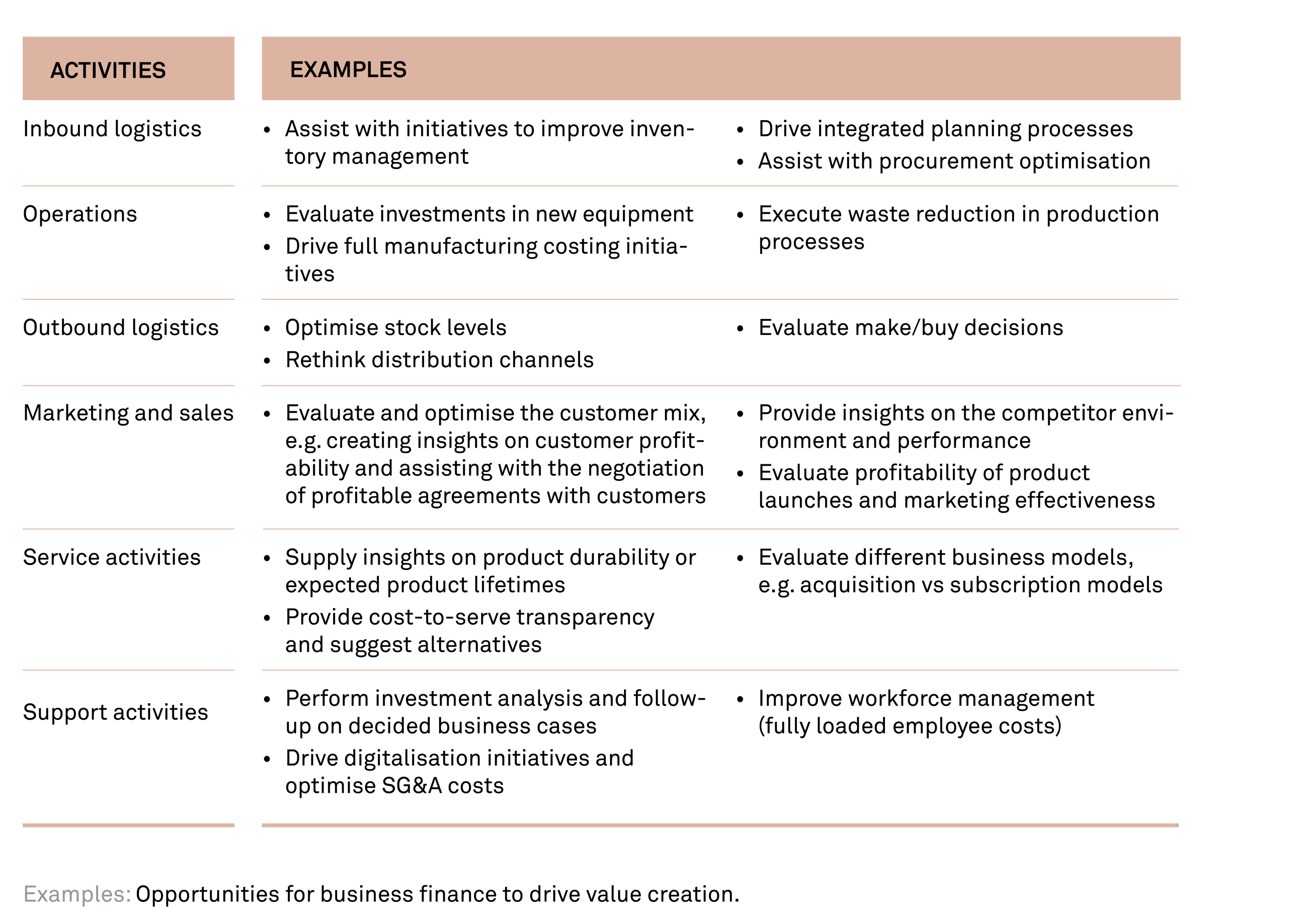

Here are just a few examples of opportunities for business finance to drive value creation:

Must-win battles

Another approach to identifying opportunities for finance business partners to drive value creation starts with the company’s strategy and must-win battles. Must-win battles are typically a high priority and included in performance appraisals from business stakeholders. Contrary to the value chain approach which focusses on the business’ current value proposition, the must-win battle approach is future-oriented towards the business’ strategic aspirations.

Case

We recently worked with a customer that had market expansion as one of its must-win battles (where to play). Our customer’s business finance community mobilised resources to go to India, explore potential market entry strategies and conduct analysis on potential opportunities in the new market. This included an evaluation of potential customer segments and optimal product range, recommendations on distribution set-up and make-buy for manufacturing.

By focussing on the must-win battles, business finance was able to be proactive, take on the role as an invaluable business partner and impact the decision-making process.

The finance business partner can support the implementation of must-win battles by translating the initiatives into measurable KPIs and milestones that are regularly monitored and managed. The finance business partner can help to identify problems or deviations that require corrective action and help to drive the initiatives.

Naturally, the value chain and must-win battle approaches can also be combined and therefore, both approaches should be the focus of business finance.

3. How will we win?

Now that we have defined the playing field for business finance, the next question is how to go about driving value creation by interacting with business stakeholders. One way of tackling this is by looking into underlying tasks to be performed by the finance business partner and grouping activities according to their characteristics and interconnections.

The characteristics of business finance tasks

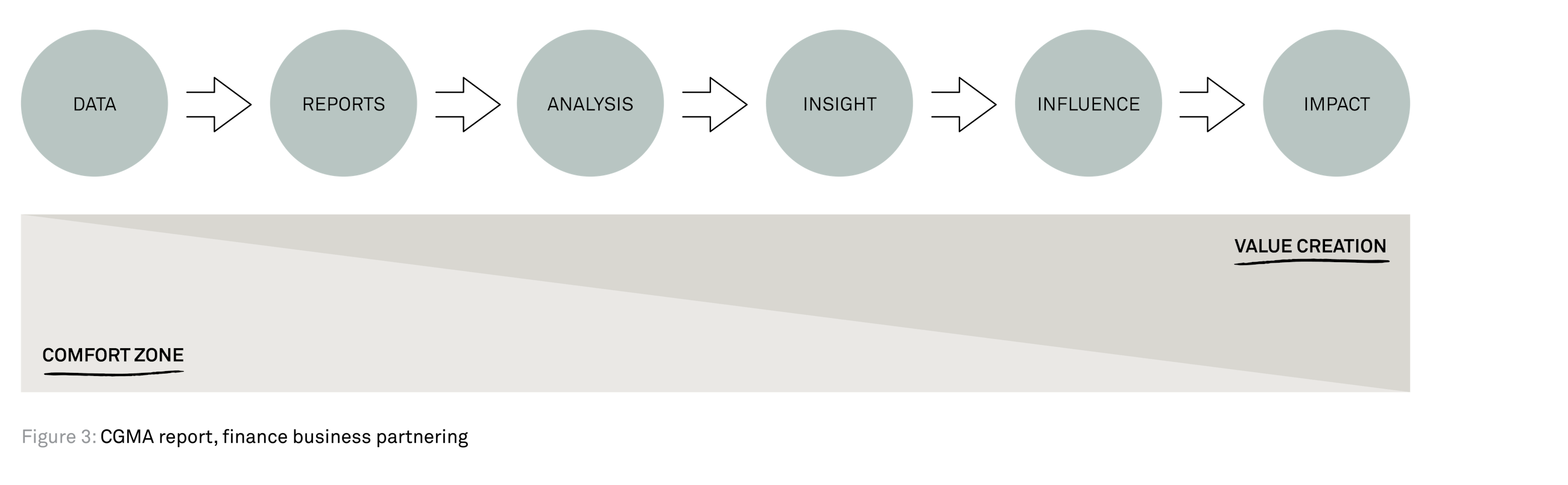

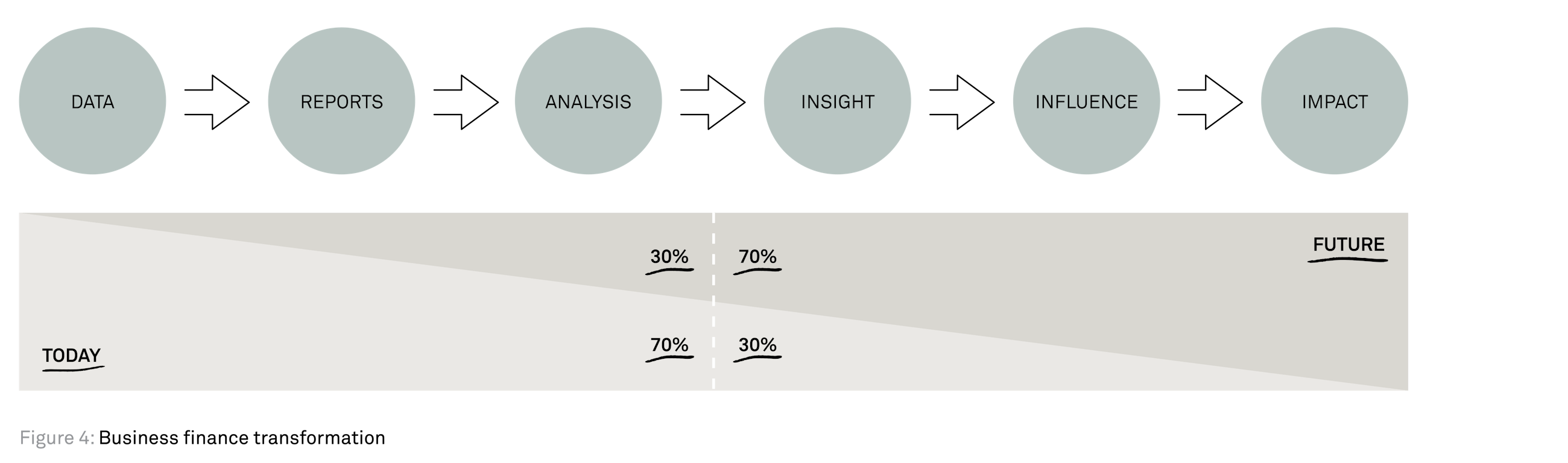

The following is an example of how grouping activities according to their characteristics and interconnectivity may follow a flow, such as the one presented in figure 36.

A finance business partner for a sales team accesses relevant and accurate data. The finance business partner then pulls relevant reports to show specific performance to the team. Based on these reports, the finance business partner can perform analysis on deviations compared with the expected performance. The analysis leads to new insights and reveals additional relevant information to the team. The final steps involve the finance business partner communicating the information to the sales team to influence decision-making in a direction that the finance business partner believes will create the most impact and value. Understanding the characteristics, difference and interconnection between business finance tasks is the key to exploring whether time is spent efficiently in each activity group or whether some activities take up unwanted or unnecessary amounts of time.

Finding the right balance between different business finance tasks

Decision support is at the core of business finance, however research shows that only 18% of time in the average finance function is spent on this7. Moreover, finance traditionally spends most of the time that is allocated to decision support on data, reports and analysis – the comfort zone of most finance professionals. However, the biggest opportunity for value creation lies outside of this comfort zone, in the tasks of insight, influence and impact.

If so many finance business partners want to spend their time and efforts differently, why do so many of them fail to make the transformation needed to become trusted advisers?

Survey

In our recent survey of more than 500 finance business partners, we found that they spend around 70% of their time on data extraction, data validation and report generation and analysis. They only spend 30% of their time on providing insights, influencing decisions and driving impact.

However, when asked what they would prefer to spend time on, finance business partners answered that they would like to see the 70/30 division of their time flipped on its head in the future, so they could spend more time on performance management and creating value with their business stakeholders and less time on data, reports and analysis (figure 4).

Transforming business finance

Transforming the business finance organisation is, of course, the CFO’s responsibility. However, this does not need to be a huge investment or a task that rests squarely on the CFO’s shoulders. It can simply start with each finance business partner taking a look at themselves and thinking about what they personally can improve on.

Why are some finance business partners constantly overburdened and struggling with tight deadlines, while others in the exact same role are ready to take on new tasks and always find time to plan ahead? We believe that the answer lies in the ability to make time for work that really matters8. We need to focus on the most important tasks to be highly effective:

- Eliminate time spent on unimportant activities

- Delegate activities that can be handled by others

- Redesign tasks so they require less time

This business finance transformation is in fact a personal exercise – it doesn’t require big investments in organisational redesign or technology. It is a five-step process: identify, categorise, offload, allocate and commit. In our experience, going through this process may enable finance business partners to free up one day every week and reallocate time for work that really matters.

4. What capabilities must be in place?

The capabilities of finance business partners form the underlying foundation of the “What”, “Where” and “How” of business finance considerations (steps one, two and three of the Strategy Choice Cascade process). At the end of the day, it all comes down to people showcasing a certain kind of behaviour, as finance business partnering is more like a personality than a job description.

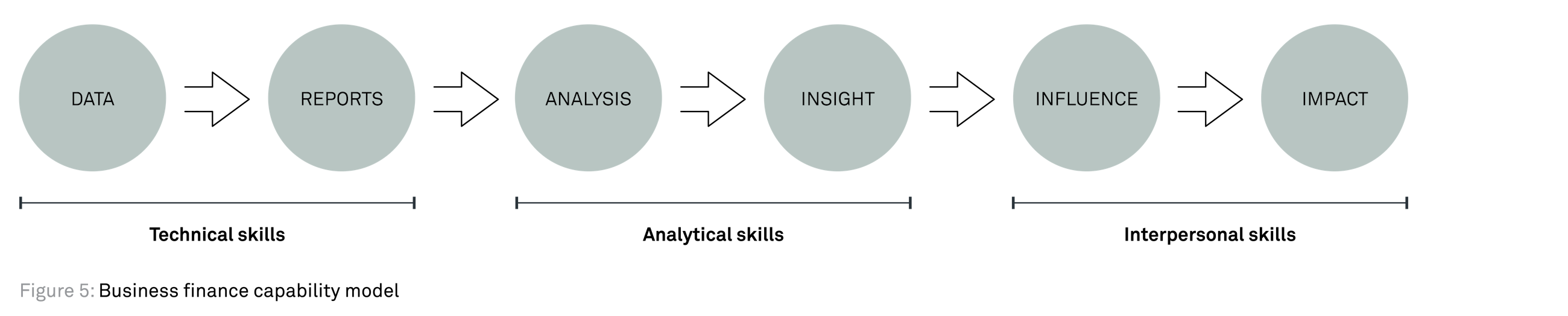

As the domain of a finance business partner spans a broad spectrum of quantitative and qualitative skills, the role requires a holistic profile. In a nutshell, the capabilities of a finance business partner are a combination of hard skills (analytical and technical skills) and soft skills (interpersonal skills).

Defining the capabilities needed

Finance business partners naturally require an understanding and knowledge of the business strategy, market environment, competitors, products, customers etc. However, the role also requires a specific skillset combination in order to fully support each of the value-adding tasks that the role encompasses. Managing data and reports may require technical skills, i.e. accounting, reporting, planning, controlling etc. Producing analyses and insights may require analytical and problem-solving skills, i.e. the ability to identify the right problems, generate multiple solutions, bring forward clear recommendations etc. However, at the other end of the spectrum, influencing and impacting the business may require interpersonal skills such as listening, questioning, communicating, sensitivity, building trust and relations etc. (see figure 5).

By adopting this structured approach to defining the capabilities needed to support business finance activities, we can eventually develop a full competency model that can clarify the expectations of the role. This competency model can serve multiple purposes related to training, job postings, personal development plans, stakeholder feedback surveys etc.

Case

We recently worked with a customer, who wanted to improve their analytical skills. Their assumptions going in were that as data scientists with a focus on systematically applying statistical and logical techniques in order to describe and illustrate data correlations, their analytical skills should be improved9. In other words, taking large amounts of data, analysing these and coming up with new insights based on the past.

However, this was not what we ended up doing. Based on 10 on-the-job cases, we found that only two of them would be solved from a data scientist approach. The other eight were better solved with a different type of analytical approach – let’s call it problem-solving and design thinking10.

Let’s use one of the eight cases as an example. A key account manager came back from a customer meeting and immediately called the finance business partner who he trusted to help him make a strong recommendation for a plan of action. The customer had told the key account manager that a competitor, who wasn’t currently operating in this geographical area, was planning a market entry and had offered the customer a significant discount compared to current prices.

The finance business partner and key account manager came up with a plan that included three very strong scenarios for what the company could do, including considerations on who the most important customers to keep were (based on profitability, volume, strategic relationships etc.), what part of the product range that could be discounted to go head-to-head with the competitor and what part of the product range that could survive a price increase and adjustment of production capacity if the competitor was to get a fair market share etc. The skills used were very much centered around problem-solving and less so on analysing historical data to gain insights.

Developing new behaviour

Another important reflection related to the wide range of competencies and capabilities needed to perform as a finance business partner concerns behaviour. Research in personality preferences, for example, HBDI11 and MBTI12, shows that people tend to rely on inherent predispositions when it comes to ways of thinking, perceiving and judging, which often leads to a preference for certain behaviour and activities. In other words, most people do not thrive equally in all roles. Hence, it should come as no surprise that not all business finance activities appeal equally to everyone. We need to recognise that the array of business finance activities depends on employees being able to transition between very different kinds of behaviour. This in turn requires a work environment designed to nudge finance business partners out of their comfort zones. For example, an analytically skilled and experienced finance business partner might only need slight encouragement to reach out to the right business stakeholder, thereby unfolding their full value-adding potential. On the other hand, an extroverted and social profile might need a lot more encouragement to spend the necessary time delving into the analysis before approaching the business.

Helping finance business partners explore capabilities outside their preferences might seem straightforward, but it is a task that is unfortunately often overlooked by many CFOs. A classic example that we often encounter is the financial controller who has been promoted to a new role as finance business partner. In this case, the financial controller often has the proper technical skills to under¬stand the financial and other relevant data, but lacks experience with facilitation, communication and problem-solving. In this situation, if nothing is done to foster and nourish the new behaviour, it is unlikely that the finance business partner will move beyond data, reporting and analysis into the activities that truly influence, impact and create value for the business.

5. What management systems are required?

The final step to consider when building a business finance framework is how to anchor the winning aspiration, the playing field, the allocation of time between business finance activities and key capabilities in daily business operations through a management operating system (MOS).

MOS is the specification of how an organisation translates corporate goals into actions and results. It ensures that the strategy (in the long/medium/short term) is consistently converted into more specific and actionable targets and actions for front-line workers. It is an approach to bring information into meetings, conversations and work practices to support effective decision-making and implementation in an aligned, visible and responsive way.

Case

Four Seasons Hotels and Resorts has a winning aspiration of making business travellers feel more at home with impeccable service and quality. To ensure that the hotels live up to the value proposition, a management operating system was put in place around what was called the “glitch report”. Whenever anything goes wrong with a guest, from the simplest delay of a taxi to a hotel room malfunction, it must be recorded as a glitch in the daily glitch report. Every morning, the hotel manager meets with the entire staff to review the glitch report and define a service recovery plan for each glitch.

The service recovery plan ensures that the guest feels great before the case is closed. On a weekly basis, the glitch report is sent to corporate. The goal is not to eliminate glitches all together, but rather to instil a culture of openness and willingness to learn, thereby continuously seeking to become even better. Thus, the processes, structures and rules allow the organisation to build capabilities, reinforce and measure the organisation’s strategic choices through their management system.

(Martin, Roger L. [ArtCenter College of Design] (2013, June 7). Roger Martin’s How Strategy Really Works Lecture at ArtCenter [Video file]. Retrieved from here.)

In our experience, many finance organisations fail to achieve their goals for business finance as they believe these can be achieved by simply changing the organisational design. However, we believe that defining organisational ties through full or dotted lines between business units and the finance department does little to translate business finance aspirations into actual behavioural change. So how do you define an approach that ensures finance business partners bring relevant information into meetings, conversations and work practices, and thereby support effective decision-making?

Organisational structure

A recipe for strong finance business partnering has more important ingredients for success than organisational design, improved processes or new systems. Although proper organisational structure is important, establishing an effective business finance community depends on so much more than merely a well-designed organisational chart. The development of MOS for business finance should, therefore, focus on establishing close physical proximity between business finance and the business, as well as nurturing the right kind of behaviour, actions and culture amongst finance business partners. Hence, an organisational structure where finance business partners enjoy physical immediacy to the business and are included in management teams is essential for successful finance business partnering. Furthermore, taking finance business partners’ personal characteristics (i.e. educational background, experience outside finance and interpersonal capabilities) into account has also proven to be a crucial part of the organisational structure.

Performance management systems

A streamlined performance management process across organisational hierarchies is another important factor in designing MOS for business finance. Designing key performance indictors linked to the first four elements of the framework is only part of this process. Performance management and business intelligence must be supported by a standardised drumbeat of meetings to ensure that the right people meet at the right time with the right tools in order to make the right decisions based on the right data, thereby fulling setting the business finance community up for success. On paper, this sounds fairly simple, but in practice the process proves to be a significant cultural challenge for many organisations.

Summary

Building a business finance framework is about making strategic choices and answering five integrated key questions.

- The first question one should ask as a CFO is, what is the winning aspiration of business finance? The answer is value creation. This question is a crucial first step in building a framework because business finance as a function is only sustainable if it creates more value than its upkeep costs.

- Defining the playing field of business finance is the second vital step in this process. There are two approaches to prioritising business finance and maximising value creation: we can look at the current value chain or we can take a future-oriented perspective by focussing on the company’s must-win battles.

- The next essential questions that CFOs should ask when setting up a business finance framework is, how will business finance drive value creation? And where should we focus business finance efforts in the business in order to create the most impact? We recommend a structured approach to this step by breaking down business finance activities and grouping them by characteristics and interconnections. Finding the right balance between the activities – and particularly having enough time to spend on decision support – is the key to the success of business finance.

- The fourth step in the business finance framework is defining and cultivating the behaviour and capabilities of finance business partners. As business finance requires employees who possess a broad spectrum of hard and soft skills and can transition between varying behaviour, even outside of their comfort zones.

- Finally, an efficient management operating system is needed to bring the business finance framework to life and ensure that finance business partners can thrive and have the necessary tools and environment to support effective decision-making.

As a CFO creating a business finance framework, you should ask yourself the key questions in figure 6. They form an integrated approach to understanding business finance that may prove invaluable when building and establishing a successful business finance framework. These questions should be answered as a nested set of choices that are internally consistent and reinforcing, e.g. if we want to create trusted partnerships with the business as part of our winning aspirations, then our key capabilities should focus on how to create strong relationships and trust with the business. The aim is to simplify and create a shared language of strategy across our business finance organisation, which we ideally should be able to communicate on a page.

At Implement Consulting Group, we welcome any opportunity to further discuss the topic of business finance.

References

1 Martin, Roger L. & A.G. Laffey (2013) Playing to Win, How Strategy Really Works

2 Sinek, Simon (2009). Start with why: How great leaders inspire everyone to take action. Portfolio. https://startwithwhy.com/

3 Deloitte (2013). Finance business partnering. Making the right move.

4 Kaufman, Hall & Associates (2016). Performance management survey. https://www.kaufmanhall.com/

5 Porter, Michael E. (1985). The competitive advantage. Creating and sustaining superior performance. The Free Press.

6 CGMA report (2015). Finance business partnering: The conversations that count. The Chartered Institute of Management Accountants.

7 CFO.com (2015). Metric of the Month: How Finance People Spend Their Time. Retrieved from http://ww2.cfo.com/budgeting/2015/12/metricmonth-finance-people-spend-time

8 Birkinshaw, Julian & Cohen, Jordan (2013). “Make time for the work that matters”. Harvard Business Review.

9 Thomas H. Davenport and D.J. Patil: Data Scientist: The Sexiest Job of the 21st Century, Harvard Business Review October 2012.

10 Martin, Roger L. The Design of Business: Why Design Thinking is the Next Competitive Advantage, Harvard Business Press, 2009.

11 Herrmann Brain Dominance Instrument®, http://www.herrmannsolutions.com/

12 Myers-Briggs Type Indicator®, http://www.myersbriggs.org